Summary

1. How will COVID-19 impact the Automotive Industry?

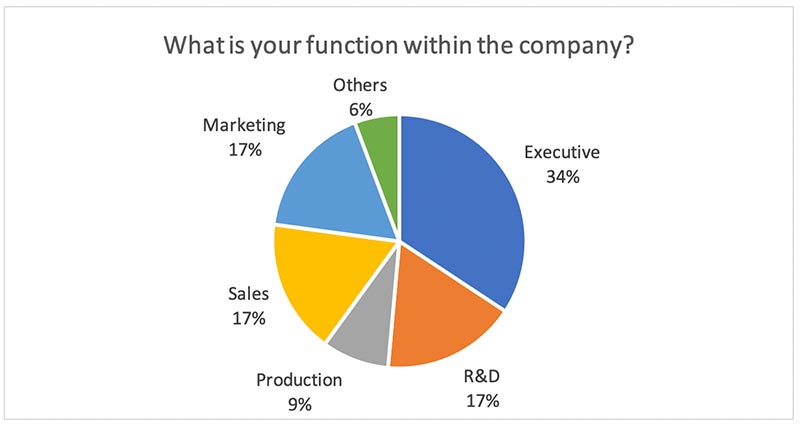

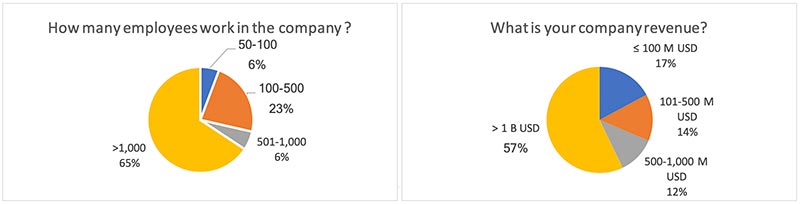

2. Profile of respondents

a. Position

b. Company profile (revenue and # of employees)

