Introduction

Driven by increasing environmental & energy concerns and rising focus on climate change, many countries have built their strategies and set timetables to phase out the traditional fossil fuel cars, including both production and sale, in the next 5 to 20 years. Stimulated by regulatory guidelines and fueled by rapidly-developing battery technologies and reducing production cost, NEVs (new energy vehicle) including Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle and Fuel Cell Vehicle have become an unstoppable trend in the global automotive industry.

Driven by increasing environmental & energy concerns and rising focus on climate change, many countries have built their strategies and set timetables to phase out the traditional fossil fuel cars, including both production and sale, in the next 5 to 20 years. Stimulated by regulatory guidelines and fueled by rapidly-developing battery technologies and reducing production cost, NEVs (new energy vehicle) including Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle and Fuel Cell Vehicle have become an unstoppable trend in the global automotive industry.

On account of the complicated and diverse automobile systems and the complexity of the entire automotive industry value chain, the NEVs development will extensively create new opportunities and challenges for OEMs as well as for Tier Suppliers in all related fields, e.g. power battery, used battery recycling, electric motor, plastic materials, precious metals, electric materials etc.

In this article, Daydream will give a brief introduction of the Chinese NEVs industry, list some key potential opportunities for the NEV (sub)system and components, and pick some of the topics related to plastic materials for a further introduction: light-weight and Electric Material for NEVs.

If you need more information linked to green cars and related industries, please contact: contact@daydream.eu, stephanie.lorini@dynovel.com, jean-louis.cougoul@daydream.eu, yusi.chen@daydream.eu

Development of NEVs (new energy vehicle) industry in China

Context

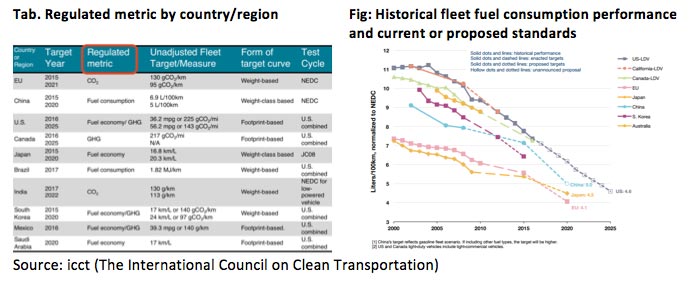

Increasingly severe energy and environmental issues compel the governments to strictly control the energy consumed and air pollutant emitted by automobiles. All around the world, the major automotive manufacturing countries and regions started to set up goals to restrict the fuel consumption rate of passenger cars. Achieving those targets require widespread adoption of electric vehicles.

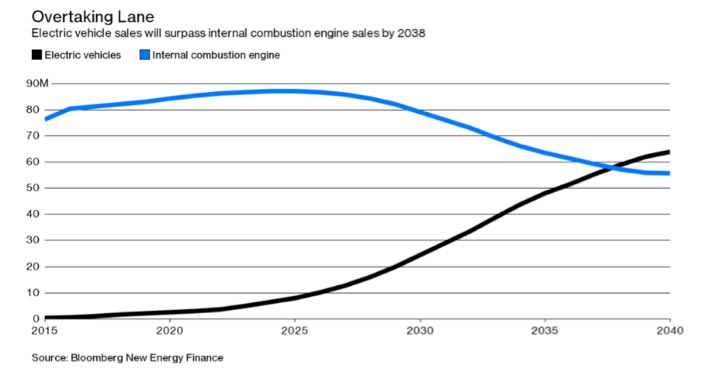

According to BNEF (Bloomberg New Energy Finance), the NEVs sales will surpass that of traditional fuel vehicles by 2038.

