Introduction

Introduction

A decade ago, it was hard to think that Electric Vehicles (EVs) could be the future of transportation. However, today, with technological improvements, stricter emissions standards, and changes in consumer tastes, electric cars have been driven further into the mainstream. It is no longer a question of if but when EVs will dominate the global Automotive sector. In this dynamic context, key players must now be prepared and must anticipate the potential effects on different industries. As the transition from fossil fuel-burning vehicles to EVs continues apace, there will be a significant impact on a number of associated markets. Demand for different resins and materials will change as the new technical requirements (thermal, mechanical, electrical, etc.) associated with EV systems come to the fore. One such material segment that will experience an important impact from a market perspective is the lubricant space. The landscape of lubricant usage in cars will look significantly different as the internal combustion engine (ICE) is first modified in the case of hybrid and plug-in hybrid electric vehicles (HEVs and PHEVs), and then completely removed for battery electric vehicles (BEVs).

Daydream – Dynovel has a wide variety of customers in the specialty chemicals and materials industry that will be affected in different ways by the changing market landscape in the Automotive sector. The following White-Paper presents an introduction of this Growing EV market with a special focus on lubricants and its evolution in the context of the transition to electric vehicles in the coming years.

If you need more information linked to this topic and the related industries, please contact us at: contact@daydream.eu, stephanie.lorini@dynovel.com, yusi.chen@daydream.eu, jean-louis.cougoul@daydream.eu.

Electric Vehicle (EV) introduction & perspective

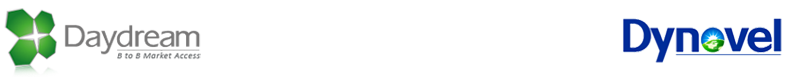

Today, there are three main types of EVs: BEVs, HEVs and PHEVs, with the latter two often grouped together in analyses. Figure 1 below depicts the engine/motor structure of these vehicles.

Figure 1: Structure of the different EVs in the market today: HEVs, PHEVs and fully electric BEVs (Source- “Plugged in; The End of the Oil Age”, by Gary Kendall, WWF).

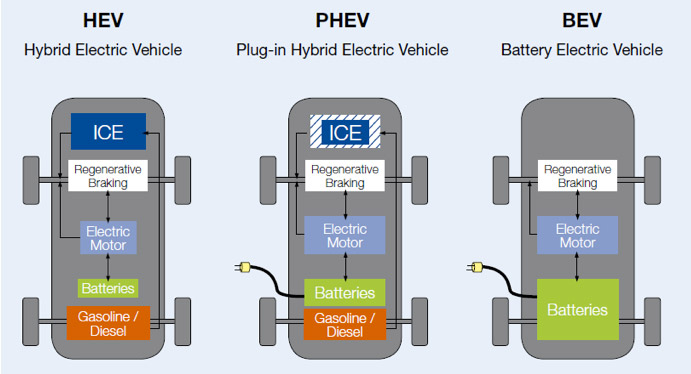

In 2015, there were about 1.1 billion light passenger vehicles on the world’s roads. Well under 1% of them were electric, with HEVs and PHEVs representing 89% of the EV space, as seen in Figure 2. Clearly, despite increasing consumer demand and regulatory pressures promoting the EV industry, penetration was minimal in 2015. Today, light passenger vehicle numbers are approaching 1.2 billion, and though EV numbers have grown since 2015, overall penetration remains minimal (<1%). Within the EV space, HEVs and PHEVs are expected to continue to grow in the next few years, delaying the expected future dominance of BEVs.

Figure 2: Breakdown of global EV market in 2015 (Source- McKinsey Energy Insights)

The market growth rate is expected to exceed double digits in the coming years in the key regional markets of North America, Europe and Asia, fueled by public concern regarding climate change and pollution, rising regulatory pressures and technological innovation. With significant overall global growth in the number of automobiles on the roads expected in the short-to-medium term, in particular in developing economies in Asia, ICE-based vehicle numbers will likely continue to grow, but the percentage of total cars that will be electric will increase, as EVs capture share from their traditional counterparts.

