About China Pet Market:

2024 marks a period of transformation for China’s pet industry, as the market enters a phase of high-quality development driven by product excellence and changed Customer needs, with them now preferring practical high-quality products.

This makes the relevant pet industry one of the markets not suffering from the low-margin and low-price competition in China.

In 2024, the urban pet (dog and cat) consumption market in China grew by 7.5%, surpassing RMB 300 billion (USD 42 billion) for the first time. Among this, the cat-related market reached RMB 144.5 billion, representing a 10.7% increase. It is projected that by 2027, the urban pet (dog and cat) consumption market in China will expand to RMB 404.2 billion.

Report introduction:

Regarding the pet food market, Daydream released a report in August 2024: https://www.daydream.eu/pet-fair-asia-2024-august-2024-facts-figures/

Based on a brief review of the development of China’s pet economy in 2024, this report is focus on introducing the market overview, industrial value chain and typical companies in the pet grooming sector.

*Currency rate: USD 1 = CNY 7.09 = EUR 0.87 (as of Nov. 19, 2025)

Table of content

1. The China pet economy and its potential

2. The expanding pet product category

3. Pet grooming market

4. Daydream: B2B Tailor-made Projects in Europe / Asia / North America

5. Sources

1. The China pet economy and its potential

1.1 Size of China’s pet market

Dogs and cats still dominate the China’s pet market, as of today. In 2024, the urban dog and cat population reached 124.11 million, up 2.1% from 2023 — including 52.58 million dogs (a 1.6% increase) and 71.53 million cats (a 2.5% increase).

1.2 Drivers of China’s pet-relevant markets

1.2.1 Pet penetration rate in households is rising

The pet ownership rate among households in China has been rising steadily, increasing from 13% in 2019 to 22% in 2023 but is still lower than USA (70%), Germany (36%) or Japan (28%).