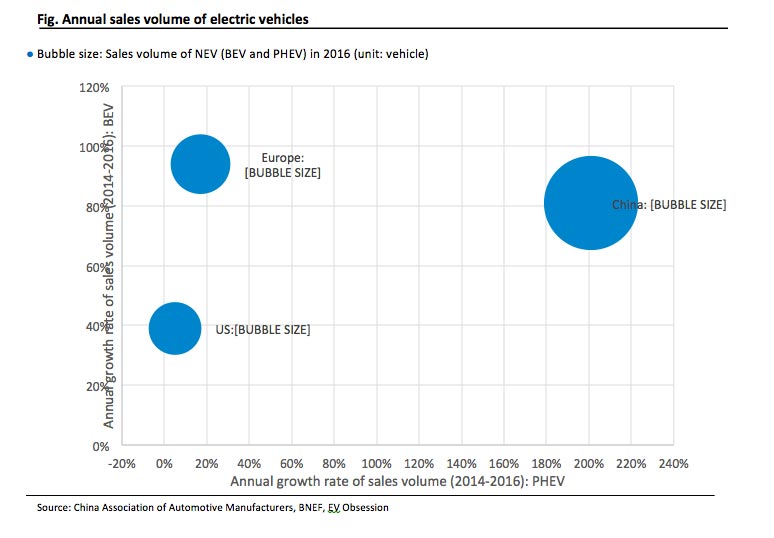

China has overtaken America and become the leader in the NEVs industry with an impressive 43% of global NEVs production in 2016.

Market of NEVs in China

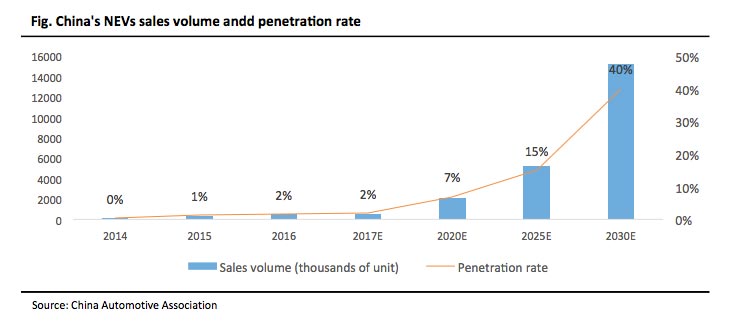

The Chinese new energy vehicle industry has stepped into a fast-developing period that began in 2014. According to the China Automotive Association, the penetration rate of Chinese green cars is predicted to be 6% by 2020 from 2% in 2016, and will reach up to 15% by 2025.

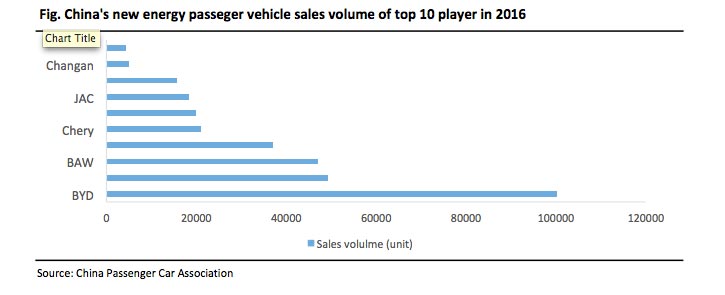

The top 10 best-selling NEVs manufacturers in China in 2016 were BYD, Geely, BAW, Zotye, Chery, SAIC, JAC, JMC, Changan and Dongfeng. All of them are domestic brands.

Drivers of the Chinese Market of NEVs

The rapid development of the Chinese electric vehicles industry in the past several years is driven by the combination of different factors:

- NEVs being the possibly best solution to overcome the contradiction between

- The Chinese expanding passenger car market driven by the rising household income and urban population

- And the jeopardized air quality attracting more than ever focus of the public and government

- Breakthrough in development of batteries – the core challenge to NEVs

- Cost of the average battery kept dropping (in 2010: ~$900/kWh, in 2016: ~225/kWh, in 2020: prospected to be below $150/kWh)

- Energy density per battery being optimized

- Upgraded value chain of battery production with strong presence of leading local players

- Regulatory factors

- The Chinese government shows strong willingness to leverage the NEVs industry upgrade to its short-to-long-term development strategy in various area: environment, energy security, CO2 emission, economic development, etc.

