Tags : composites E&E energy storage Graphene key players Market size patent production

Abstract

Graphene, a two-dimensional nano-carbon material with extraordinary performances, has been a very hot topic in the materials world for many years. It is called a “Super Material”, with the potential to bring revolutionary change to the world.

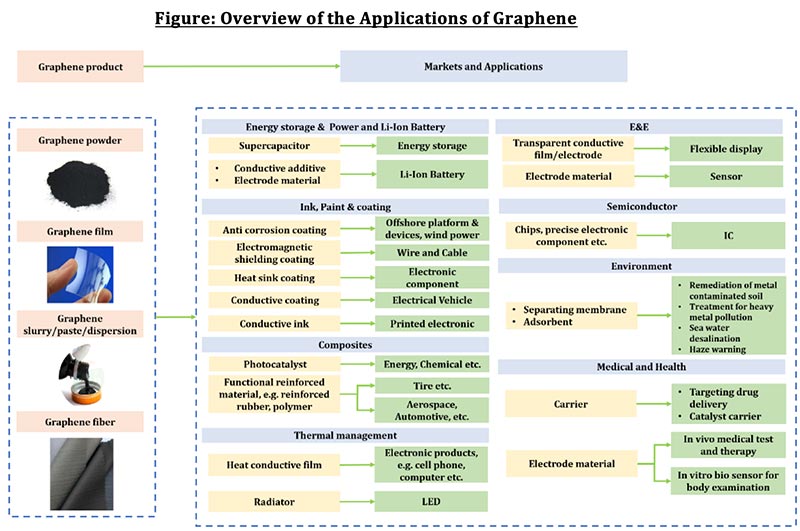

Graphene is gradually moving forward from laboratory research to industrialization by incorporating this super material into different applications, such as, energy storage & power, E&E, paints & coatings, composites, environmental, etc.

While, as graphene is an emerging market and there still exist many uncertainties in the future, research agencies made different estimations for the size of global Graphene market in around 2025, ranging from 150 to 2,000 million USD. In spite of this large gap between the projections of market size, most of agencies foresee a fast growing of Graphene in the next few years, with CAGR over 20%.

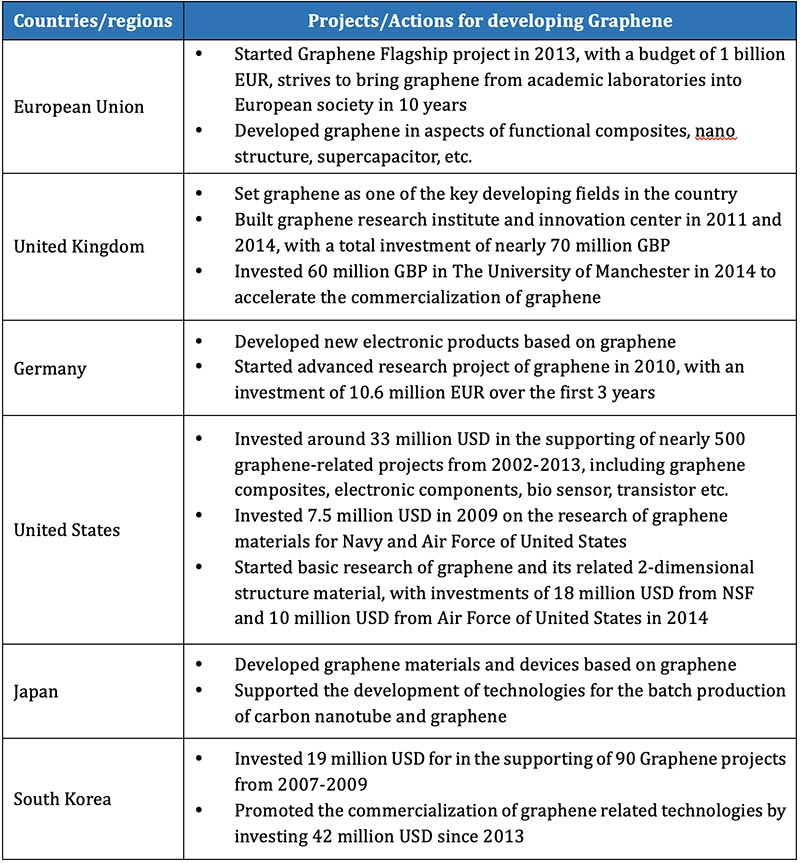

China, United States, South Korea, Japan and European Union are the Top 5 countries/regions for the research and application of graphene. China is considered to play an important role in graphene industry in the future, due to the quick development of technology, supportive policies and investment, and large potential consuming markets.