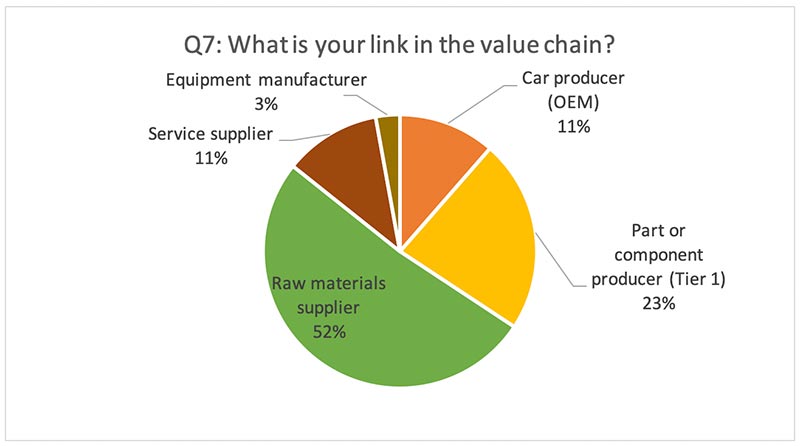

c. Value chain

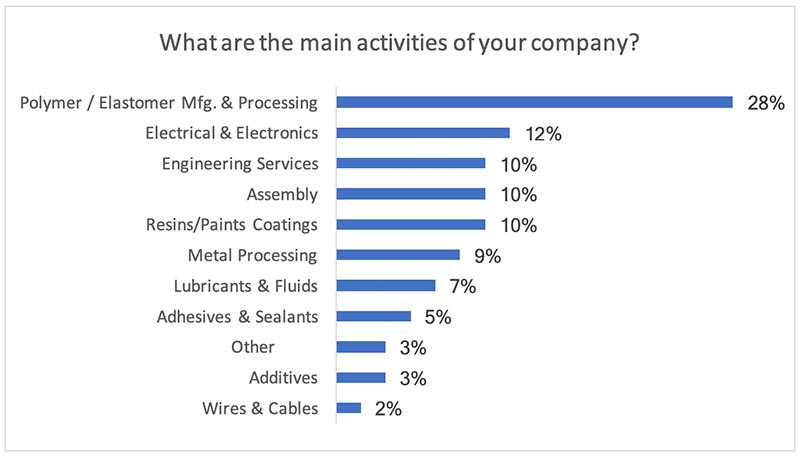

d. Main activities

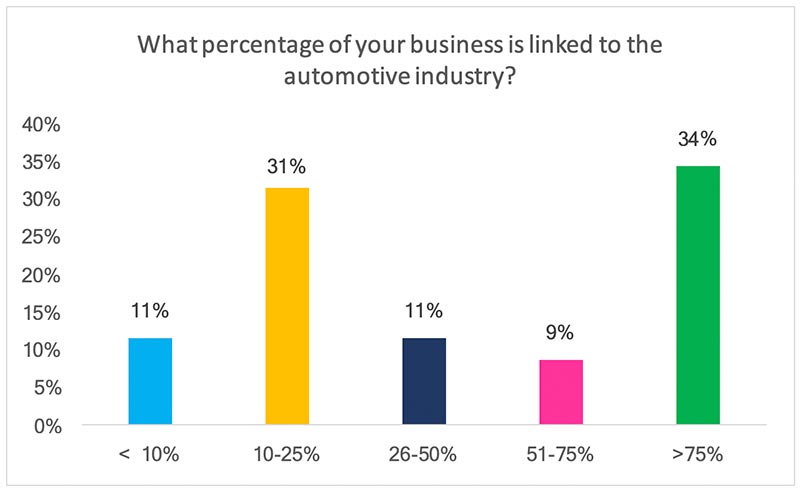

3. Percentage of Automotive Activities

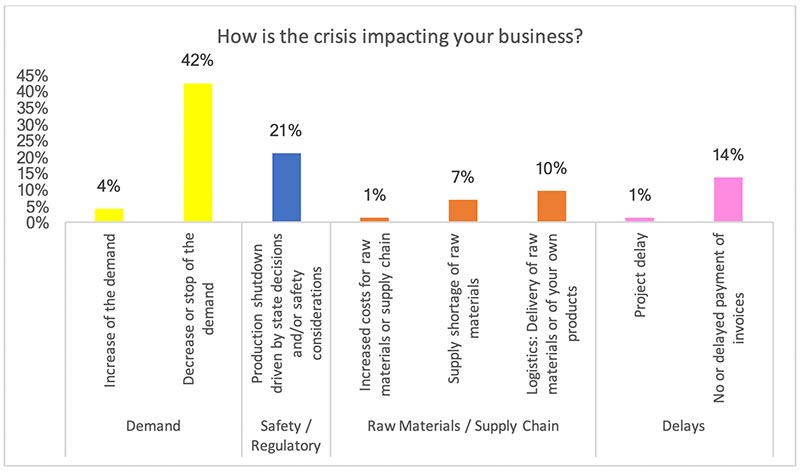

4. Impact of COVID-19 on Automotive Business

a. By value chain level

b. By company size

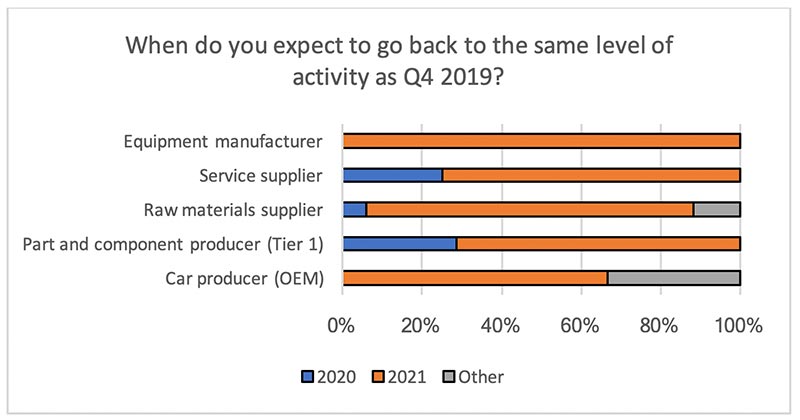

5. Recovery Timeline

a. By value chain level

b. By company size

6. Actions taken to fight COVID-19

7. Future of the automotive industry

a. Modifications to transportation

b. Personal car sales

c. Personal car sales by value chain level

d. Personal car sales by value chain level

e. Repair and maintenance sales

8. Conclusion

1. How will COVID-19 impact the Automotive Industry?

In March and May 2020, we conducted 2 surveys about the impact of COVID-19 on the chemical industry. In both versions of the survey the number one ranked industry of correspondents was the Automotive segment of the chemical industry.