- Environment: China is confronting a greater environmental pressure and is one of the biggest atmosphere polluters in the world. The ICE with fossil fuel as source of propulsion is the major resource of the NOx emission and one of the biggest contributors of PM2.5 in the air

- Energy security: China’s import dependence on crude oil increased to 65% in 2016[1]. Meanwhile, over-capacity of power generation started to be an issue as the national demand for electricity is slowing down together with the macro economy

- Climate change: in 2016, China has signed the Paris Climate Agreement and committed to the following actions by 2030:

- Lowering carbon dioxide intensity (carbon dioxide emissions per unit of GDP) by 60 to 65 percent from the 2005 level

- Increasing the share of non-fossil fuels in primary energy consumption to around 20 percent

- Economic development: in 2016, the total sales value of the Chinese automotive industry was 8,019 billion RMB, holding 6.9% of the total industrial output value[2].

- Current stimulus includes

- The mandatory policies, e.g. limitations to automotive fuel consumption and pollutant emission

- The supportive policies based on fiscal subsidies

Among all these factors mentioned, government stimulus is the most powerful and direct one for the short-term Chinese explosive development of the NEVs industry. Below are some further explanations of the related policies.

- 1) Mandatory policies against the traditional automotive industry provide developing space for NEVs

Since 2004, the Chinese central government has introduced a series of policies to limit the average fuel consumption and emission of passenger cars.

In 2012, China’s Ministry of Industry and Information Technology have set the target for corporate average fuel consumption of passenger cars (CAFC) as 5L/100Km by 2020, and as down to 4L/100Km by 2025. The

common solutions OEMs have applied to reduce fuel consumption include improving fuel efficiency, increasing proportion of small-displacement engines, reducing the car weight, and developing NEVs.

But from a practical point of view, the result of fuel consumption reduction is unsatisfactory in the past years. By the end of 2016, the qualification rate of CAFC among 96 Chinese local passenger car OEMs is 68%, while that among 27 imported OEMs is only 52%. If the current situation remains unchanged, the target of CAFC seems it will be difficult to achieve.

[1] Source: Sinopec

[2] Source: the National Bureau of Statistics of China

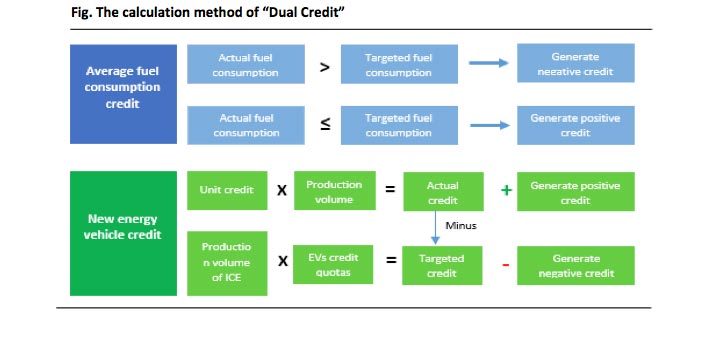

In this context, Chinese central government is working out a new powerful policy known for short as “Dual Credit Policy”. According to the draft scheme, carmakers will not only be assessed against the fuel-consumption credits, but also be examined in terms of NEVs credits. This policy sets passenger NEVs credit quotas of 8%, 10% and 12%, respectively, for all carmakers from 2018-2020. The calculation of NEVs credits depend on the production & import volume of NEVs and the driving range on one charge of NEVs models. Those who fail to meet the goals will have to buy credits from other carmakers or be fined. The NEVs credits can be used to enhance their gasoline fuel consumption efforts and to compensate the negative fuel-consumption credits.

With the mandatory target of CAFC, there are reasons to believe that the “Dual Credit Policy” will help to boost the Chinese NEVs development.