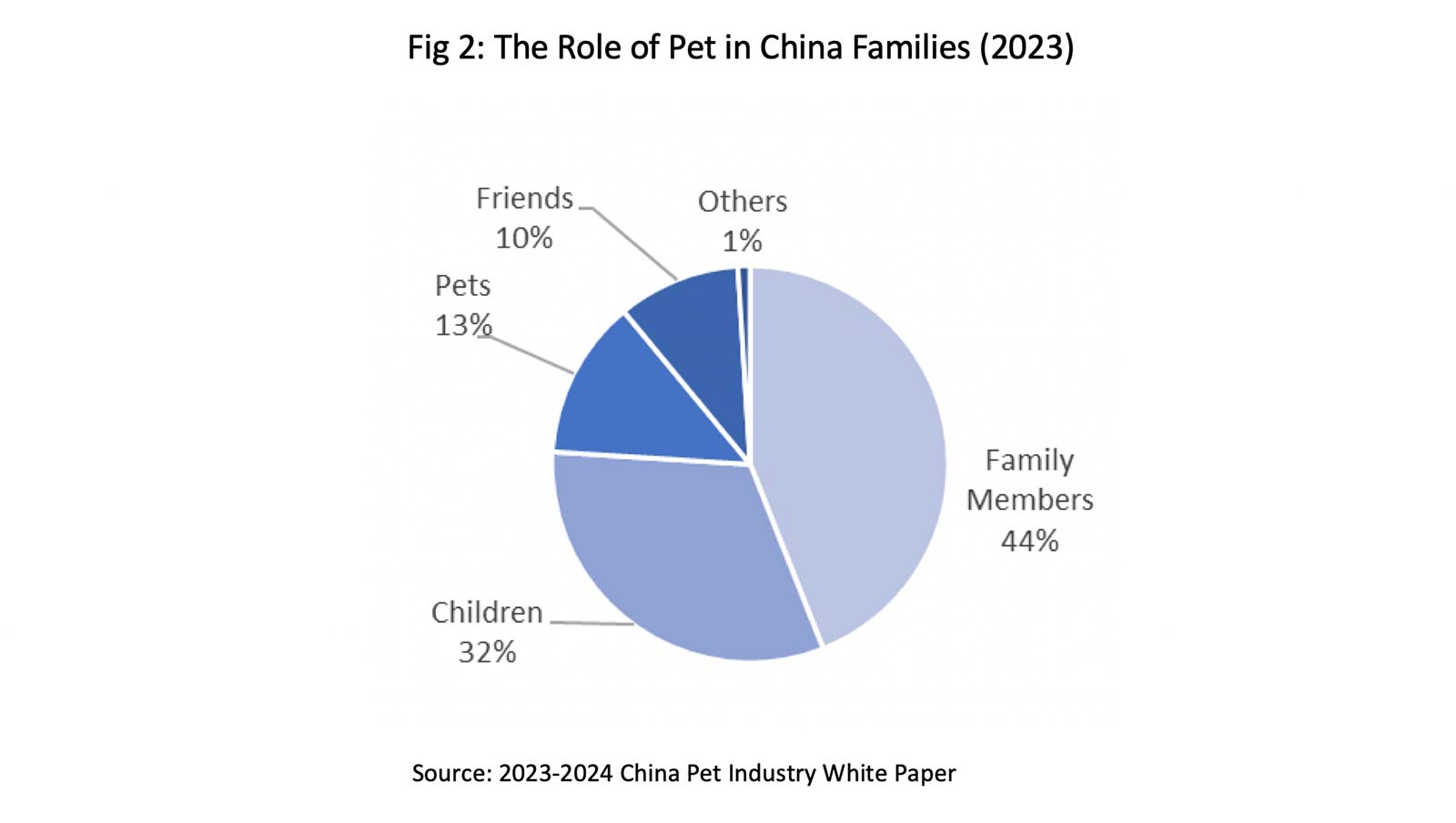

As people’s demand for emotional companionship from pets continues to grow, the role of pets in Chinese families has gradually shifted from being merely “pets” to “family members”, “friends” and even “children”. This trend has promoted the further maturity and refined development of the entire pet industry chain.

1.2.2 Pet owners’ income and education levels are constantly increasing

Currently in China, most pet owners’ monthly incomes are between RMB 4,000 and 10,000, and their education levels show a clear upward trend — with 73.6% holding a bachelor’s degree or higher.

After a slight decline in 2023, the average annual spending per pet rebounded in 2024. The average annual expenditure per dog or cat reached RMB 2,961, up 3% year-on-year, while the average spending per cat was RMB 2,020, an increase of 4.9% from 2023.

1.2.3 More diversified and standardized products

Pet products show a distinct trend: catering to the needs of niche markets. For instance, pet staple foods have now been divided into various forms such as baked food, freeze-dried food, and wet food, aiming to cater to the personalized needs of different pet species, breed and age groups.

At the regulatory level, on-site inspections of pet feed manufacturing enterprises have been carried out since the middle of 2024. The Ministry of Agriculture and Rural Affairs of China has initiated the formulation of national standards, plans to release the updated standards for dog food and cat food in 2026, and simultaneously advances the project approval for technical specifications of probiotic supplements.

