The Battery Show North America 2025 is the leading show of its kind in North America, and for the past 14 years has been bringing together professionals in advanced battery and electric hybrid & vehicles technology to discover ground-breaking products and create powerful solutions for the future.

This year, over 1,300 companies exhibited at The Battery Show North America 2025 in Detroit and the organizers reported that more than 21,000 industry professionals attended, making it one of the largest battery tech expos globally.

Dynovel visited the Battery Show (Detroit, USA) from October 6th to 9th, 2025, and surveyed companies across the battery value chain, including those offering materials, technologies, services and solutions to the battery and EV industries. Compared to the 2024 show, it is worth noting that most of the participants shared a perception of fewer people visiting and exhibiting in this 2025 edition, with many speculating that it is due to the current US administration focusing on fossil energy vs. electrifications & green energy.

Table of content

1. Companies & professionals surveyed

2. Battery value chain levels surveyed

3. Summary of feedback on the EV battery industry and trends

3a. Top areas of Improvement for the EV battery industry

3b. Trending markets for battery usage

3c. Supply chain trends

4. Our conclusion

Legend

LFP: Lithium ferrous phosphate

LRM: Lithium Manganese Rich

NMC: Nickel Manganese Cobalt Oxide

NCA: Nickel Cobalt Aluminum Oxide

SSB: Solid-state battery

EV: Electrical Vehicle

ESS: Energy Storage System

1. Companies & professionals surveyed

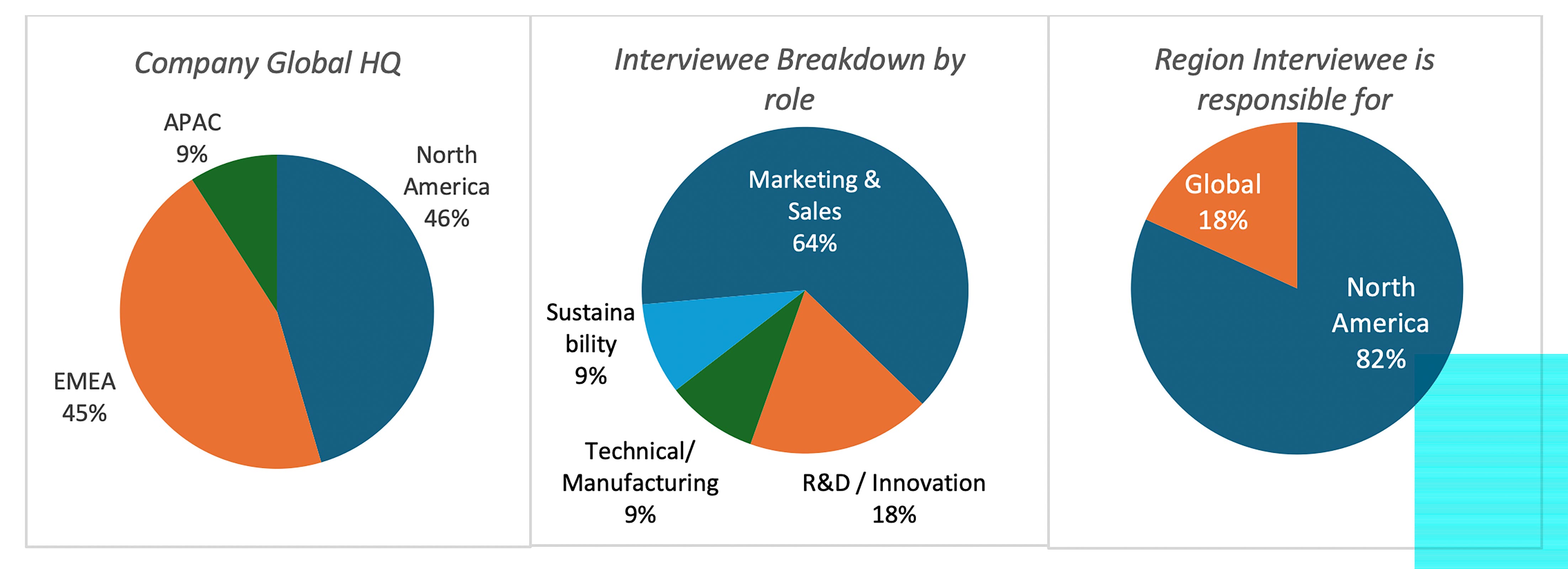

Dynovel interviewed 11 participants from key exhibitors and attending companies at the fair, covering different regions and involved in various roles within their companies.