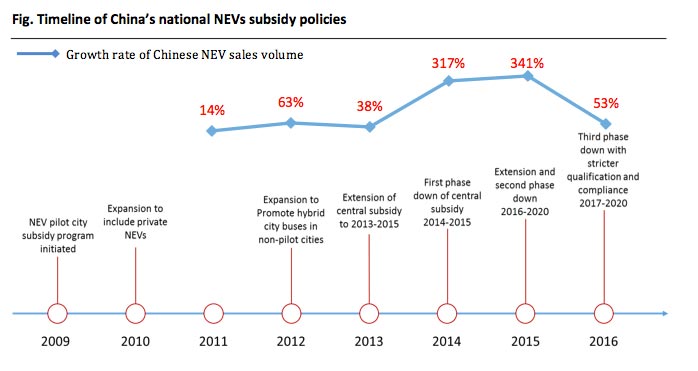

- 2) The support policies directly resulted in the explosive growth of Chinese NEVs

Since 2009, the new energy vehicle industry has been listed as one of the seven strategic emerging industries with high value in China. A series of policies has been introduced involving the whole industrial chain to guarantee substantial promotion and application.

Among these policies and regulations, the fiscal subsidy at both the national & provincial levels undoubtedly retains one of the most powerful NEVs-stimulus mechanisms. Chinese subsidy policies can be simply split into two sectors:

- Fiscal subsidies for power battery manufacturers and other industrial players related to NEVs

- Fiscal subsidies for NEVs buyers

Directly subsidizing the NEVs purchasing dramatically stimulates the NEVs adoption. This policy was implemented in 2010.

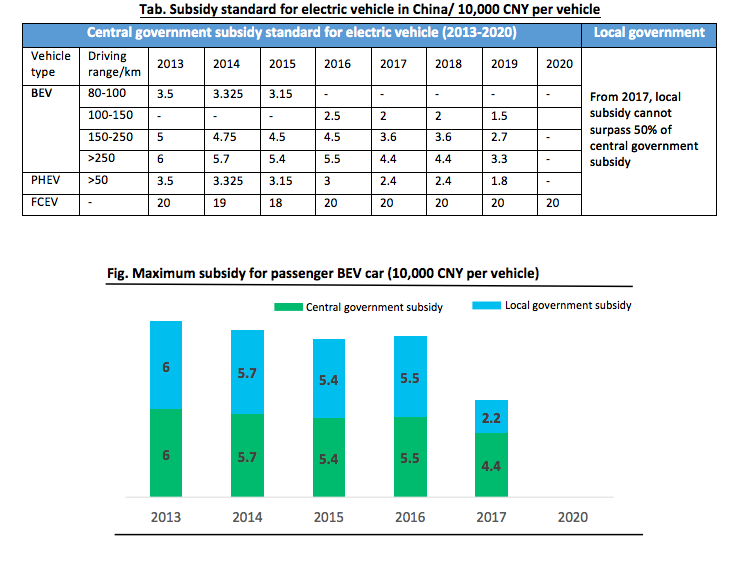

Taking the passenger BEV for instance, the maximum purchasing incentives could reach up to 120 thousand CNY for purchasing every single passenger BEV, which means that consumers could buy the NEVs with a lower price compared to similar-level traditional cars.

While increasing NEVs sales volume, the policy also brings some disharmonious factors to the market, the most serious one are subsidy fraud scandals. According to a nationwide investigation conducted by the Chinese government in early 2016, more than 20 manufacturers including some well-known OEMs had cheated to receive the subsidies. Though, fiscal subsidies are indeed a key driver of NEVs uptake in China, the policy design and implementation in China has vulnerabilities and loopholes, which are the main causes of subsidy fraud.

The Chinese government has recognized these loopholes and has taken actions to address them.