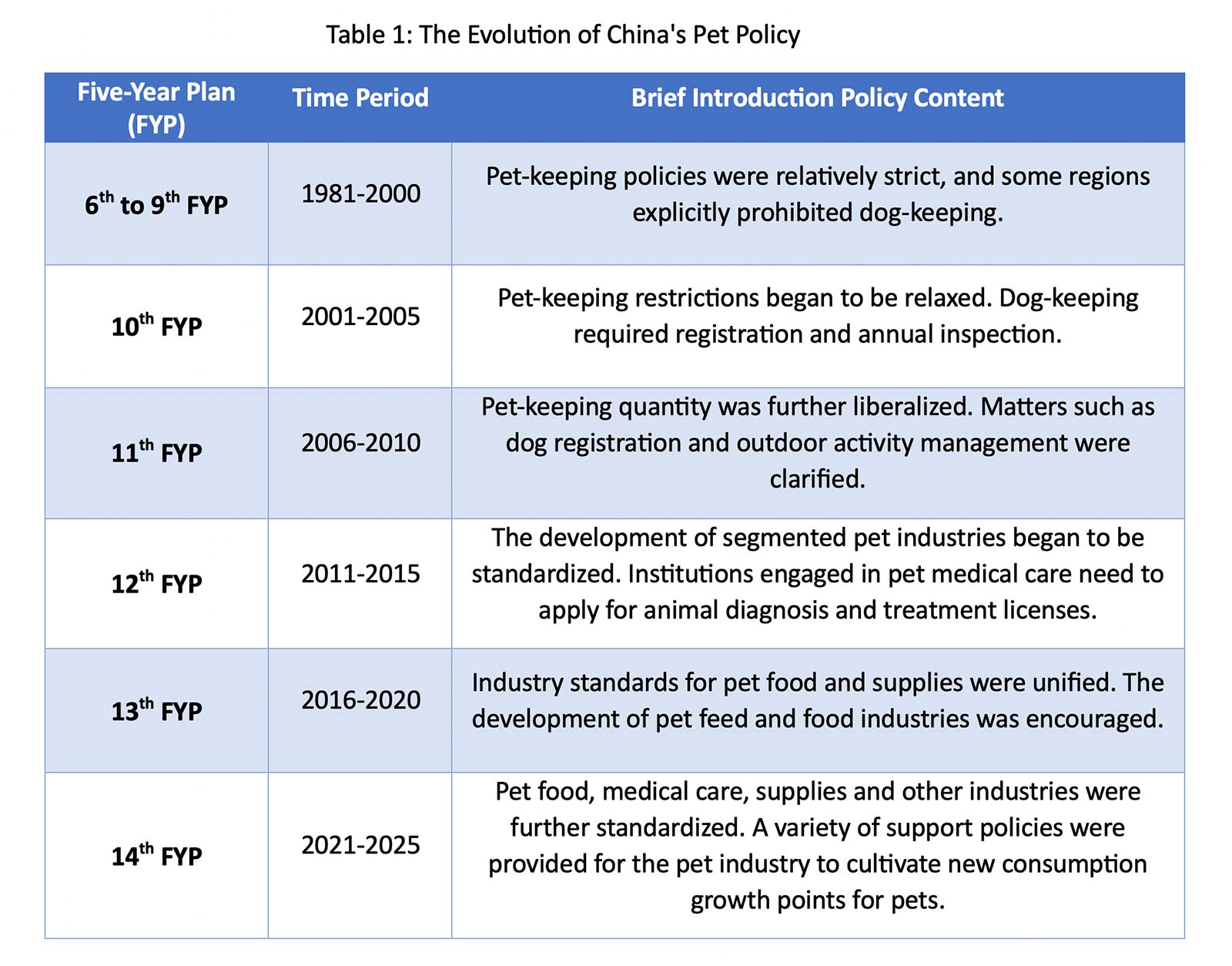

1.2.4 Policy stimulus

Since the launch of the 14th Five-Year Plan, in order to promote consumption and stimulate the vitality of domestic demand, Chinese administrations have successively introduced a series of policies to promote the expansion of consumption.

The pet economy relevancy is closely related to factors such as the economic development or the consumers’ standard of living. Implemented policies tied to income improvement, consumption support funds or consumption environment optimization, has been linked to increased general consumption, with a further expansion of the demand in the pet industry, therefore expanding its scale.”

