China’s economy continues to expand, and the country’s demand for chemicals remains large. Following 35 years of annual growth in GDP above 10%, recent announcements and forecasts project a 7 to 8% year to year growth in the period 2011-2015 – this will remain totally unmatched in the western world and is outstanding when bearing in mind the size of the industrial base already in place.

China was the second largest consumer of chemical products in 2010 and the local chemical industry is strongly benefiting from this remarkable growth of industry demanding areas (road and construction, transportation, E&E, …), as well as the strong raise of the interior household demand of certain products (HPC, equipments, carburant…).

In the last decade, heavy investments in capacity have put the Chinese chemical industry at the forefront of the world, and in 2010, the total chemicals output of the Chinese industry exceeded the one of the US, making China the largest producer worldwide for the first time. According to the CPCIF (Chinese Petroleum and Chemical Industry Federation), the Chinese Chemical output was of about 5.23 trillion CNY (*), an outstanding 33% growth from 2009, and it contributed 52.1 percent of the Asia-Pacific production. The growth is forecasted to maintain a 15% level throughout 2015, participating to 40% of the worldwide growth of the industry.

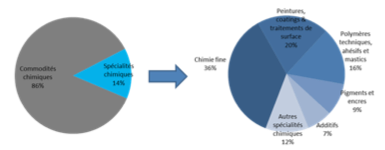

The mega-trends of the local chemical industry, which employs more than 5 million people, comprise a profound structural transformation of the production towards more advanced and higher margins areas together with a consolidation of the whole industry (more than 30,000 companies are registered, which implies on average an output for each 6 times lower than Western companies).

It is also interesting to notice the emergence of local quality demand driven by the raise of a middle class, increasing environmental standards concerns, and the narrowing of operational cost gaps between local and international players.

Beside the profound transformation of Chinese global players such as Chemchina (**), there are strong opportunities for Western companies to invest and penetrate the Chinese chemical markets in various segments.

The US department of commerce is, for example, emphasizing a list of chemical categories where opportunities are present:

- Construction and industrial coatings

- Environmental protection and treatment

- Plastics and rubbers

- Personal care

- Dyes, pigments and leather / textile chemicals

To these segments, we can add fast growing sectors such as food-additives and electronic chemicals.

Daydream, present in Asia since 2007, is already there to support our clients in understanding and reaching new growth reservoirs. Being efficient in China means to be located there with highly qualified native teams, to assimilate and develop an integrated understanding of local business practices and to continuously adapt a wide range of approach strategies for accessing the markets.

We have built and we keep on building strong local partnership. Our first partnership with a well reputed local firm gave us exclusive access to more than 150 multi-client market reports on commodities for the past 20 years. Furthermore our expert network with market federations and associations allows us to be closer to the information.

Thanks to our partnerships, our own databases and our improved methodology we generate for our clients sharp and adapted business intelligence and valuable opportunity pipelines to ramp-up their projects towards success.

(*) Currency March 2012: € 1 = USD 1.33 = CNY 8.39

(**) Chemchina is the 19th chemicals corporation in the world in 2011.