In the updated version of the subsidy policy, the Chinese government has made some important adjustments:

- A phase-down of fiscal incentives is included in the new policy. The per-vehicle subsidy from 2017 to 2020 ramps down by 20% every 2 years from the 2016 levels before the national fiscal incentive program ends in 2021. The maximum incentives for purchasing one passenger BEV falls from 120 thousand CNY in 2010 to 66 thousand CNY in 2017

- Tightened technical requirements for NEVs to qualify for subsidies. Subsidies will be graded depending on endurance mileage of NEVs, the electric vehicles with advanced technologies are preferred

- Strengthen anti-fraud and enforcement measures

Faced with the incentive reduction, Chinese OEMs have to seek technical development for cutting down manufacturing cost and improving product quality.

Emerging opportunities for the plastic materials industry from NEVs

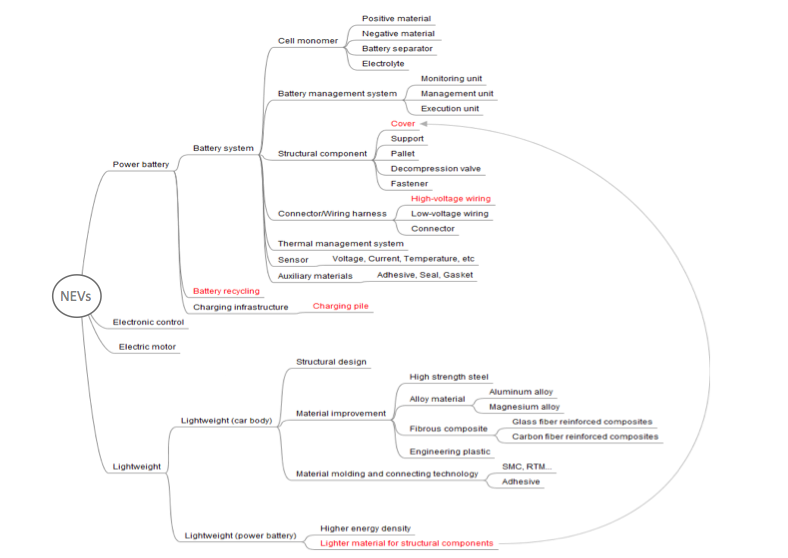

The new energy vehicle industry is a very complex one in terms of product technologies and value chain. Below are key trends & focus related to NEVs.

The driving range is always a pain point for a larger adoption of electric vehicles. Development of EIC systems and lightweight vehicles are the effective solutions to this problem, so they are considered as the priorities of research and development in the NEVs industry.

The EIC system in NEVs refers to the Power battery, Electric motor and Electronic control system. The development of EIC system, especially the power battery technology, determines how far the NEVs industry can proceed to some extent. The power battery industry is comprised of battery manufacturing, battery recycling and battery charging, providing extensive opportunities for plastic material enterprises.

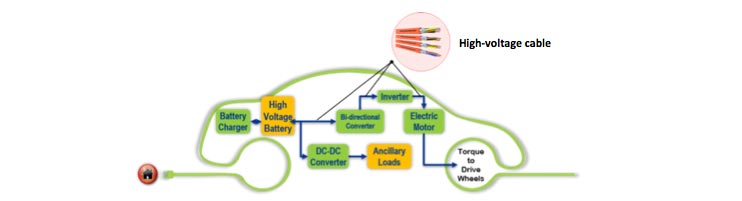

- Plastic materials involved in the power battery manufacturing include

- Structural parts: Battery shell, Battery support, Battery pallet, etc.

- Connector & Cable harness: High-voltage cable, Low-voltage cable, Connector

- Others

- Charging infrastructures are estimated to create a large potential market for engineering plastic materials

The NEVs are more eager to cut the weight down compared to ICE vehicles for energy-saving, longer driving range, and driving safety reasons. In addition to reducing the car body weight, the same as what is done in the ICE vehicles, the EVs can also achieve the lightweight target via reducing the weight of battery system, which can hold 15-25% of the entire car weight. The common approach is to replace the metal with engineering plastics for the structural parts, e.g. battery shell, battery pallet, connector, etc.