Throughout May and June 2020, we completed an anonymous study on how the pandemic has affected the Automotive Industry in Europe and the United States. Our goal was to collect and analyze automotive industry management insights from companies active all along the Value Chain in Europe and US about the current market situation. This includes their needs, the most impacted activities, the implemented actions to pass the crisis and the perspectives for the coming months.

2. Profile of respondents

a. Position

The largest portion of feedback came from Executive level (34%), Sales, Marketing and R&D contributed 17% each. The remaining feedback came from Production (9%) and Others (6%).

b. Company profile (revenue and # of employees)

The majority of feedback was collected from employees who work for “large” companies that have over 1,000 employees (65%) and/or have revenue over $1 billion USD (57%).

c. Value chain

Respondents represented all links in the value chain including OEMs, part and component producers, raw material suppliers, service suppliers, and equipment manufacturers. Raw material suppliers, which represent a strong link to the chemical industry, provided over half of the feedback (52%). Tier 1 manufacturers were the second largest group (23%) to provide feedback.

d. Main activities

There are many ways that the chemical industry is connected to the automotive industry. Participants’ main activities related the automotive industry varied. Some companies are involved in multiple areas. The rankings of the key activities are as follows:

3. Percentage of Automotive Activities

Nearly half (43%) of the participants’ businesses are strongly driven by the automotive industry (at least 50%). About 90% of the contributors have business that accounts for at least 10% of their sales.

4. Impact of COVID-19 on Automotive Business

Companies have been impacted by the pandemic in numerous ways. There are three main categories of how companies have been affected: Demand, Safety/Regulatory, Raw Materials / Supply Chain, Delays (ranked in descending order of overall impact).

Demand is the most significant area where participants were affected. The largest problem faced was the decrease or the complete stop of demand. Nearly half (42%) experienced this issue. Only 4% of participants experienced an increase in demand that impacted their business.

Furthermore, production was shutdown by regulations and employee safety. These shut downs were the second largest overall problem and category faced by particpants, with 21% experiencing this issue.

Raw material and general supply chain complications were the second overall largest category of issues faced by contributors. Almost 10% of participants faced logistic issues of either delivery their own products and/or receiving raw materials to make their own products.

Delays of projects and payments was the third ranked category of difficulties that impacted participants. The third highest overall issue (at 14%) that contributors experienced where delay of invoice payments

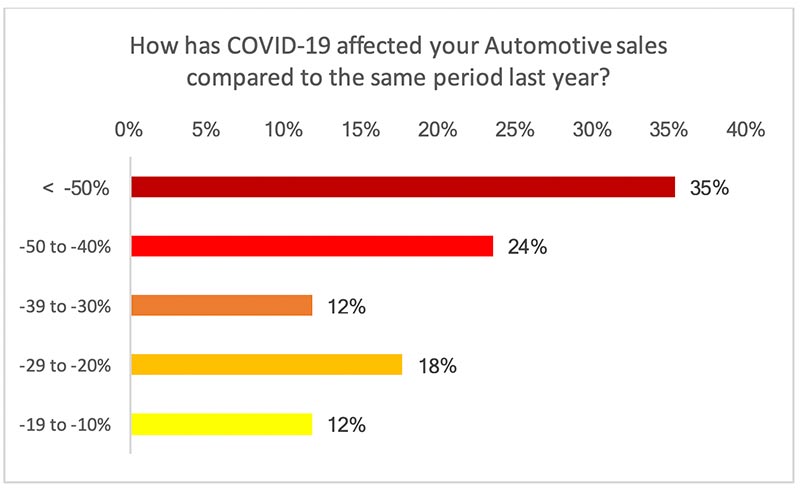

Subsequently, the issues mentioned so far have a qualitative impact on each company’s automotive business. All of the particpants experienced decreased sales in the automotive segment compare to last year. Furthermore, each contributor has experienced a decrease of at least 10% compared to 2019. The majority (59%) experienced losses of at least 40%. Significantly, the highest percentage of contributors (35%) experienced a change of over -50%.