2. Battery value chain levels surveyed

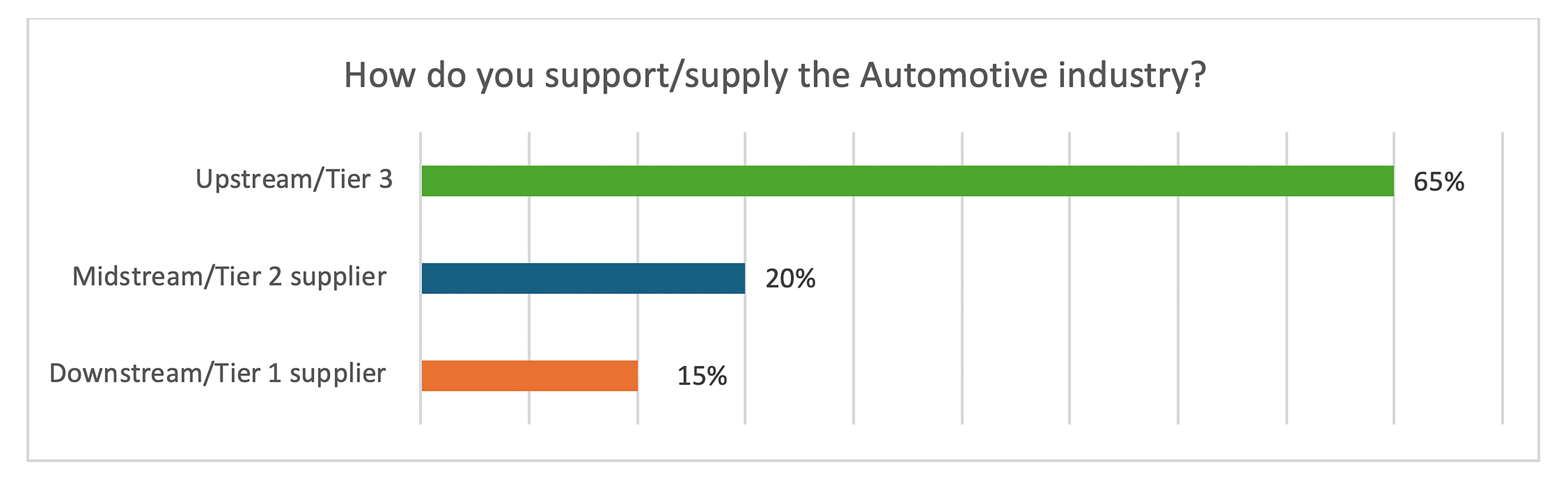

The interviewees’ companies were described as Downstream (modules, systems, etc.), Midstream (parts, components, etc.) or Upstream (chemicals and materials), reflecting the wide range of interests at the show.