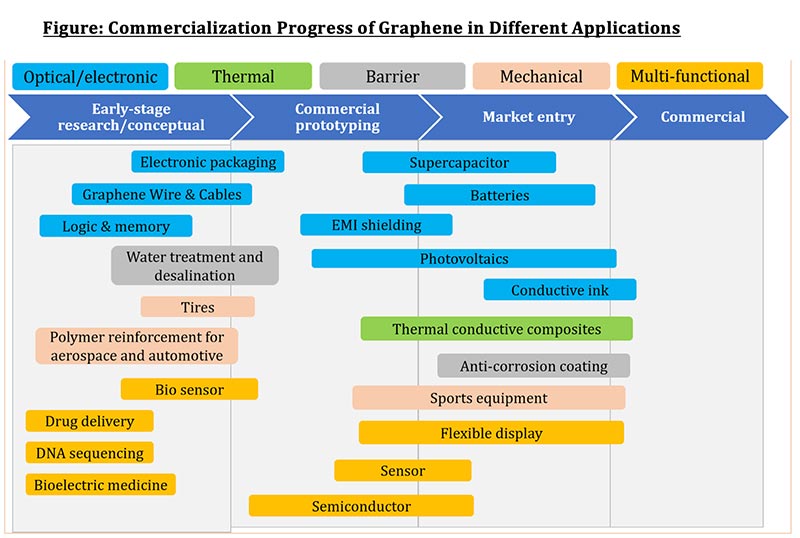

Future development in graphene industry mainly focuses on achieving the large-scale production of graphene products and commercialization of graphene in applications, which includes energy storage, Li-Ion battery, E&E (touch display, sensor, etc.) and semiconductor.

Contents

- General Introduction of Graphene: Definition and Properties

- Market Overview of Graphene

- Value Chain and Key Players

- Research and Industrialization of Graphene

- Trends and Drivers

1) General Introduction of Graphene

1.1 Definition of Graphene

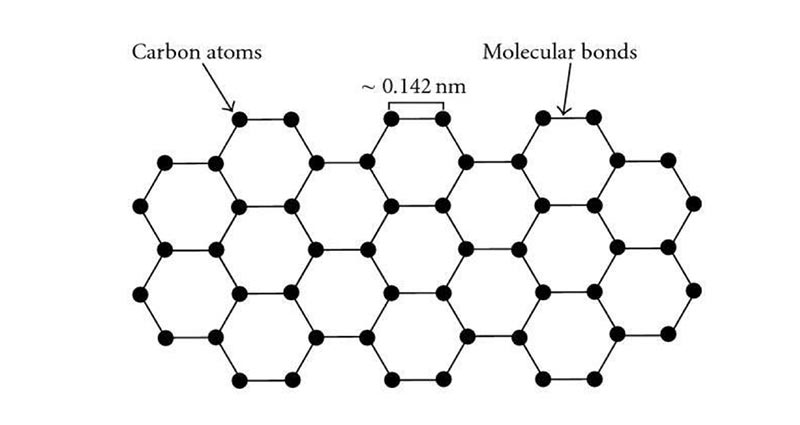

Graphene is a nano-carbon material with a two-dimensional structure, it is actually a one-atom-thick sheet of carbon atoms, in which the carbon atoms are arranged in a hexagonal lattice pattern.

Graphene is the structural element for many forms of carbon, such as graphite, carbon nanotube, and fullerene. It is reported that 1 micrometer-thick graphite consists of around 3 million layers of graphene.

Figure: Schematic Structure of a Graphene Sheet

Source: Structural and mechanical properties of graphene reinforced aluminum matrix composites

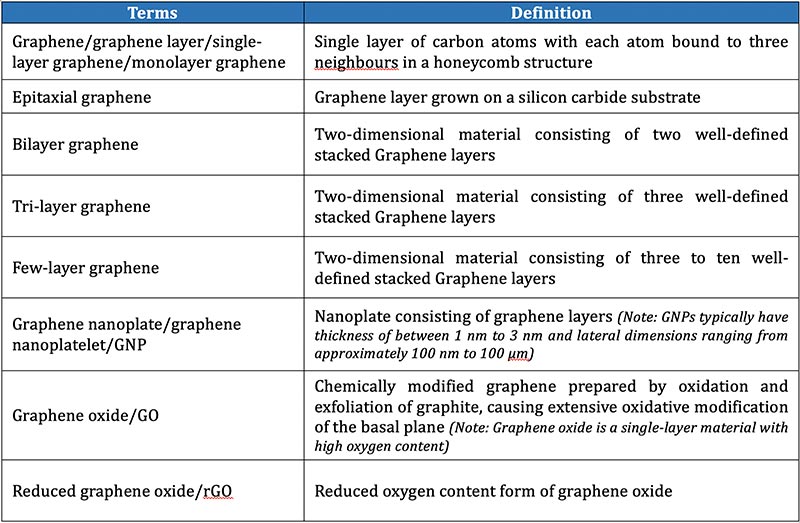

1.2 Terminology Standardization of Emerging Graphene Industry

If strictly following the academic definition, the term “Graphene” refers to an one-atom-thick carbon sheet. However, actually, in the market, “Graphene” is also used in names of carbon materials with multi-layers. In some cases, even the carbon material that is hundreds of layers thick is incorrectly named “few-layer graphene”, which misled the end users, and also blurred the line between Graphene and Graphite

In order to standardize the use of terms in graphene industry, the National Physical Laboratory (NPL) published the world’s first ISO Graphene Standard in 2017 (ISO/TS 80004-13:2017(en) Nanotechnologies — Vocabulary — Part 13: Graphene and related two-dimensional (2D) materials), aiming at providing consistency to the emerging graphene industry and accelerating the commercialization of Graphene.