2. The expanding pet product category

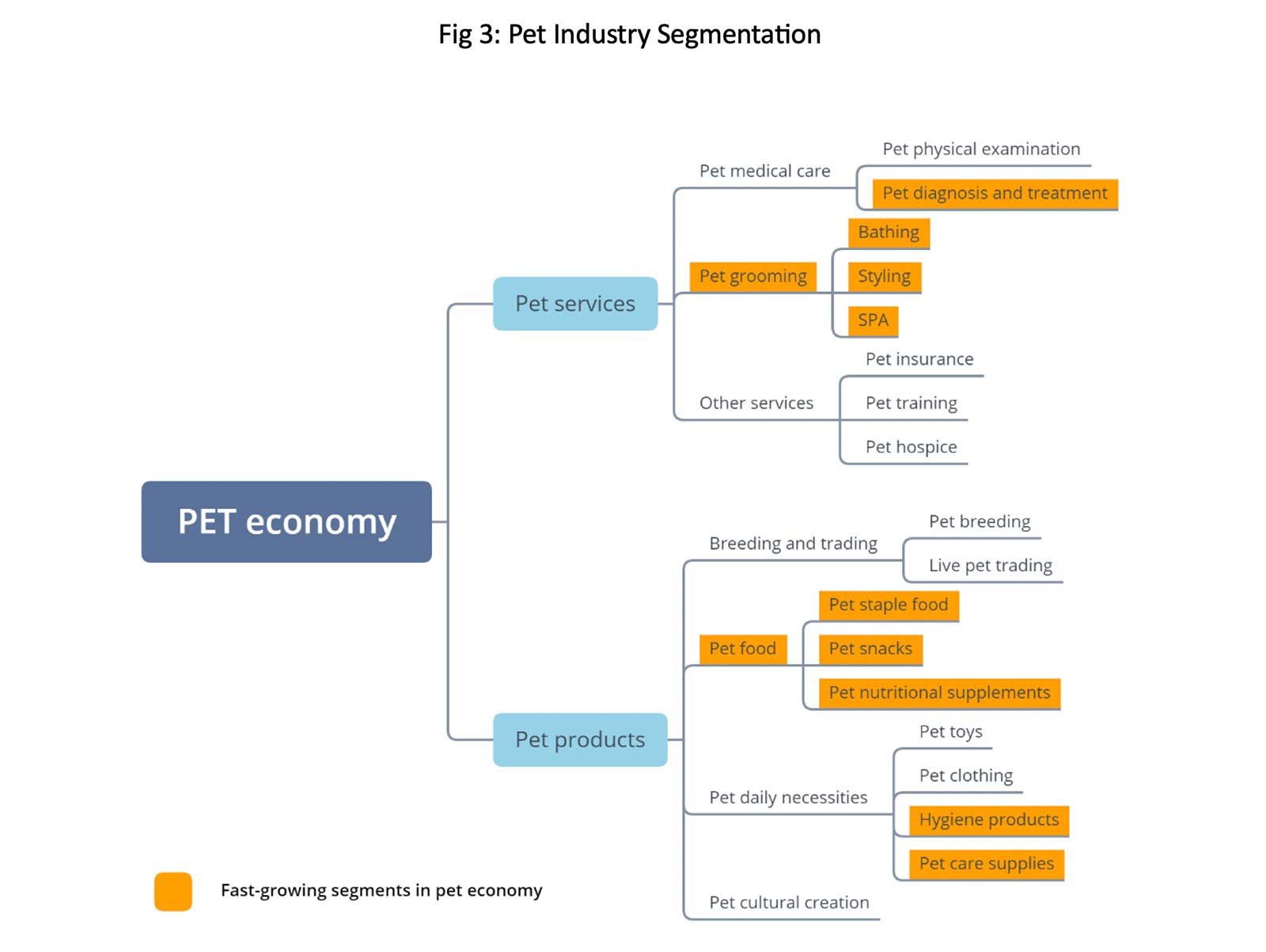

The industry chain covers aspects related to pet food, pet health encompassing diagnosis and treatment, hygiene …. Etc.