As mentioned above, regulatory measures and rising public concern regarding the effects of greenhouse gas emissions on climate change will drive growth in the EV space. In addition, this growth will be further propelled by technological advancements in battery and materials technology which will make EVs more cost effective to produce and to operate. Recent scandals such as the Volkswagen emissions scandal have served to add fuel to the public’s concerns and will help drive increasing demand for electrification in the Automotive industry.

The following are measures that have either already been put in place or have been planned for the coming years that are likely to promote relatively rapid growth of EVs generally.

- The Paris Climate Accords

- 195 members of the United Nations Framework Convention on Climate Change (UNFCCC) have signed the agreement, one that includes greenhouse gas emission reduction targets among other goals that must be realized by signatory parties by specific future dates

- The US recently announced plans to withdraw but the agreement states that the earliest date at which this can happen is November 2020

- Automakers like Toyota and Volvo have set ambitious goals when it comes to EV production growth

- Volvo has announced that it will only produce BEVs or HEVs/PHEVs from 2019 onwards

- Toyota expects to offer more than 10 BEVs globally by the early 2020s. In addition, by 2025, they plan to have all Toyota or Lexus models be either BEVs, HEVs/PHEVs or other vehicles that have an electric option (e.g. hydrogen fuel cell)

- New players arrive very quickly on the market by jostling existing players like Tesla, BYD …

- Different countries have either enacted or are considering plans to promote EV growth and reduce dependence on ICE-based vehicles

- India is considering a ban on sales of petrol/diesel cars by 2030

- France, under Emmanuel Macron’s leadership, has announced plans to ban all gasoline and diesel vehicles by 2040

- Other countries are following suit

Current lubricant usage in the Automotive industry:

Lubricants are typically organic compounds that are used to reduce friction between two surfaces that are in contact. Their role is vital in reducing wear and extending engine life, while also improving fuel efficiency and performance. They may provide other functions as well, including protection against corrosion and rust, contaminant transportation, and heat dissipation. In vehicular systems, there are a number of metal-to-metal points of contact that require lubrication. In time, lubricants degrade under the high temperature and pressure conditions of engines and automotive systems, so they need to be changed every so often, depending on the lubricant type and function.

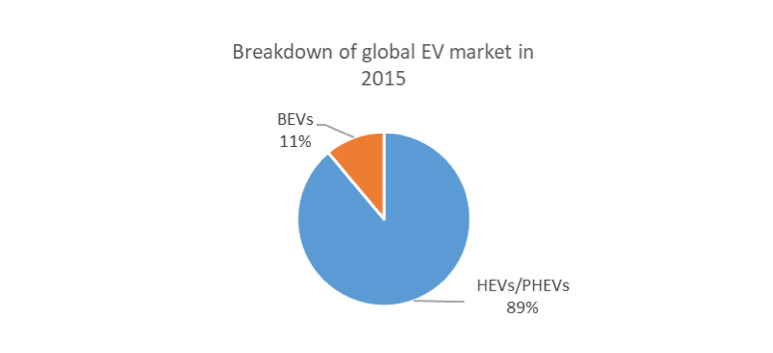

There are four key types of lubricants that are used in traditional ICE-based cars and EV cars:

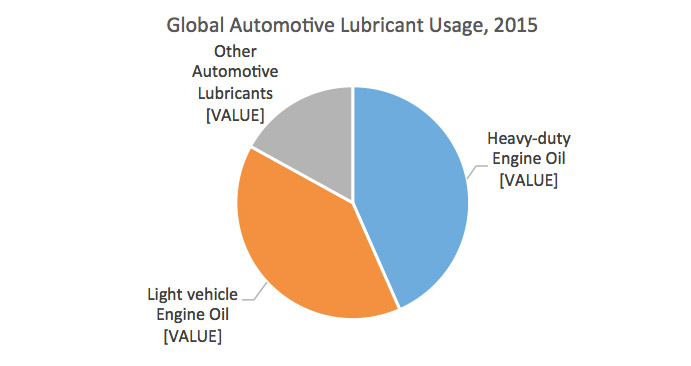

Clearly, Engine oils represent the key segment for Automotive lubricants (>80% of all lubricants consumed by volume in this space, including both passenger cars and heavy-duty vehicles like trucks). Refer to Figure 3 below for a breakdown of lubricant consumption in the Global Automotive sector in 2015.