In this ISO Graphene Standard, a clear definition is given for clarifying the difference between Graphene and Graphite, which is that “In the case of graphene layers, it is a two-dimensional material up to 10 layers thick for electrical measurements, beyond which the electrical properties of the material are not distinct from those for the bulk (also known as graphite)”

As for graphene, there is a group of terms given in this ISO standard which are related to graphene, including

Source: ISO/TS 80004-13:2017(en) Nanotechnologies — Vocabulary — Part 13: Graphene and related two-dimensional (2D) materials

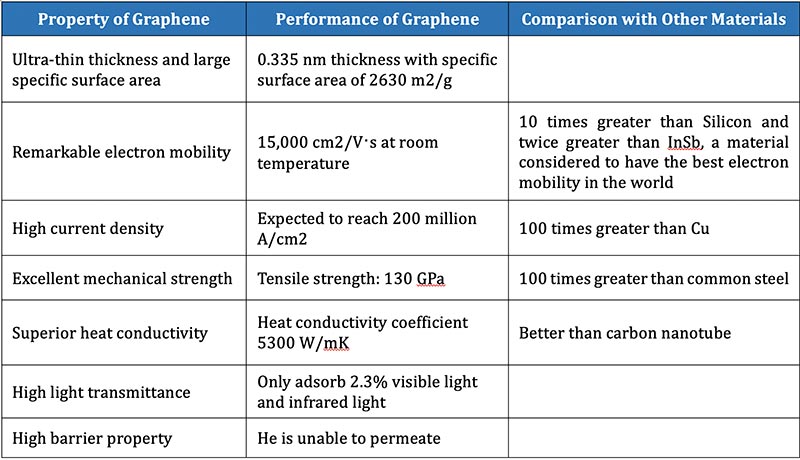

1.3 Properties of Graphene

Graphene is called a “Super Material” due to its extraordinary performances compared with other materials, including,

Also, graphene shows some specific properties which enable it to be developed in some high-end applications:

- High performance sensor: Graphene is able to detect single molecule

- Catalyst like functions: Graphene used in composite could strengthen the ability to transport electron

- Oxygen adsorption ability: Graphene is able to adsorb oxygen at low temperatures

- Ballistic transport:Ballistic transport is possible at room temperature, enabling graphene to be used in laser components

- Stress sensor: Able to foresee the strong magnetic field after deformation occurs

2) Market Overview of Graphene

2.1 Market Size and Growth

Varied projections were made for the global market value of graphene by different research agencies. Some agencies held conservative attitude, such as IDTechEx, Lux Research etc., predicted a value of 150-350 million USD for global graphene market during 2024-2026. While, some of agencies were more optimistic about the global market value of graphene, such as BCC Research etc., estimated that the global market value of Graphene will reach over 2,000 million USD in 2025.

In spite of the large gap between the projected market size of global Graphene industry, most of the agencies foresee a fast growing of graphene market in the next few years with a CAGR over 20%.

Table: Projections of Global Market Value of Graphene by Different Research Agencies (Unit: million USD)

2.2 Application of Graphene

2.2.1 Global Overview

Graphene is anticipated to be used in various end use markets including energy storage, Li-Ion Battery, paint & coating, composites, E&E, environment, medical & health etc.

Graphene has achieved industrialization in some markets and applications, such as, conductive ink, flexible display, thermal conductive composites etc., but is still in the early-stage of commercialization. More work needs to be done to promote the further development in these markets. For some applications, like drug delivery, DNA sequencing, polymer reinforcement for aerospace etc., graphene products are only in the early research stage. Some markets like medical and aerospace have high entry barriers for the new material and the evaluation process is lengthy.

Source: IDTechEx Research report: Graphene Markets, Technologies and Opportunities 2014-2024; Graphene Flagship, European Union; Daydream research

Table: Actions of Countries/Regions in the World for Developing Graphene

2.2.2 Application of Graphene in China

Status Quo

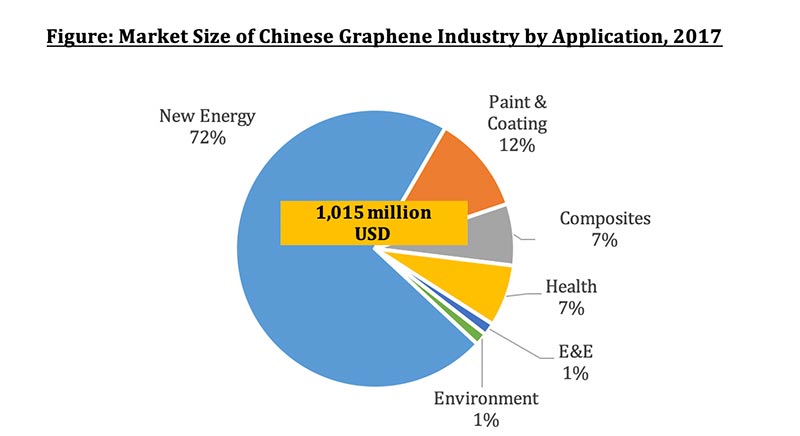

According to the estimation of China Innovation Alliance of the Graphene Industry (CGIA), market size of Chinese Graphene industry was 87 million USD (*) in 2015, and grew to 1,015 million USD (*) in 2017, at a CAGR of over 200%.