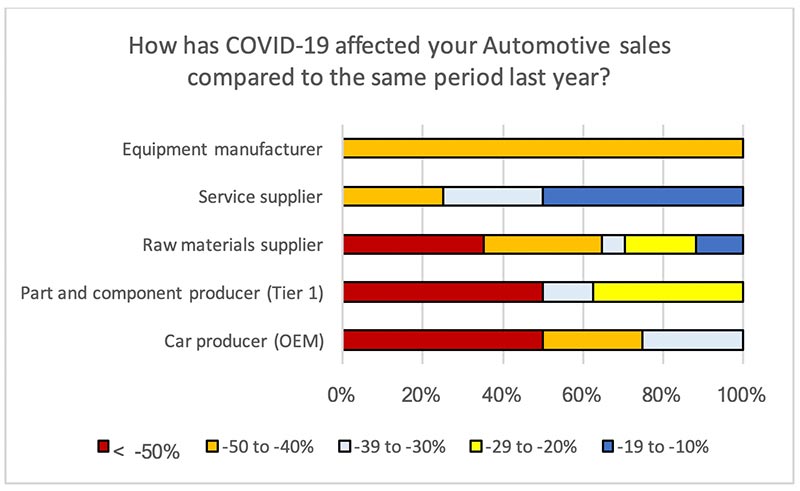

a. By value chain level

Tier 1 manufacturers, raw material suppliers and OEMs were affected the most by the pandemic. These groups were the ones to experience losses of < -50%. This loss category (< -50%) was experienced the most out of the other loss categories (highest percentage for each group).

Raw material suppliers were the only group to experience all ranges of lost business that were reported. Over half of the raw material suppliers commented that their business changed by at least -40%.

b. By company size

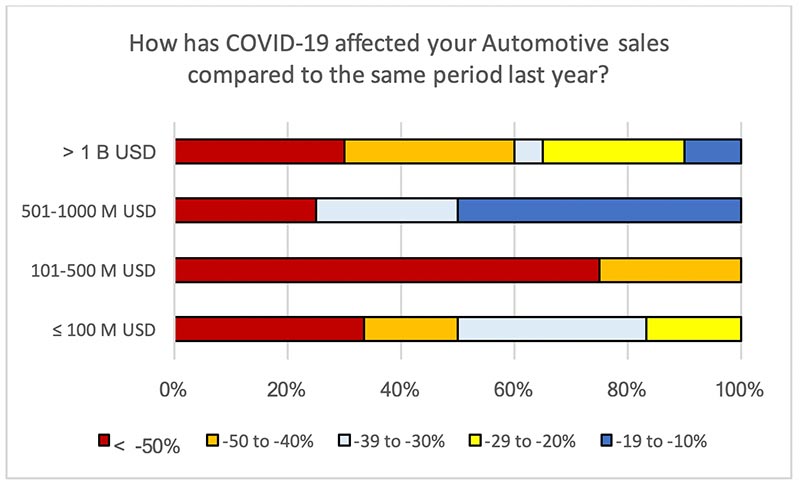

For every revenue category we have defined at least 25% of the participants have experienced a change of < -50% of automotive business compared to last year. Only companies above 500 M USD in revenue experienced the “least” change of automotive sales within the range of -19% to -10%.

Companies in the 501-1,000 M USD revenue range were the least impacted by the crisis according to the feedback received. They were they only group with the majority of participants in the lowest loss range of -19% to -10%.

Medium sized companies (101-500 M USD) experienced a loss of at least 40%. Smaller companies (≤100 M USD) had varying levels of loss, but all commented that their sales decreased by at least 20%. A third of smaller companies either experienced a loss of < -50% or in the range of -39% to 30%.