Figure 3: Breakdown of Global Automotive Lubricant Consumption in 2015

(Source- McKinsey Energy Insights) [1]

Lubricants are formulated by using a base oil (different polyolefins, esters, or other compounds can be used) and a number of performance-enhancing additives. Typical lubricants have base oils at concentration of over 90% by weight, with additives at less than 10%, but many modern automotive lubricants have additives reaching concentrations as high as 20%. Different additives provide different functionalities to improve performance in different ways. Corrosion inhibitors help prevent rust and increase metal component lifetimes. Pour point depressants help prevent crystallization at lower . Overall, there are many additives that are used for different reasons in automotive lubricant formulations.

[1] “Heavy-duty engine oil” refers to engine oils consumed in heavy-duty vehicles such as trucks, while “light vehicle engine oil” refers to those consumed in passenger cars, also called light vehicles.

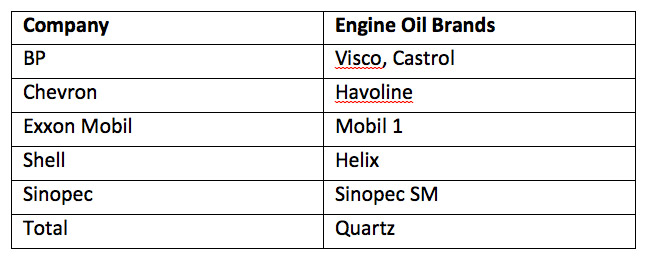

The following are the main suppliers of automotive lubricants, listed alongside their principal engine oil brands:

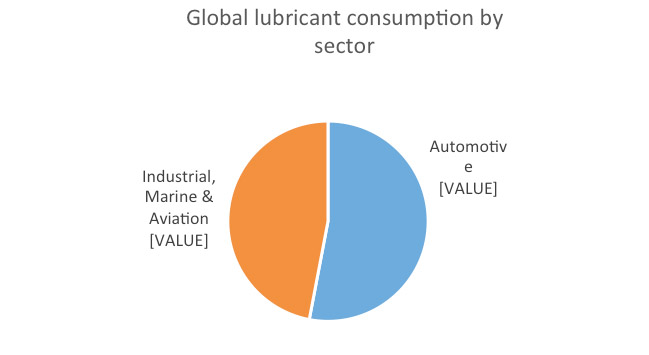

Any significant change in automotive lubricant usage will have an equally significant impact on the global lubricant industry. Overall, automotive lubricants (primarily consumed by ICE-based vehicles) currently represent over 50% of global lubricant consumption (refer to Figure 4 below). Clearly, the transition to BEVs and HEVs/PHEVs and the associated decline and changes to the deployment of internal combustion engines will have a major influence on the automotive lubricant space.

Figure 4: Breakdown of global lubricant consumption volumes by sector

(Source- McKinsey Energy Insights)

EV lubricant needs and consumption

BEVs

BEVs do not have an internal combustion engine and therefore do not consume engine oils. They also only use small quantities of the secondary lubricant products previously mentioned, such as gear oils. However the changes of structure and using condition of some critical parts in the cars are bring new requirements upon secondary lubricant products, for examples:

- Bearing grease: Lubricants for Powertrain Engine Bearing which works in higher temperature and higher rotating speed condition

- Transmission oil: Lubricants for gearbox with small-size but high transmission efficiency, which need to have better electric performance and good copper protection performance, even after being oxidized.

