1. The short- and long-term impacts of Coronavirus (COVID-19) on the chemical industry

2. When did the operations of your company rebound to its level before the Coronavirus?

3. How did COVID-19 impact your 2021 and 2022 business?

4. When did the countries’ Industrial Production to rebound to over 95% as before COVID-19?

5. Previous policies and long-term strategy to fight COVID-19

6. Importance of the questions/problems faced due to the current Coronavirus crisis

7. Conclusion

8. Appendix: Survey #4 – Profile of respondents – Position – Industries – Market

.

1. The short- and long-term impacts of COVID-19 on the chemical industry

Daydream – Dynovel is a Business Consulting firm focusing on B2B Market Strategy & New Business Development for Chemical industries. Since 2000, we have successfully helped 100+ chemical companies define strategies, overcome business challenges, and seize opportunities all over the world.

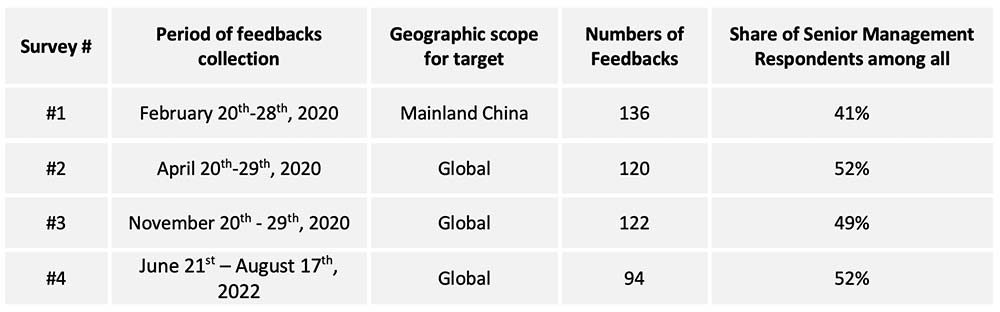

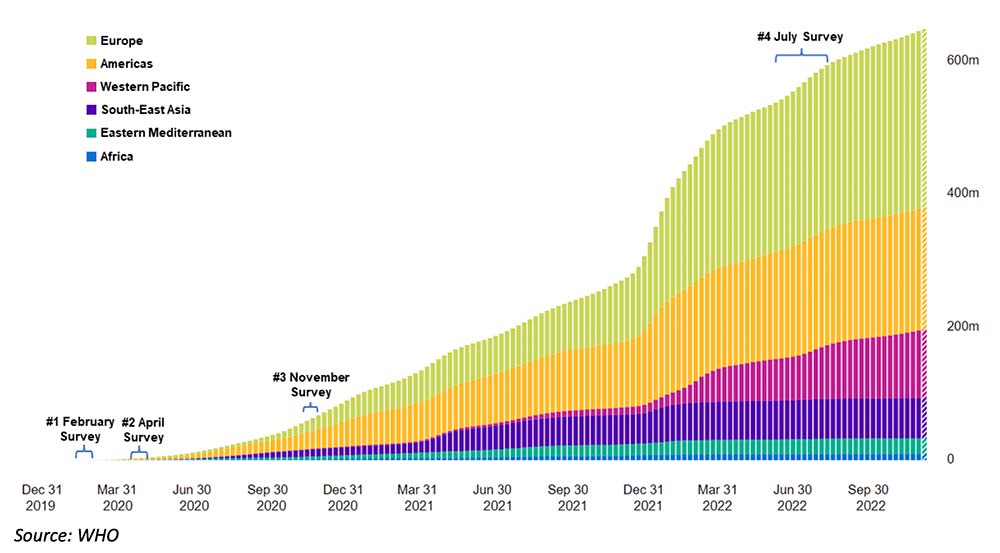

COVID-19 Survey # 1 / 2 / 3: In 2020, Daydream made 3 surveys (February, April, and November 2020) to understand the extent of the changing impacts of COVID-19 on the chemicals and materials industries.

Survey # 4 – Jun.-Aug. 2022: A 4th survey was conducted in 2022 with 94 responses gathered from practitioners in the global chemical industry from June 21st – Aug 17th, 2022, primarily from senior executives, sales and marketing executives and other operational positions in chemical companies.