3. Summary of feedback on the EV battery industry and trends

3a. Top areas of Improvement for the EV battery industry

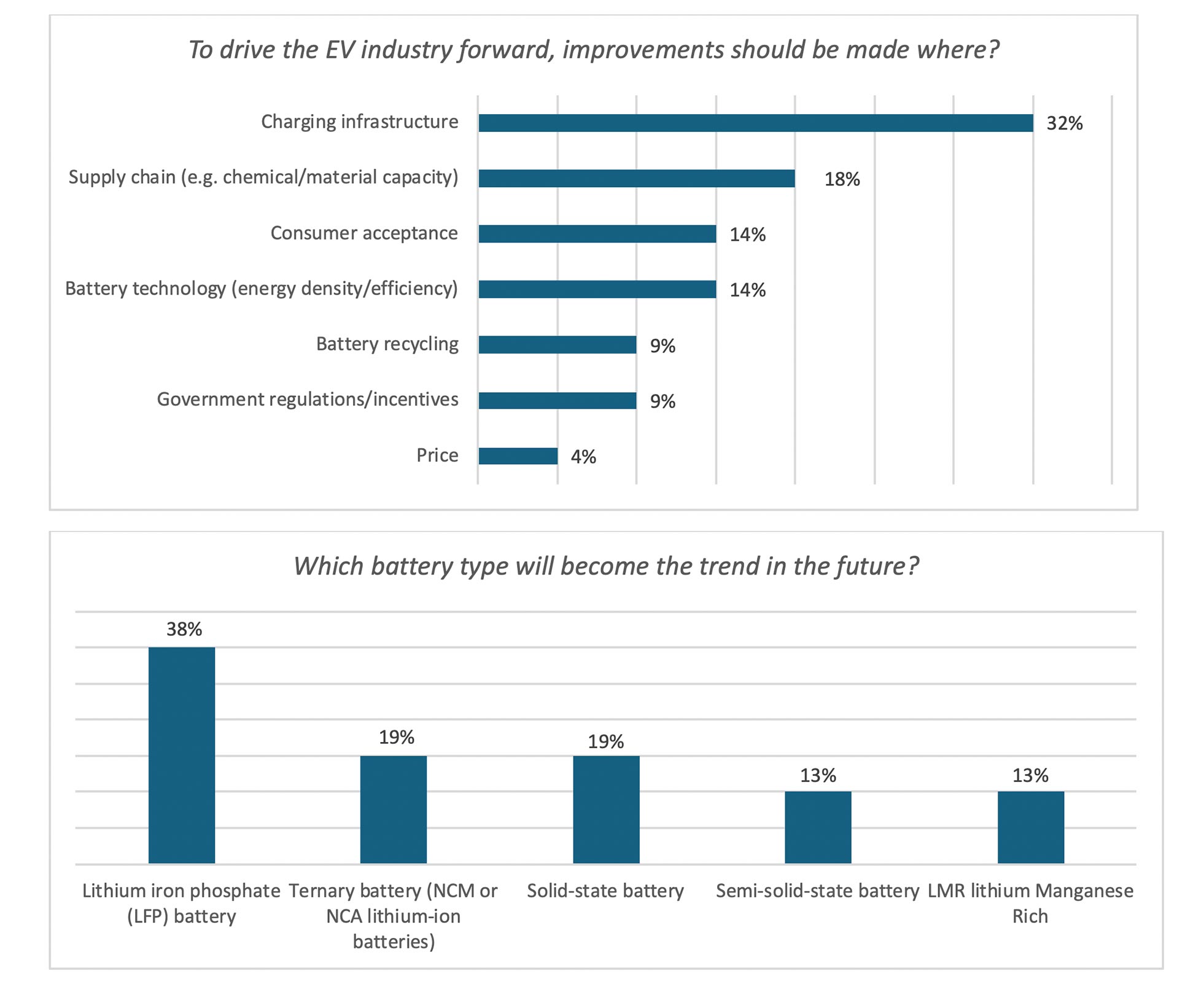

Interviewees were asked: To drive the EV industry forward, improvements should be made where?

Up to two options could be chosen.

Charging infrastructure and Supply Chain received the most mentions.

Charging infrastructure was emphasized for a second year in a row, while Supply Chain has seen an increase in focus since the 2024 show. Improvements to charging infrastructure were viewed by many respondents as driver of consumer acceptance.

Meanwhile, Supply Chain has been brought to the forefront of concerns due to uncertain trade relations and tariffs heavily impacting the battery industry.

Battery technology was mentioned the third most and was explored in a subsequent question examining trends in battery chemistry.

When asked “which battery type will become the trend in the future?”, responses were in favor of LFP batteries for ongoing and short-term development. Ternary batteries (NCM or NCA) and solid-state batteries were the next most mentioned with a longer-term timeline especially for solid state.

From talking with attendees at the show, Chinese companies seem to push for LFP and, in the future, solid-state batteries. While in the USA, an emerging is around LMR batteries, with announcements on LMR from GM and Ford. GM, partnering with LG, has claimed LMR batteries will be able to provide 33% higher energy density, while being comparable to LFP batteries in cost.

The LMR technology is opening a path to build a supply chain less dependent from China, as Manganese is more widely available and cost-effective than any other critical materials. LMR technology has been explored by major companies in the space since at least 2010, but LMR still has some process control challenges and material inconsistencies for manufacturers to overcome. The most cited LRM battery issues have been their short lifespan due to voltage decay and capacity loss, thermal instability. However, GM and LG say they have found ways to fix these limitations, and the EV industry anticipates LMR batteries to be seen in EVs by 2027 or 2028 (GM, Ford).