HEVs: new technical challenges for engine lubricants

1) Achieving the balance between lower viscosities and protection of metal components

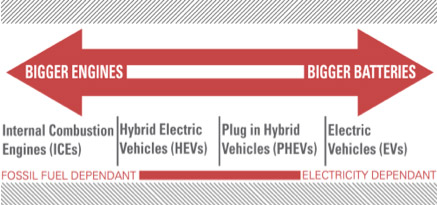

HEVs have a smaller internal combustion engine than traditional gasoline-burning vehicles, because they also have an electric motor (see Figure 5 below for an illustration of this concept). When the battery contains enough stored power to drive the vehicle, the ICE will be automatically turned off and the electric motor will kick in. The way this typically works out is that under low speed or minimal load conditions, such as in traffic, the electric motor can power the car, but under conditions of higher speed or load, roles are reversed and the engine takes over.

Typical vehicular journeys are characterized by a number of changes in these speed/load conditions, so the HEV engine will be subjected to a number of stop-start events on most journeys. Thus, time-weighted average engine operating temperatures will be lower, with these new conditions having an impact on lubricant technical performance requirements. When the engine starts up, it needs to be able to kick-in quickly and efficiently, and for that to happen, lubricants in the engine must have lower viscosities than the oils used for traditional ICE vehicles. Therein lies the challenge- lower lubricant viscosities reduce the lubricant’s capability to protect key metal components from mechanical stress and wear, thus promoting greater overall engine wear in the process. Finding the right balance will be vital.

Figure 5: Depiction of the position of the different vehicles on the Engine Size – Battery Size spectrum (Source- Maryland EV)

2) Maintaining stability under higher pressure, more compact environments

In addition, the HEV engine being smaller and more compact than the traditional ICE will add even greater pressure on lubricants and their ability to maintain stability over time, and they will need to withstand these new operating conditions to provide the required functionalities cost-effectively throughout a vehicle’s lifetime. The working condition of some parts is with higher voltage and higher temperature.

3) Achieving optimal compatibility with the electric system

Moreover, lubricants in HEV engines will have to be compatible with the overall electric system (where are more components made of copper and polymers), from the wiring to the modules to the new materials that will be used in and around the motor and battery.

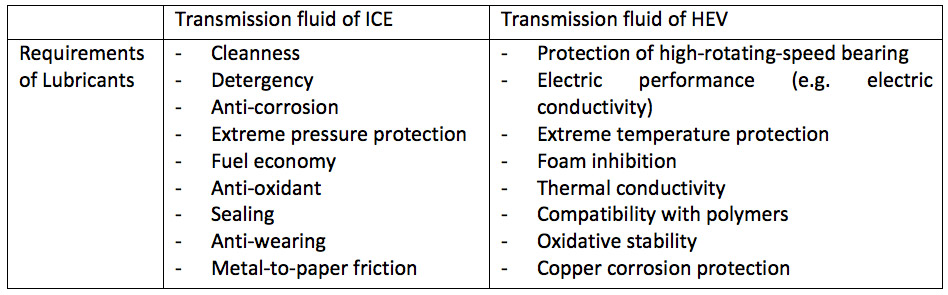

Comparison of typical requirements of transmission fluid used for ICE and HEV

All in all, it is important to note that there is currently no clear industry standard when it comes to the design of HEVs (e.g. the position of engines). Different automobile manufacturers are currently in the process of testing different designs in order to settle on a high-performance solution that is reliable and satisfies future consumer needs, so the exact industry-wide technical requirements for HEV engine lubricants remain unclear today and must be investigated further.

In summary, what is clear is that higher performance grade lubricants are needed for HEVs relative to ICE-based cars. Over the next decade, HEVs are expected to continue to make up the majority of the EV fleet over BEVs, just as they do today. BEVs are likely to one day dominate the EV fleet, but this is not expected for a long time yet, a timeline that is in itself unclear. HEVs will help provide the bridge between ICE-based cars and BEVs and will have an important role to play in the market in the short, medium and long term. Lubricant suppliers would do well to pay attention to trends associated with HEV growth in particular over the coming years.