2.1 The structure of pet economy

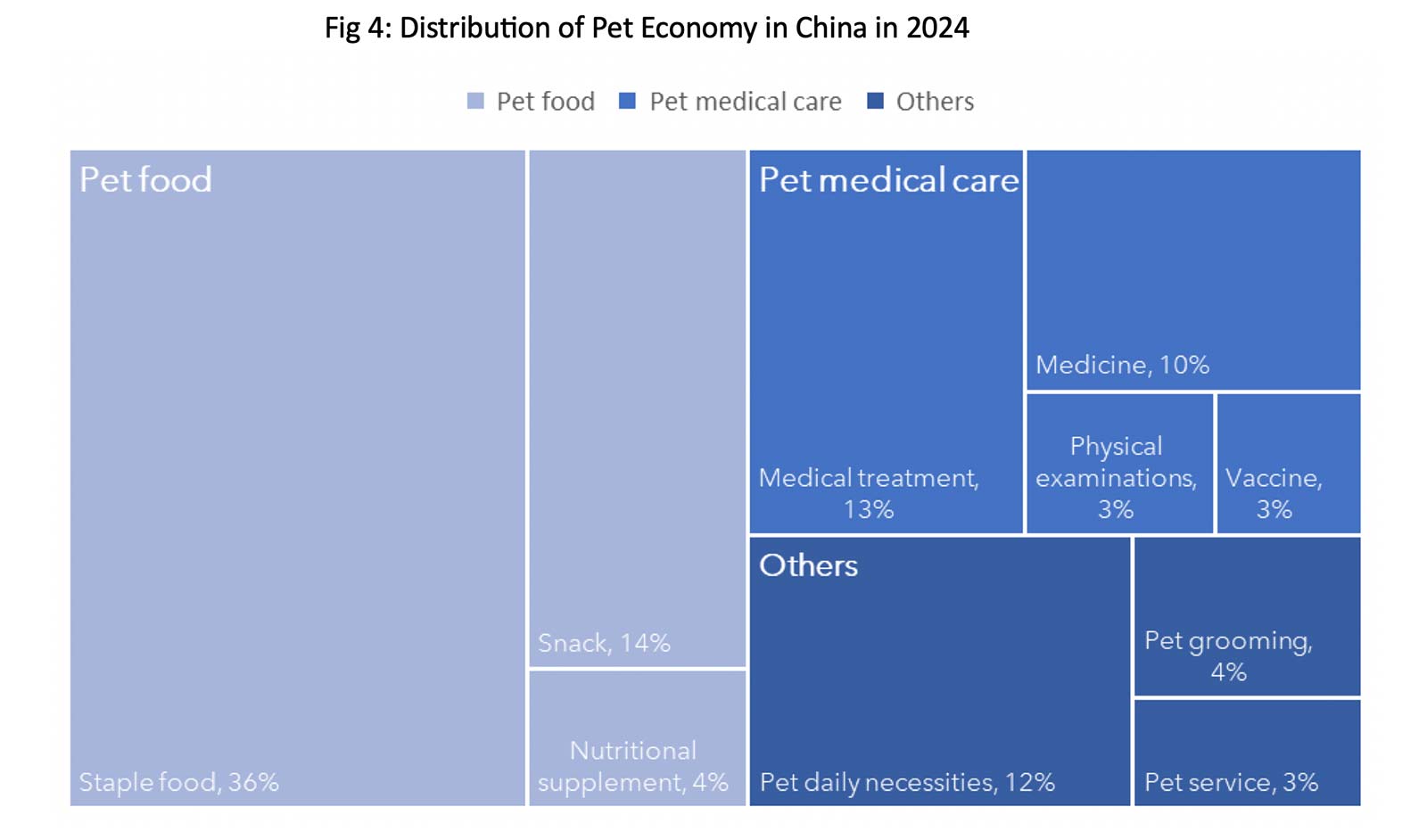

Pet food remains the main pillar of the pet economy with 52.8% of the pet consumption market.

Pet medical care comes next 28% of the market.

The market shares of Pet daily necessities, Pet grooming, and other services are relatively smaller.

Looking at the sub-segment structure, the share of staple food and nutritional supplements increased slightly in 2024, while snacks saw a slight decline. Overall, fluctuations compared with 2023 remained within 1 percentage point, indicating that the consumption structure of China’s pet market has now become relatively stable.

2.2 Pet food market

Referencing our past D-News report:

https://www.daydream.eu/pet-fair-asia-2024-august-2024-facts-figures/

3. Pet grooming market

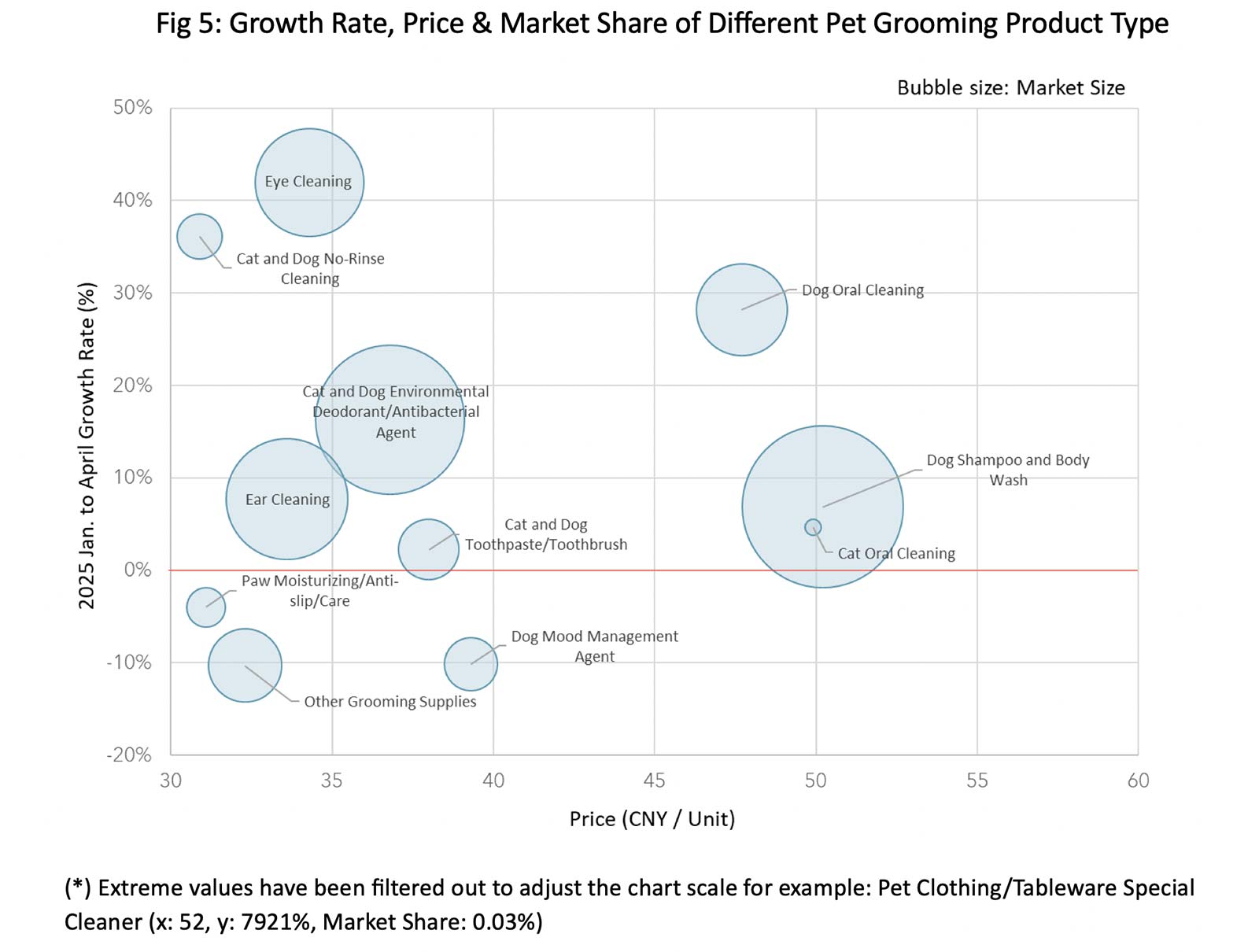

In 2025, the penetration rate of pet cleaning and grooming products is expected to remain relatively stable — around 70% for dogs and 40% for cats.

3.1 Pet grooming market size

From January to April 2025, sales of pet grooming products reached nearly 240 million RMB, representing a year-on-year growth of 109%, with over 7.32 million units sold, up 77% year-on-year.

Between April 2023 and April 2025, online e-commerce sales of pet grooming products surged from 20 million RMB/month to 71 million RMB/month (+260%), while sales volume increased from 0.6 million units/month to 2.2 million units/month (+250%), indicating continued industry expansion.