Daydream ran 4 anonymous surveys from February 2020 to August 2022

Fig. Number of confirmed COVID-19 cases, By data of report and region, Dec. 30th, 2019-Dec. 16th, 2022

2. When did the operations of your company rebound to its level before the Coronavirus?

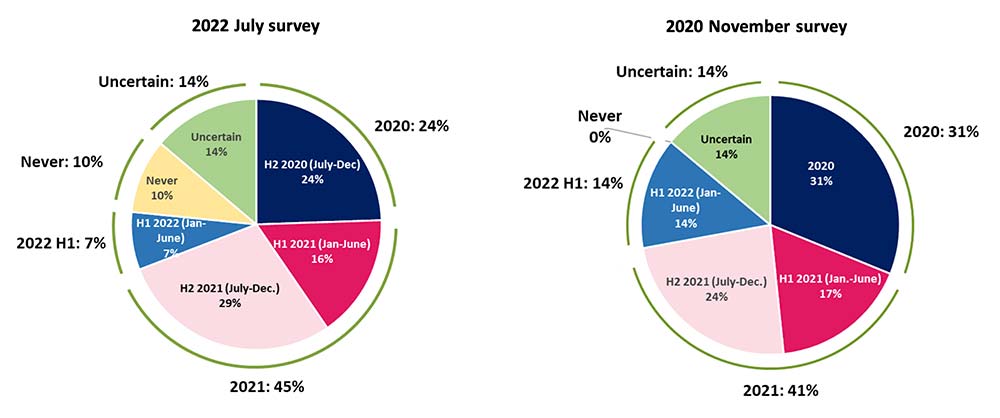

In Survey #4 (July 2022):

- ~70% of the respondents thought that operation of their companies has recovered in 2020 and 2021

- Compared with Survey #3 (Nov. 2020), no significant change for the expectation of the time for company’s recovery

- More companies may have lost their faith in rebounding to pre-COVID-19 levels

- 1/10 of respondents foresaw that operation of the company may never be as they were before the COVID-19.

Q9. When did the operations of your company rebound to its level before the Coronavirus?

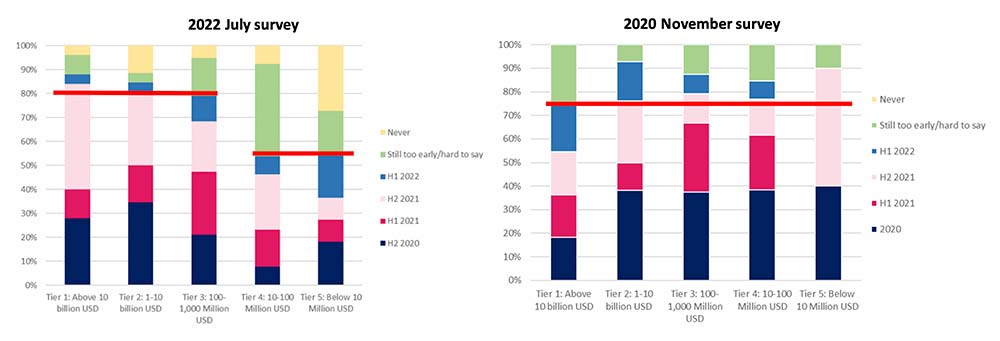

Recovery Of Companies’ Operations – By Company Size

In Survey #3 (Nov. 2020), >75% of the respondents expected that the operations of their company would rebound to pre-COVID-19 level before 2022 H2, no matter the size of the company.

However, until July 2022, different sizes of enterprises illustrate different ideas about recovery of their company’s operation

- Tier 1,2,3 companies: ~80% or more of the respondents believed that the companies’ operation have recovered

- While for companies with smaller size (Annual turnover <100 Mn USD), ~45% of the respondents were not clear about the recovery time, or even lost their faith in their business’s future.

Q9. When did the operations of your company rebound to its level before the Coronavirus?