Source: CGIA, 2019 Outlook of the development of Chinese Graphene Industry

(*) Since Graphene is a very new market, currently, there is few uniform and systematic standards to define the market size of the Graphene regionally and globally. Different research agencies and industrial alliances have their own methods to make the definition and estimation, which may lead to the differences.

New Energy is the largest end use market of graphene in China, followed by the paint & coating in 2018, Graphene was successfully used in Huawei Mate 20 cell phone, which meant that the commercialization of graphene in thermal management stepped into a new stage and the market size will continue to enlarge.

Future development

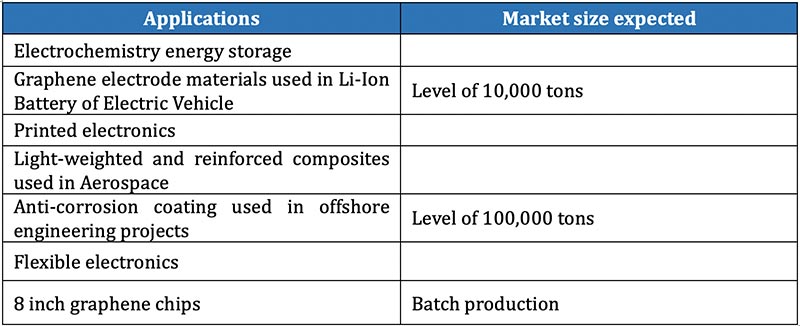

Graphene is a key field to be developed in China, as mentioned in “Made in China 2025”(*). The technology roadmap for the Graphene industry is the following:

- Large scale production of graphene

- Production volume of high-quality graphene powder is expected to be over 10,000 tons annually, film is estimated to be hundreds of million m2

- Commercialization of Graphene in applications:

(*)“Made in China 2025”, released in 2015, is an action plan for promoting the development and improvement of Chinese manufacturing industry