5. Recovery Timeline

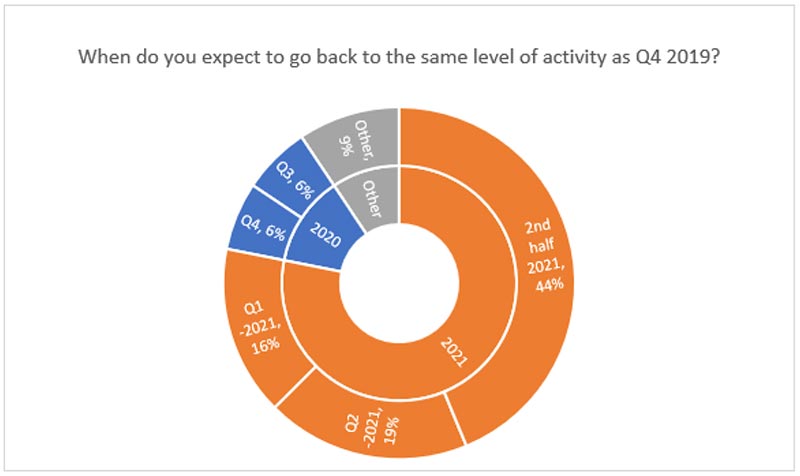

The majority of participants (79%) believe that their business activities within the automotive segment will not return until 2021. Furthermore, it is strongly perceived that their sales will not “recover” until the second half of 2021 based on the response of 44% of contributors.

Only 12% of participants are optimistic that sales will return in 2020. The responses were split evenly between Q3 and Q4 of this year. However, only 9% of contributors that the recovery time will go beyond 2021.

a. By value chain level

It is likely that business will recover in 2021. All across the value chain, the majority (at least 67%) of participants in each group believe that business will recover by the end of 2021. Some (33% or less) raw material suppliers and OEMs think that business will not be recovered until after 2021. Equipment manufacturers and OEMs were not confident that business will return in 2020, although a few service, tier 1, and raw material suppliers hope that business will recuperate in 2020.

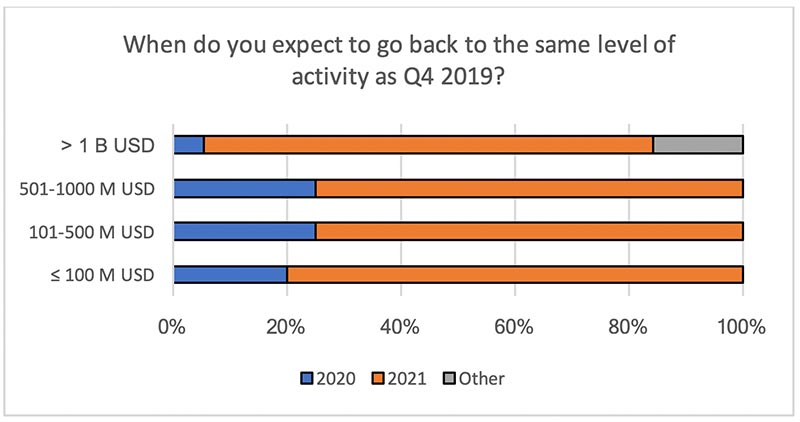

b. By company size

The majority of each revenue group (at least 75% each) believe that their automotive activity levels will return by the end of 2021. Larger companies (> 1 B USD revenue) are the only category where participants expect recovery after 2021. However, this view is only held by 16% of the contributors.

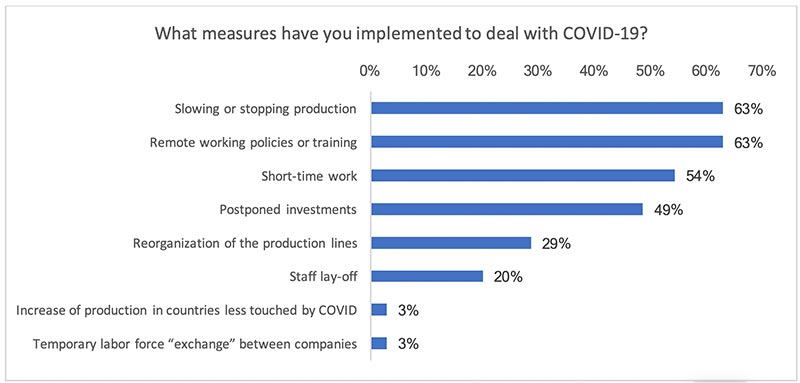

6. Actions taken to fight COVID-19

Over 50% of participants took actions such as slowing/stopping production, remote working policies / training, and/or organizing short-term work in order to combat the impact of COVID-19. Nearly half of the contributors had to postpone investments that were planned.