Taken together, NEVs create plenty of new applications for plastic materials, in the next chapters, Daydream will select three examples to give a brief introduction:

- Plastic material for battery shells

- Thermoplastic material for high-voltage cable harnesses

- Plastic material for charging infrastructure

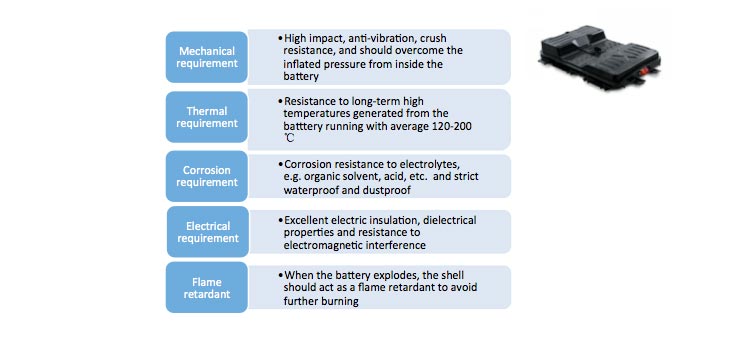

1) Plastic materials for battery shells

The battery shell is a key component in EVs as a container of electrolytes and protector of the cell pack from damage. The materials for the shell have to meet the following requirements:

The traditional material of a power battery shell are steel, aluminum and hard rubber. With the lightweight trend in the automotive industry, OEMs are using more engineering plastics and fiber reinforced composites to replace metal. The non-metal materials in use include SAN, ABS, SMC composites, GF PP, GF MPPO, PVC, etc.

Although the non-metal materials have not been largely adopted as battery shell materials because of the high technical requirements (especially the electrical properties), material molding technology and the material cost, some industry pioneers of NEVs OEMs have already succeeded in applying plastics as battery shell material. The demand for lighter battery shells from NEVs OEMs will accelerate the technical progress of plastics, and the excess material costs will decrease due to scaling effects if plastics can be largely applied in NEVs.

The non-metal power battery shell market in China is mostly occupied by global materials giants, including Covestro, Dupont, etc. Some emerging Chinese domestic players includes Shenzhen Wotlon, Shanghai Pret, Keju, Kingfa, etc.

2) Thermoplastic materials for high-voltage cable harnesses

The cable harness is a very important component in automotive electric systems, playing the role of energy delivery and signal transmission.

In an ICE vehicle, there is only a low-voltage electric system (12V) for the air conditioner, lighting system, instrument system and all kinds of controllers. In NEVs, apart from the low-voltage electrical system, there is an additional high-voltage electrical system (>300V), where the high-voltage cable harness is required to connect the battery and motor. The requirements for low-voltage cables in NEVs and ICE vehicles is similar, but the high-voltage cable has distinct needs of material, manufacturing process and equipment.

The serious challenges to high-voltage cables include overheating, combustion, harsh use conditions, and EMC, resulting in a large security risk. So a qualified cable harness is an important guarantee of an electric vehicle’s safe and reliable operation.

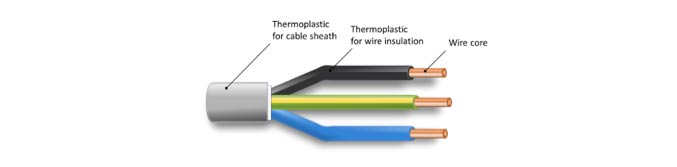

The thermoplastic is a very important constituent in high-voltage cable harnesses. It’s used to dress the wire core, acting as insulation, encapsulation, being moisture and dust proof, and as a mechanical protection sheath. The requirements for thermoplastics are listed as the following:

- Thermal resistance. It’s the essential and primary consideration when manufacturers choose the thermoplastic for wring

- Mechanical requirements. material with excellent flexibility is preferred, in addition, the wear resistance is also needed