3) Value Chain and Key Players

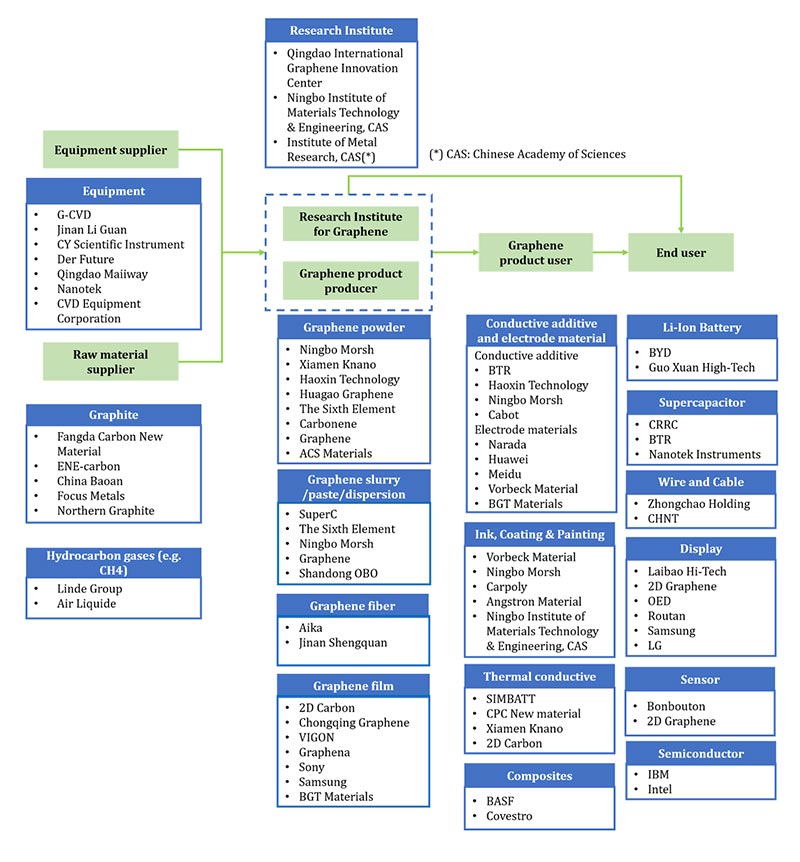

Figure: Value Chain and Key Players of Graphene Industry

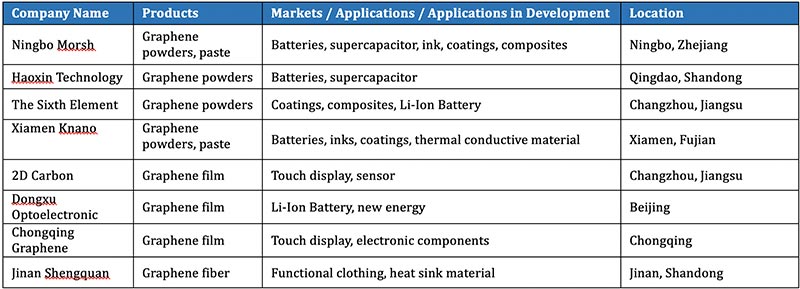

3.1 Key players in China

There are more than 4,800 companies registered in China involved in the graphene industry. This includes 300+ graphene producers and 600+ graphene users, covering the application fields of anti-corrosion coating, thermal management material, energy storage, display etc.

Table: Key Players in China

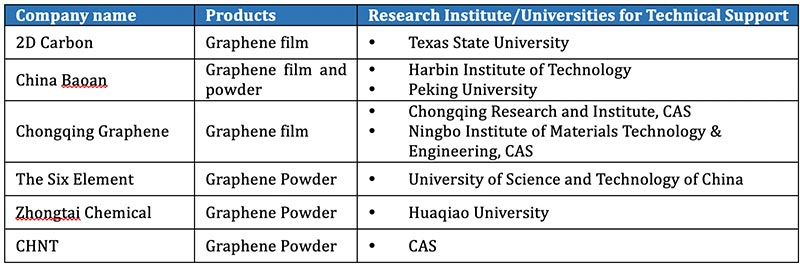

Research institutes and universities also play important role in the graphene industry in China. These institutes are specialized in the R&D of graphene products, and they invest or provide technical support to some graphene companies to promote the industrialization of graphene in different applications.

Table: Collaborations between Graphene Production Companies and Research institute/universities

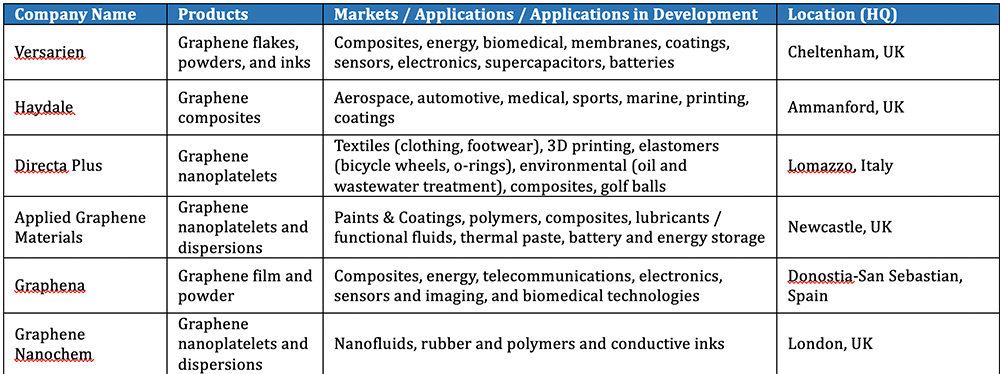

3.2 Key Players in Europe

3.2.1 Manufacturers and Application Development (R&D)

3.3 Key Players in North America

3.3.1 Manufacturers and Application Development (R&D)

Since graphene production is still in the developmental stages there are various other players and manufacturers located across the United States. Many companies are working on collaborations with each other and with research institutions. Some of the key research institutions involved in graphene development and future commercialization include Oak Ridge National Lab, Argonne National Laboratory, Lawrence Livermore National Laboratory and the US Department of Energy. IBM is a key American company involved in research and application development (there are many patents filed under IBM). Prominent players in the carbon industry are also involved in the industry; Cabot produces conductive graphene additives used in electrical applications.

3.4 Key Players in Australia

There are two major global players headquartered in Australia: First Graphene and Talga Resources. First Graphene mines graphite in Sri Lanka and produces graphene. They are focused on developing future applications for graphene like fire retardants, airplane plane wings (composites), building materials, and Voretx fluidic devices, and turbo thin film.

Talga Resources is also a graphite miner and graphene supplier that is working on application development. They have been working with companies like Tata, Chemetall, Haydale, Zinergy and Jena Batteries to develop graphene applications. Some of the market segments and applications being developing include coatings, batteries, concrete, epoxy composites, panels, inks, desalination, automotive, lubricants, energy, paints, biomedical devices, sensors, telecommunications, robotics, 3D printing, renewable energy, and many more.