Many companies (29%) began to convert their production lines to focus on different or new business areas where there was higher demand.

In some cases, the impact of COVID-19 was severe enough where staff had to be laid off. This was the case for 20% of contributors.

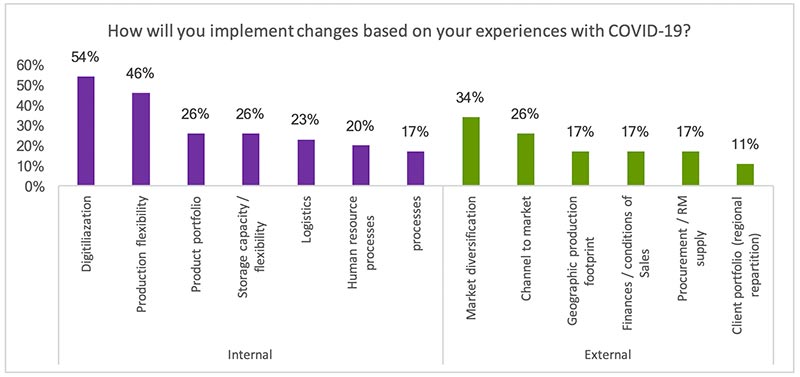

As a result of the pandemic, companies will implement changes in order to be prepared for similar situations in the future. Over half of the participants (54%) plan to make changes to their digitalization strategies. Similarly, 46% of contributors plan to make their production more flexible. Companies will also begin looking to diversify their market strategy to include new/different markets according to 34% of the participants.

Other key areas where at least a quarter of contributors (26%) plan to make changes include channel-to-market, product portfolio, and storage capacity / flexibility. There will also be some changes to logistic (23%) and human resources processes (20%).

7. Future of the automotive industry

a. Modifications to transportation

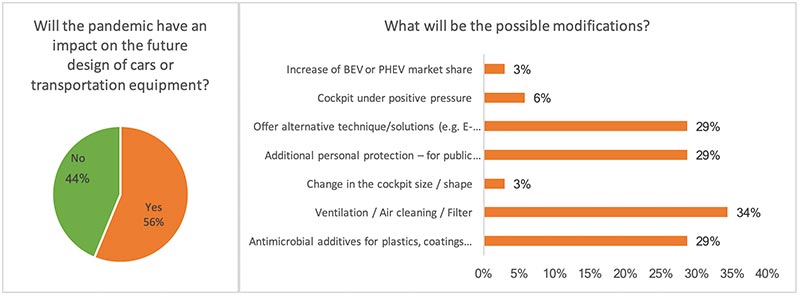

It is likely that the automobiles will have design changes after the pandemic. The majority of participants (56%) believe there will be design changes to the automotive/transportation (100% of OEMs and service suppliers that answered the question responded “yes”). The majority of tier 1 manufacturers, raw material suppliers, and equipment manufacturers think that there will not be modifications to the transportation industry. OEMs are therefore most likely to drive the potential modifications.

Based on the responses of OEMs, the most likely change would be ventilation / air cleaning / filter modifications. Other possible adjustments could be the addition of antimicrobial additives and an increase in BEV BEV (Battery Electrical Vehicles) or PHEV (Plug In Hybrid Electrical Vehicles) market shares.

Similarly, tier 1 manufacturers also expect ventilation and antimicrobial modifications. On the other hand, they also believe that there will be adjustments for additional protection for public transportation and more alternative transportation options.

Likewise, raw materials suppliers strongly anticipate ventilation and antimicrobial modifications. The next most commented altercations for RM suppliers were for additional protection for public transportation and more alternative transportation options. Equipment manufacturers and RM suppliers believe that there could be cockpit changes as well.

Overall, ventilation / air cleaning / filter modifications are the most likely change according to 34% of participants. The other most likely changes according to over a quarter of participants (29%) include over offering alternative transportation solutions, additional protection factors for public transportation and antimicrobial additives being added to materials.