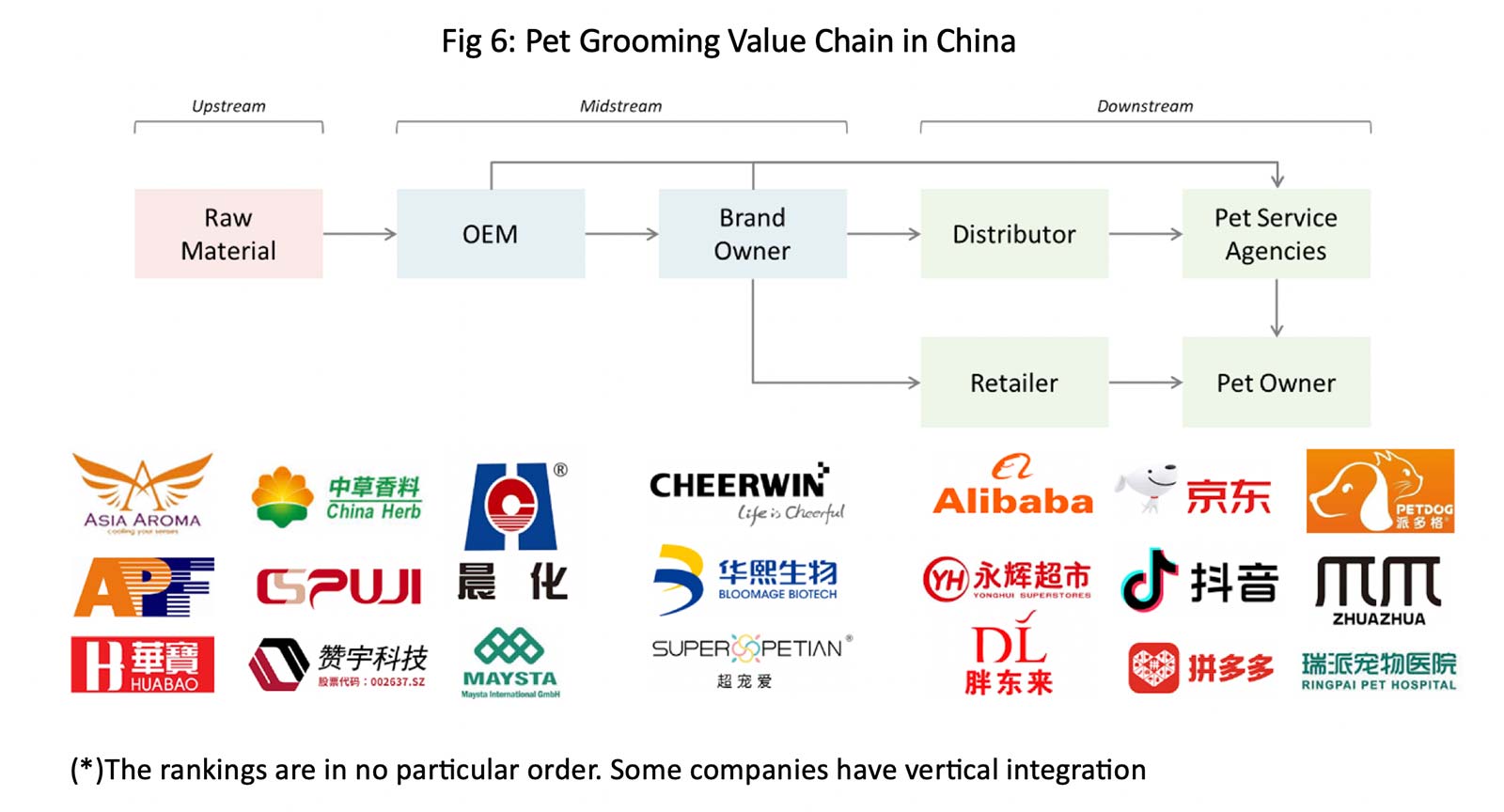

3.2 Pet grooming value chain

The upstream of the pet grooming industry consists of raw material suppliers, mainly providing fragrances, surfactants, and plastic packaging materials.

The midstream segment includes OEMs and brand owners of pet grooming products.

The downstream segment is composed of retailers, distributors, pet owner, as well as pet salon and veterinary hospitals that offer grooming services.