4) Research and Industrialization of Graphene

4.1 Production of Graphene

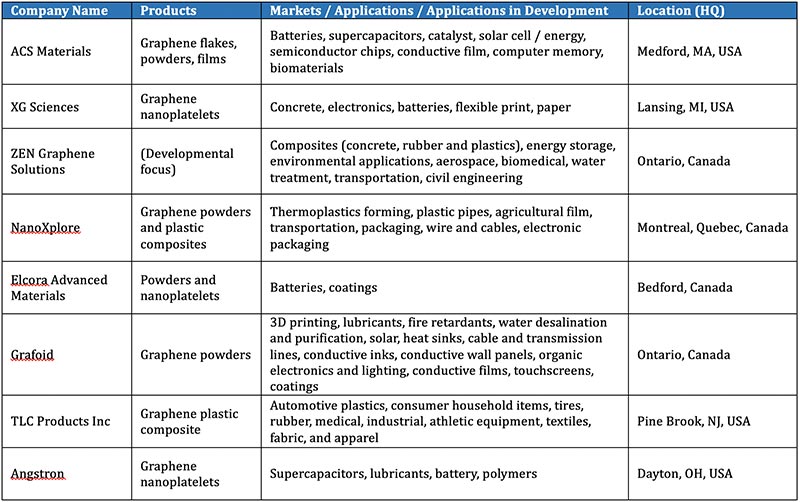

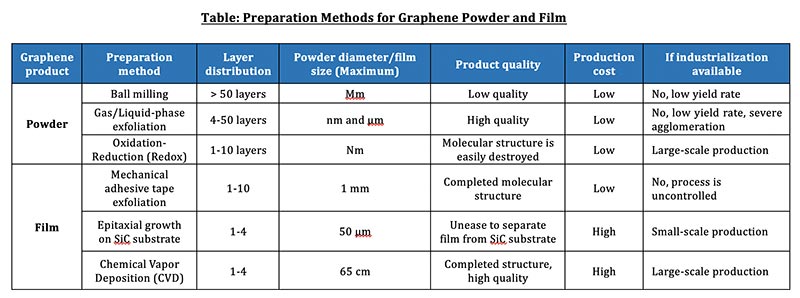

Graphene is now produced by 4 forms: powder, film, fiber, and slurry/paste/dispersion, in which powder and film are the 2 main commercialized products. Current research and improvement of production technologies mainly focus on the preparation of graphene powders and films.

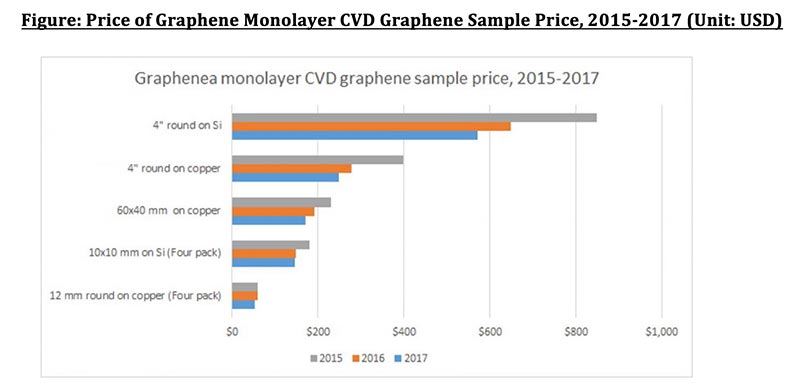

Redox and CVD are considered to be the 2 most promising methods for large-scale production of graphene powder and film respectively. As graphene production technology has improved, the prices of graphene products have become more cost effective over time and are expected to decrease more in the future.

Source: Qianzhan Industry Research Institute

Source: Graphene-info

4.2 Patents about the Production and Application of Graphene

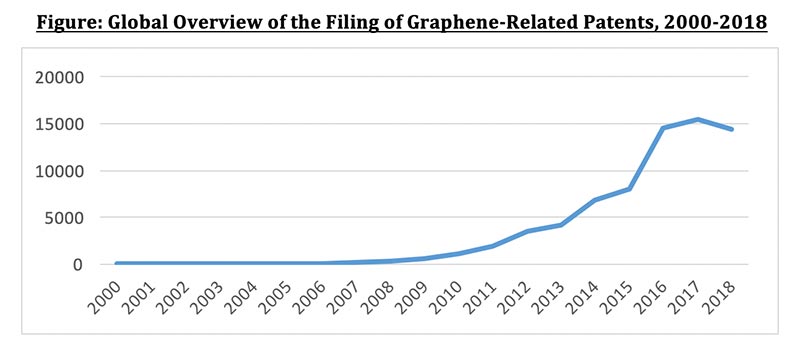

The filing of graphene-related patents has grown rapidly since 2009, followed by another surge in 2016. Nearly 15,000 graphene-related patents were applied in 2016 alone. Although rapid growth did not continue after 2016, the number of graphene-related patents filed annually was still around 15,000 in 2017 and 2018(*).

(*) Due to the long period from the delivery of patent application to the publication of information on the internet, the number of patents filed may be less than shown.