The lubricant market perspective

Drivers

The demand for automotive lubricants is likely to increase globally over the coming years, primarily driven by overall growth in the number of cars on the world’s roads, especially in the Asian markets. HEV growth will also spur demand for higher quality lubricants, as previously mentioned, which is likely to create a higher value market for the oil giants as well.

Hurdles

With the transition to HEVs and BEVs that is likely to take place in the years to come, the average quantity of lubricants consumed per individual vehicle is likely to decrease, but the increase in the number of cars produced, sold and driven annually will help propel automotive lubricant growth. Growth in EV market penetration will help slow this growth, but the rate of decrease of this growth remains unclear today. In addition, in the long run, the average frequency of lubricant replacement in a car will decrease as internal combustions decrease in size (HEVs) and eventually get phased out. This is because engine oils get dirty as contaminants associated with the combustion process appear, so smaller engines (or no engines) mean less contaminants overall.

Future prospects and uncertainties

The real question is how fast EVs can penetrate the market. Further investigations are required to understand the industry’s expectation with regards to the speed of EV growth and the expected timelines involved. A deep-dive is also required to understand what hybrid vehicular design is likely to become standard in the long term, and how that will specifically affect the type and quality of lubricants needed for HEV systems. Finally, the Automotive industry is different from region to region, and there are different trends and demands in the different regions, both from the perspective of consumers and regulators. These different demands will affect the technological development of EVs and associated lubricant needs in different ways in the different regional markets. Understanding these impacts will require further research and work.

Conclusion

In conclusion, the transition from ICE-based vehicles to EVs will create threats and opportunities alike for lubricant manufacturers. Further investigations will be required in order for them to anticipate market trends and reposition their lubricant offerings. New products may have to be developed, while new applications may open up for existing products. The landscape of the automotive lubricant space will change, but many questions remain as to how.

References

- https://www.mckinseyenergyinsights.com/insights/impact-of-electric-vehicles-on-lubricants-demand/

- https://www.aaa.com/autorepair/articles/how-often-should-you-change-engine-oil (Source for oil change stuff)

- https://www.prnewswire.com/news-releases/global-automotive-lubricant-market-2015-2019–key-vendors-are-bp-chevron-exxon-mobil-shell-sinopec–total-300130085.html (For key suppliers of automotive lubricants)

- http://www.imedpub.com/articles/green-lubricating-oil-additives.pdf (a paper)

- Don M. Pirro; Martin Webster; Ekkehard Daschner (2016). Lubrication Fundamentals (Third Edition, Revised and Expanded ed.). CRC Press. ISBN 978-1-4987-5290-9. (print) ISBN 978-1-4987-5291-6 (eBook)

- https://www.morrislubricants.co.uk/news/hybrid-revolution.html (for the stuff on hybrid electric vehicles)

- https://www.infineuminsight.com/insight/dec-2014/hybrid-lubrication (test for best lube types of hybrids)

- https://www.fuchs.com/dk/en/products/download-center/articles/electric-cars-new-technology-calls-for-new-lubrication/

- https://www.theguardian.com/business/2017/jul/06/france-ban-petrol-diesel-cars-2040-emmanuel-macron-volvo

- https://www.engadget.com/2017/12/18/toyota-will-sell-more-than-10-evs-by-early-2020s/

- http://www.solarjourneyusa.com/EVdistanceAnalysis2.php

- “Plugged in; The End of the Oil Age”, by Gary Kendall, World Wide Fund for Nature

- https://www.statista.com/statistics/200002/international-car-sales-since-1990/

- https://www.drivesurfing.com/en/article/7/how-many-cars-are-there-in-the-world

- https://www.prnewswire.com/news-releases/global-electric-vehicles-market-to-grow-at-a-cagr-of-283-in-volume-from-2017-to-2026-reports-bis-research-664359403.html

- https://www.quora.com/Does-an-electric-car-such-as-a-BMW-i8-use-engine-oil-lubricant