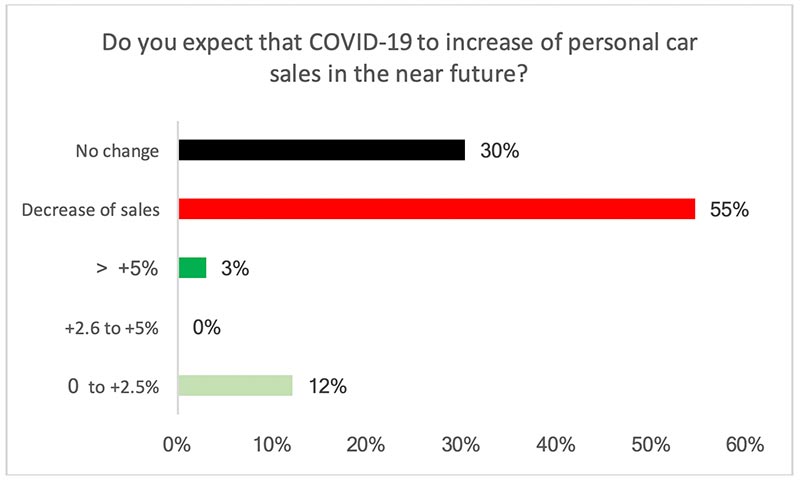

b. Personal car sales

According to the majority of participants (55%), personal car sales are likely to decrease in the near future. Over a quarter of participants (30%) think that there will not be change in personal care sales. Only 15% of contributors believe that personal care sales will increase.

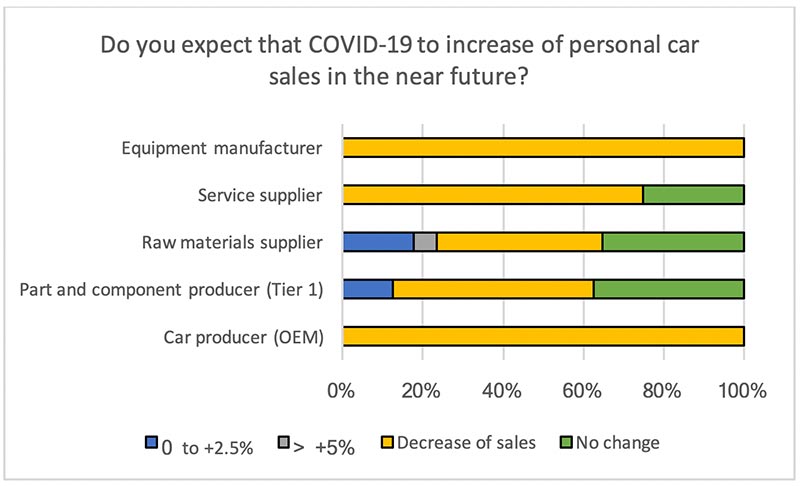

c. Personal car sales by value chain level

All of the OEMs and equipment manufacturers that responded to the survey believe that personal car sales will decrease in the near future. Similarly, the majority of participants at each level of the value chain share the same view.

Only some raw material suppliers and tier 1 manufacturers believe that automotive sales will increase. However, this viewpoint is only shared by 18% or less of the participants in each group. A small amount (6%) of raw material suppliers are optimistic that personal car sales will increase by more than 5%.