3b. Trending markets for battery usage

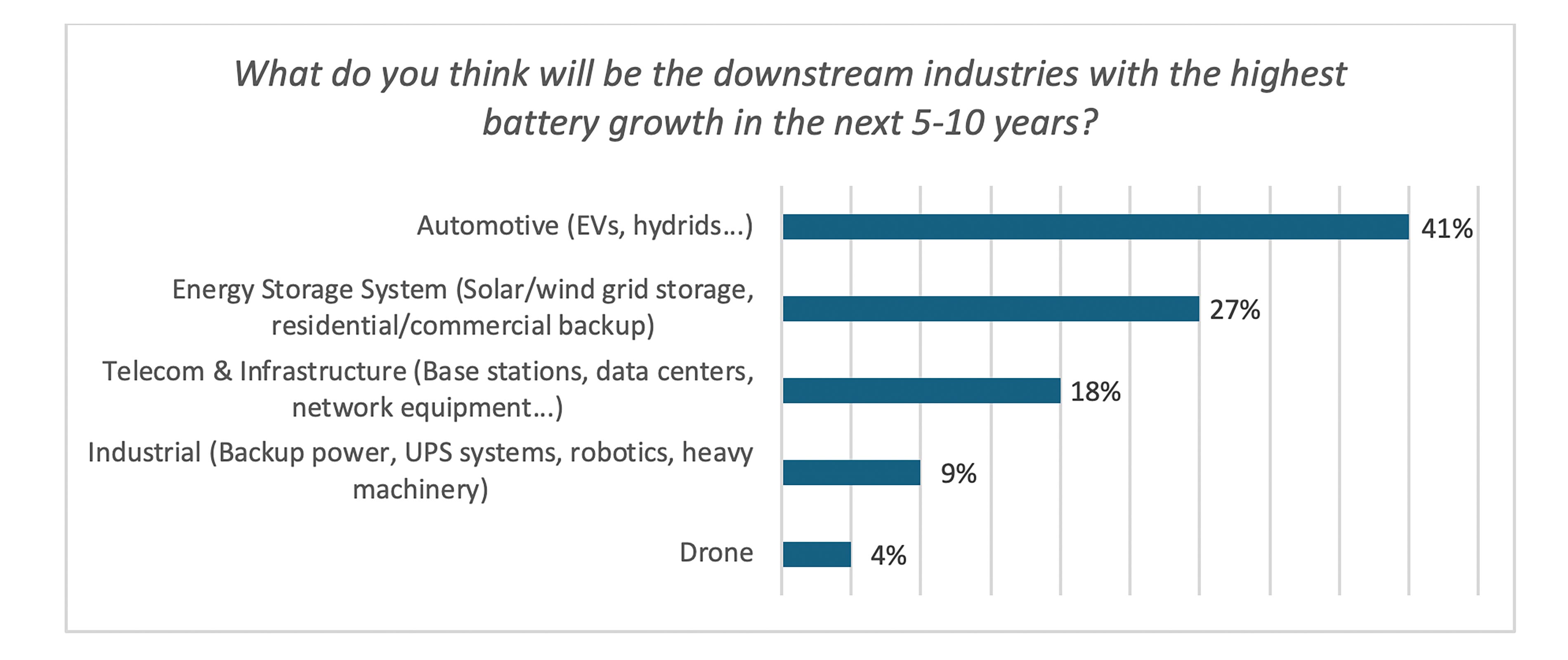

Another confirmed trend is that faced with declining EV demand, many battery players are shifting focus to the ESS (Energy Storage System) market in the U.S.

ESS, particularly for data centers, is set to see widespread growth in the US. The number of data centers in the US has grown to over 4000 in 2025, from just 1500 in 2020. It is estimated that data centers could account for up to 12% of the US’s energy demand by 2028. This will provide high growth opportunities for batteries that can support data center operations. (source: ess-news)

That being said, the automotive industry is still seen as the most promising market for batteries over the next 5-10 years due to the long-term global volume forecast.