- Insulation and EMC. Given the high voltage and high-frequency impulse in the cable harness, the electrical insulation and EMC is the guarantee of electrical safety

- Anti-aging. The cable is likely to contact various corrosive substances and be subjected to a harsh environment, so corrosion resistance and anti-aging is necessary

Modified PE and PVC are the most widely used materials for high-voltage cable harnesses now, and TPU is also used. The value of the thermoplastic materials per unit of electric vehicle is about 100-500 CNY. Coupled with Chinese production volume of NEVs in 2016 (0.52 million units), the market size of thermoplastics in high-voltage cable harnesses is roughly estimated at 50-300 million CNY.

The Chinese thermoplastic market is still dominated by some global companies, e.g. America’s Reychem and Japan’s Sumitomo. There is a significant gap in quality between the products from Chinese domestic companies and global companies, so the local players take full advantage of the lower price (about 20-50% of global ones) to capture market share. At present, the customers of domestic brands of thermoplastics are mostly local NEVs OEMs. The main domestic players include ChangYuan group, Woer and NuoDe.

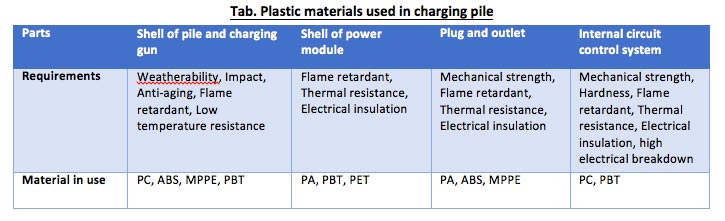

3) Plastic materials for charging pile

Development of EIC systems is the valid solution to kill the pain points of NEVs to prolong driving range. Apart from developing the power battery technology, increasing availability and speed of charging infrastructure are also urgently required.

There were 150,000 units of public charging piles installed in China by the end of 2016, increasing from 1,122 units in 2010 with a CAGR of 126.1%. In addition to the public charging piles, there are 170,000 units of private charging piles in 2016. According to the Chinese central government policy, the targeted distributed charging pile stock should reach up to 4.8 million units, and centralized charging stations should reach 12,000 units by 2020. A 100 billion CNY potential market of Chinese charging piles could be created if the target can be achieved.

There are six parts in a charging pile using plastics, pile shell, shell of the charging gun, shell of the power module, plug and outlet, and internal circuit system (contactor and disconnector).

The large potential opportunity attracted many materials companies to enter this market. The key players include:

Global: Covestro, Sabic, Teijin, Solvay

Domestic: KingFa, Selon, Kumho Sunny, Polyrock, Shenzhen Fuheng

Every coin has two sides. With lacking sufficient control & regulation in this blossoming industry, many unqualified material products have appeared in the Chinese charging infrastructure market, which could bring damage to its healthy development.

Conclusions

The Chinese NEVs industry is entering an unprecedented growth phase with the governmental stimulus in the short term and the market pull & technology push in the longer term. It will generate enormous new opportunities but also bring about new challenges for different industries, electrical material and battery being one of them.

This market for electrical material is nearing but not yet stable and mature now. From the battery system to charging infrastructure, because of the lack of industrial standards and enough references, OEMs are looking for ways for better material solutions cooperating with their Tier suppliers including material suppliers.

References

- Patrick Hertzke, Nicolai Müller, and Stephanie Schenk, Dynamics in the global electric-vehicle market, McKinsey insight, 2017

- Alejandro Zamorano, Global EV trends and forecast, Bloomberg New Energy Finance, 2017

- Bin Zhao (Senior engineer in BYD), Automotive Non-metals Materials Technology and Application Forum, 2017

- China Association of Automobile Manufacturers, www.caam.org.cn

- China Passenger Car Association, www.cpca1.org

- China’s Ministry of Environmental Protection, www.mep.gov.cn

- China’s Ministry of Industry and Information Technology, www.miit.gov.cn