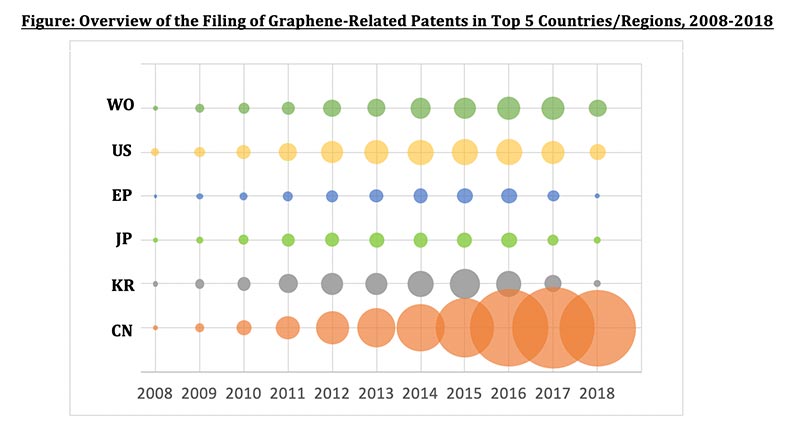

China is the largest contributor in the world for graphene-related patents

China, United States, South Korea, Japan and European Union are the Top 5 countries/regions for the filing of graphene-related patents, with China being the largest contributor of patents since 2011, followed by United States and South Korea. The number of graphene-related patents applied for in China greatly outnumbers than patents filed in the United States and South Korea.

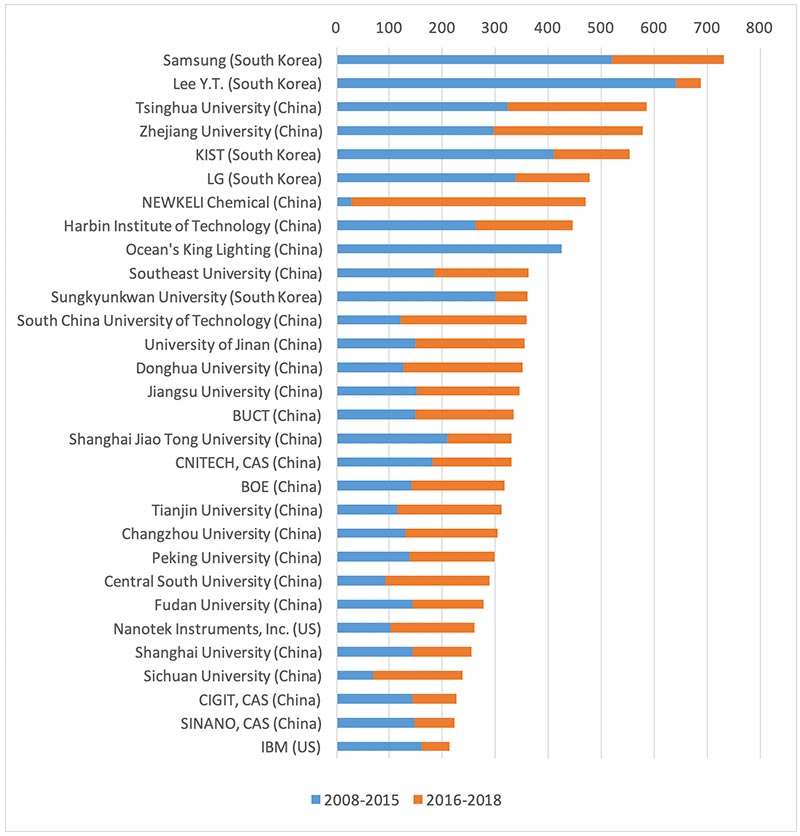

Figure: Top 30 Assignees for the Filing of Graphene-Related Patents, 2008-2018

Table: Top 10 Assignees for Graphene-Related Patents

During 2008-2018, China had the largest number of assignees in the Top 30 list for the filing of graphene-related patents, occupying 23 seats, followed by South Korea with 5 assignees and US with 2 assignees.

In the past 10 years, South Korean assignees led the filing of graphene-related patents in terms of the number of patents. All 5 of the South Korean assignees listed were ranked among the top 15. Assignees such as Samsung, Sungkyunkwan University etc., are very important players in South Korea, as well as globally for the research of graphene.

When looking at the top 10 list over the past 3 years from 2016-2018, it is evident that Chinese players are more active in the filing of graphene-related patents. In addition, there are more Chinese assignees appearing in the top 10 list; 9 out of 10 assignees are from China. Furthermore, for the majority of Chinese assignees in the ranking, graphene-related patents they applied in 2016-2018 account for nearly or more than 50% of the total graphene-related patents they applied in 2008-2018. Institutes and unversities in China play an important role in the research of graphene, occupying 20 seats in total 23 Chinese assignees listed.

There are 2 US companies ranked in this top 30 list, Nanotek Instruments, Inc. and IBM, who are dedicated to the appliction research of graphene in the fields of energy storage and semiconductor, respectively.