Due to the advancement of drones and rising geopolitical tensions, drones in the defense sector are seeing increased use. Factoring in concerns around domestic supply chains to support US national security, the market for drone batteries is positioned as a high growth opportunity in the US. While drone batteries will not reach the volumes of EV batteries, they share similar technology and supply chains with EVs, which are also seeing a push for domestic production. Already the US Army has announced they plan to produce 10,000 small drones a month by 2026. (source: https://defensescoop.com)

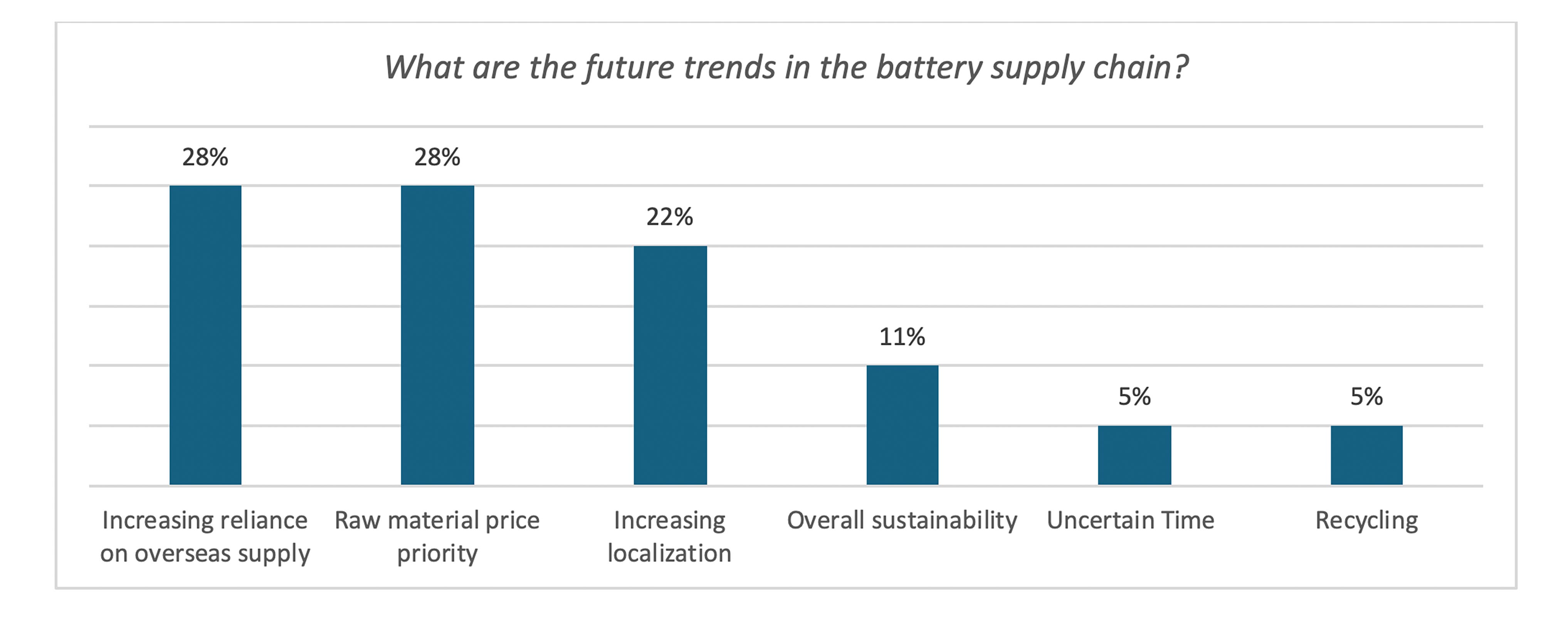

3c. Supply chain trends

4. Our conclusion

The EV battery industry is undergoing a transition characterized by diversification in both technology (LFP, NCM, LMR…) and end markets. While EVs remain the long-term growth driver, near-term momentum is building around ESS and defense applications. Strengthening charging networks, securing supply chains, and advancing new chemistries such as LFP and LMR will be essential for sustaining industry competitiveness.

Is your mind churning with new markets to tap, new applications to grow, new sourcing options to rank, and new market strategy to develop? Let us talk about it!

About Dynovel

Dynovel, active in the Battery and Automotive industries for 25+ years, serves clients globally and regionally in the Chemicals, Polymers, Advanced Materials, Energy, New Technologies analysis, with focus on helping clients to address Business Strategy and Market Development.