3.2.1 Pet grooming value chain – Upstream

The upstream raw materials of the pet grooming industry mainly include fragrances and surfactants. According to the “14th Five-Year Development Plan for the Fragrance and Flavor Industry”, by 2025, China’s fragrance and flavor industry is expected to reach a main business revenue of 50 billion yuan, with an average annual growth rate of over 2%. Production of fragrances is projected to reach 400,000 tons, while flavor chemicals will reach 250,000 tons.

In 2023, China’s surfactant output totaled approximately 4.7 million tons, up 10% year-on-year, with sales volume reaching 4.5 million tons, an 8% increase compared to 2022.

Overall, China’s fragrance and flavor industry features a wide variety of products and numerous market players, leading to fierce competition, whereas the surfactant industry continues to develop steadily with increasing market concentration.

In 2013, China’s Ministry of Industry and Information Technology (MIIT) issued the National Standard for “Cleaning and Conditioning Shampoo for Pets”, which clearly defined testing methods for surfactants and fragrances used in pet cleaning products.

- Main Player in China:

- Fragrances & Perfumes: Asia Aroma, Apple, Huabao, etc.

- Surfactants: Yangzhou Chenhua, MAYSTA, etc.

3.2.2 Pet grooming value chain – Midstream

The midstream segment of the pet industry primarily consists of pet cleaning and grooming product OEMs and brand owners.

The pet grooming product industry maintains a high gross profit margin. From a pricing perspective, pet cleaning and care products are classified in great detail. The average price for a general-purpose pet shampoo is approximately 40–50 RMB per 500ml. For example, in 2023, Chaoyun Group’s pet cleaning and care products generated 77 million RMB in revenue, representing a 0.5% year-on-year increase, with a gross profit margin of 43.2%.

- Main Player in China:

- Brand Owners: Cheerwin, Superpetian, Bloomage Bio, etc.

3.2.3 Pet grooming value chain – Downstream

Pet service agencies are developing rapidly, as service penetration continues to increase and prices gradually decline, the purchase rate of grooming products by pet owners is expected to decrease, meaning the penetration rate of pet grooming products among pet owners will likely stabilize rather than grow further.

On the other hand, in terms of retail channels, pet owners are becoming increasingly inclined to purchase grooming products online. As the demographic of pet owners continues to trend younger, this shift will further drive the overall expansion of the pet grooming market.

- Main Player in China:

- Pet Service Agencies: PetDog, ZhuaZhua, Ringpai, etc.

- Retailers: Alibaba, JD, Tiktok/Douyin , Yonghui, Pangdonglai, etc.

4. Daydream: B2B Tailor-made Projects in Europe / Asia / North America

Daydream has performed multiple projects in the B2B material industry over the last decade, across the manufacturing value chain from raw materials to products.

We have realized more than 90+ projects in Food & Feed (incl. animal nutrition) and 60+ projects in Care Products (mainly home and personal care) across the manufacturing value chain from raw materials to end-user markets for B2B players, most of them being the largest in the field.

Since 2000, Daydream offerings:

- Market & Business Strategy

- New Business Development

- Sustainability & Digitalization

- People Management – Training & Workshops

- Business Improvement for Market and Sales (Market Segmentation, Client Segmentation, Channel-to-market, Business & Go-to-market Plan, M&A Scouting, Capex project…)

Since 2000, Daydream:

- Over 120 B2B clients

- Three offices: Cologne for Europe, Philadelphia for Americas, Shanghai for Asia; Partner in India

- One unique best-in-class methodology and a team of engineers and PhDs

- A unique methodology & experiences

- A large network and knowledge

5. Sources

- 2023-2024 China Pet Industry White Paper

- Paidu Pet Industry Big Data

- 2023 China Pet Food Consumption Report

- China Pet Health Consumption White Paper

- Gambol Pet Prospectus

- Wanlian Securities Research Institute

- Decoding the New Track of “Pet Economy”: A Perspective on the Emotionally Driven Upgrade of Pet Consumption

- The pet food standards system is being improved at an accelerated pace

- 2025 Asia Pet Fair Concludes: The Vitality of the Pet Economy Marks New Heights for the Industry

- Huajin Industry Institute