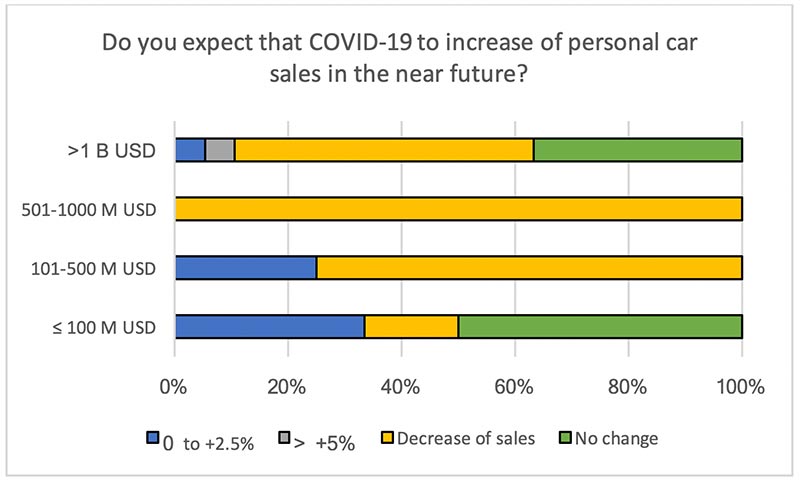

d. Personal car sales by value chain level

The majority (at least 53%) of the highest revenue group anticipate a decrease in personal automobile sales. However, this is not the same for companies in the ≤ 100 M USD range, as the majority expects no change in personal car sales. Large companies also believe that there may not be a change in sales according to 37% of the group. All of the participants in the 501-1,000 M USD revenue group expect a decrease.

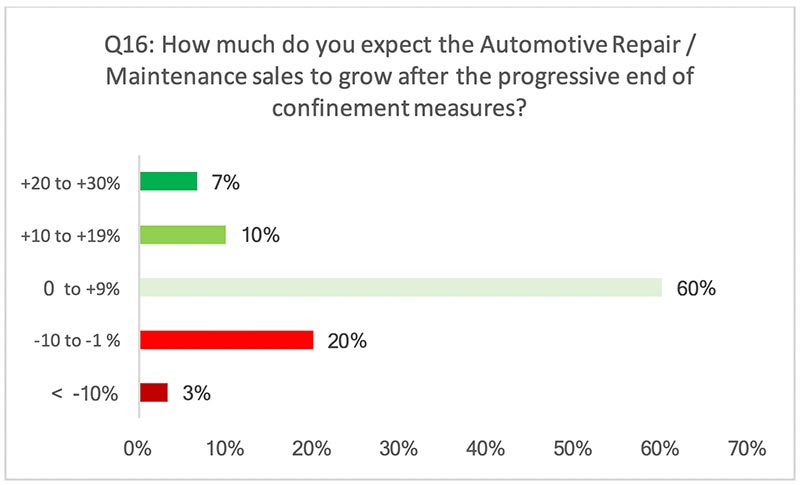

e. Repair and maintenance sales

Due to restrictions and regulations, personal vehicles were driven less during the pandemic. It is believed by participants (77%) that there will be an increase of maintenance and repair sales in the near future. The strongest belief (60%) is that the sales will increase by 0%-9%. As repair and maintenance parts are expected to experience growth, this is a potential area of focus to help regain business lost due to the pandemic.

8. Conclusion

Companies linked to the automotive industry have already been strongly impacted, as most companies have experienced a decrease in sales of at least 40%. A strong decrease of demand is at the origin of the drop more than production shutdown ordered by regulations and employee safety or the shortage of raw materials. Leading players (the highest revenue participants) in the value chain further expect personal car sales to decrease in the near future (85% of participants foresee a stagnation or decrease). However, contributors are optimistic that automotive business will return to normal by the end of 2021. Another consequence of the ongoing crisis is the expected growth of the automotive repair and maintenance market space.

OEMs are likely to initiate modifications to automobile such as ventilation / ventilation / air cleaning / filter modifications and antimicrobial additives for materials. These trends are also anticipated by raw material suppliers and tier 1 manufacturers.

Other trends are likely to have an impact on public transportation. Different levels of the value chain believe that additional personal protection will be added to public transportation. Furthermore, it is possible that there will be a surge in alternative transportation solutions like E-rollers, E-bikes, E-scooters etc.

The pandemic was a learning experience for everyone that will have a major impact on how companies define their internal and external strategies. Common internal changes mostly relate to digitalization, production and storage flexibility and portfolio changes. External strategies will also be examined such as market and geographic diversification, channel-to-market, and the sales / procurement processes. Overall participants are more focused on making internal changes to adjust their own portfolio and processes to counteract the impact made by COVID-19.

About Daydream:

Daydream-Dynovel is a Business Consulting firm for B2B Market Strategy & New Business Development of Chemical & Materials industries, that has successfully assisted in overcoming internal & external challenges and quick adaptations in this new economic context in Europe, Asia and North America.

Our next publication will be published in July 2020 with a complete Benchmark of the TOP Chemical Companies with a Specific Focus on R&D, Patents and operations footprint.

Please check more details by clicking: www.daydream.eu or contact us contact@daydream.eu