Research of graphene is strongly active in the following areas:

- Graphene preparation

- Application of graphene in

- Electrode, Li-Ion Battery, capacitor, energy storage

- Composites

- Semiconductor

5) Trends and Drivers

The superior performance of graphene has attracted lots of companies, institutes, and universities all over the world to launch projects for the R&D and industrialization of graphene. Even though commercialization of graphene has started, there is still a long road ahead for graphene to penetrate into different applications. Before graphene applications can fully enter various industries, there needs to be more basic research, long-term evaluations of performance, accumulation of the application data, and an establishment of industry standards.

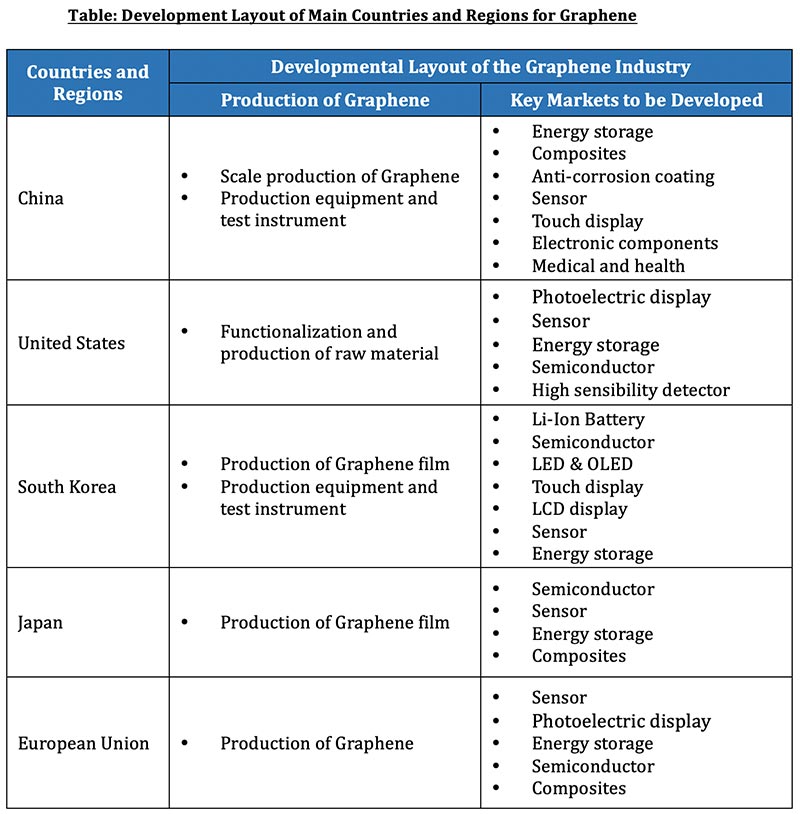

Main countries and regions in the Graphene industry, including: China, United States, South Korea, Japan and European Union, all have their own layout for the development of the graphene industry. They are all targeting large scale production, lower the production cost of graphene and to incorporate it into different applications, in a cost-effective way.

Source of information

- “graphene definition, meaning – what is graphene in the British English Dictionary & Thesaurus – Cambridge Dictionaries Online”. cambridge.org.

- “Graphene”. Merriam-Webster.

- https://www.sculpteo.com/blog/2017/11/22/the-wonder-material-in-3d-printing-graphene/

- Structural and mechanical properties of graphene reinforced aluminum matrix composites

- Qianzhan Industry Research Institute

- China Innovation Alliance of the Graphene Industry

- 2019 Outlook of the development of Chinese Graphene Industry

- Graphene Flagship: http://graphene-flagship.eu/

- Graphene-Info

- ISO/TS 80004-13:2017(en) Nanotechnologies — Vocabulary — Part 13: Graphene and related two-dimensional (2D) materials

- Graphene: An Introduction to the Fundamentals and Industrial Applications, Madhuri Sharon, Maheshwar Sharon

- Google patent

Abbreviation

ISO: International Organization for Standardization

CGIA: China Innovation Alliance of the Graphene Industry

KIST: Korea Institute of Science and Technology

BUCT: Beijing University of Chemical and Technology

CNITECH: Ningbo Institute of Materials Technology & Engineering

CIGIT: Chongqing Institute of Green and Intelligent Technology

SINANO: Suzhou Institute of Nano-Tech and Nano-Bionics

CAS: Chinese Acadamy of Sciences

Exchange rate – May 2019

1 CNY=0.145 USD

1 GBP=1.28 USD

1 EUR=1.12 USD

Author and Contributors:

Author: Siwen Pan

Contributors: Brett Ferguson, Nicolas Messin, Yusi Chen, Jean-Louis Cougoul.

Contact us

We have the Knowhow, Knowledge, Rigor and Technical background to analyze Patents, Value Chain, Market Needs to deliver BtoB projects in US, Europe, Asia on:

- Market Strategy (MS)

- New Business Development (NBD)

- Methodology & Tools for MS, NBD, Pricing.

- Training

Please contact us: contact@daydream.eu, contact@dynovel.com, jean-louis.cougoul@daydream.eu