By Company Size

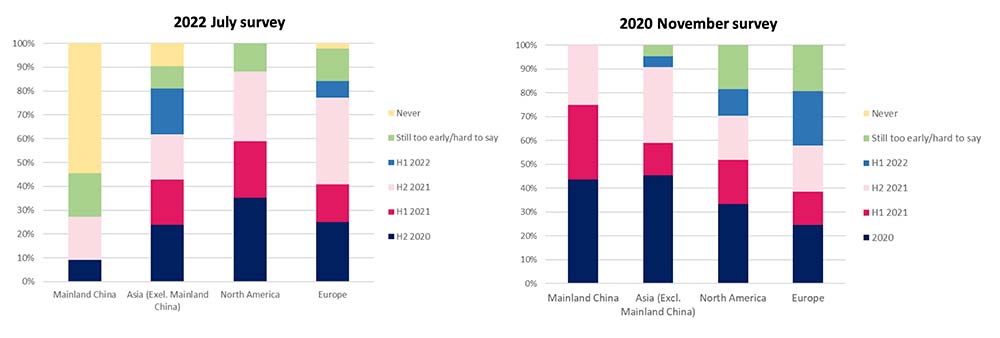

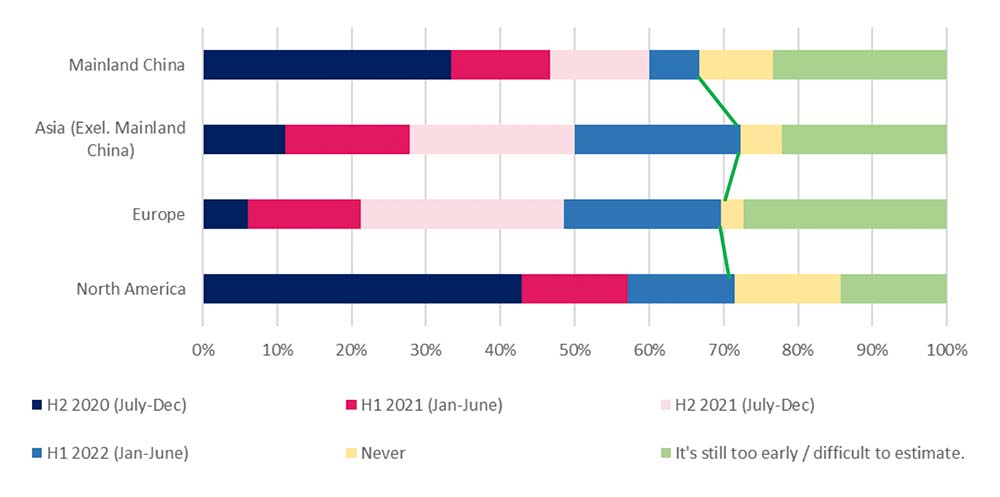

Recovery Of Companies’ Operations – By Company Origin

In Survey #3 (Nov. 2020), Asian companies were more optimistic about the recovery of operation level. But, in Survey #4 (July 2022), North American and European companies showed better recovery of company operations

- ~80-90% of the respondents from North American and European companies thought their operations already recovered in 2020 and 2021

- >50% of the respondents from Mainland Chinese companies were not optimistic that the company’s operations would rebound to pre-COVID-19 level

Q9. When did the operations of your company rebound to its level before the Coronavirus?

By Company Origin

3. How did COVID-19 impact your 2021 and 2022 business? (*)

(*) negative / positive impacts refer to “the impacts on the business of companies being decreased / increased under the Covid Context”

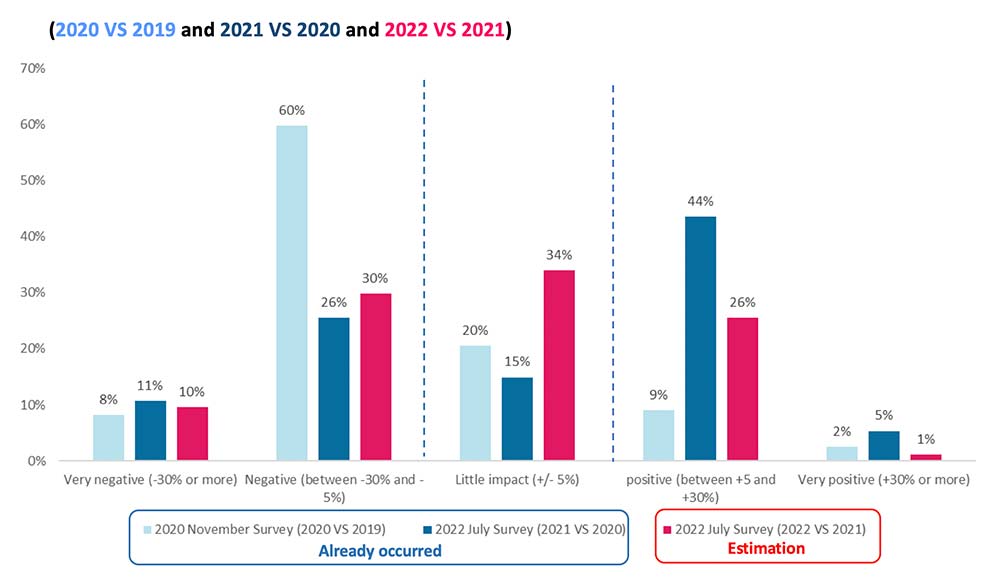

Impact on business: 2020 vs 2019

- In Survey #3 (Nov. 2020), only ~10% of respondents expected positive impact (**), 68% of respondents estimated a decline in turnover of the company in 2020 compared with 2019

(**) including slightly positive to very positive

Impact on business: 2021 vs 2020

- In Survey #4 (July 2022), nearly 50% of the respondents illustrate positive impacts on their 2021 business compared with 2020

Impact on business: 2022 vs 2021

- When estimating the business activity in 2022 VS finished 2021, just over 1/4 of respondents held optimistic attitudes, and ~3/4 respondents thought that company’s business in 2022 will be stable or even worse than in 2021 according to the Survey #4 (July 2022)

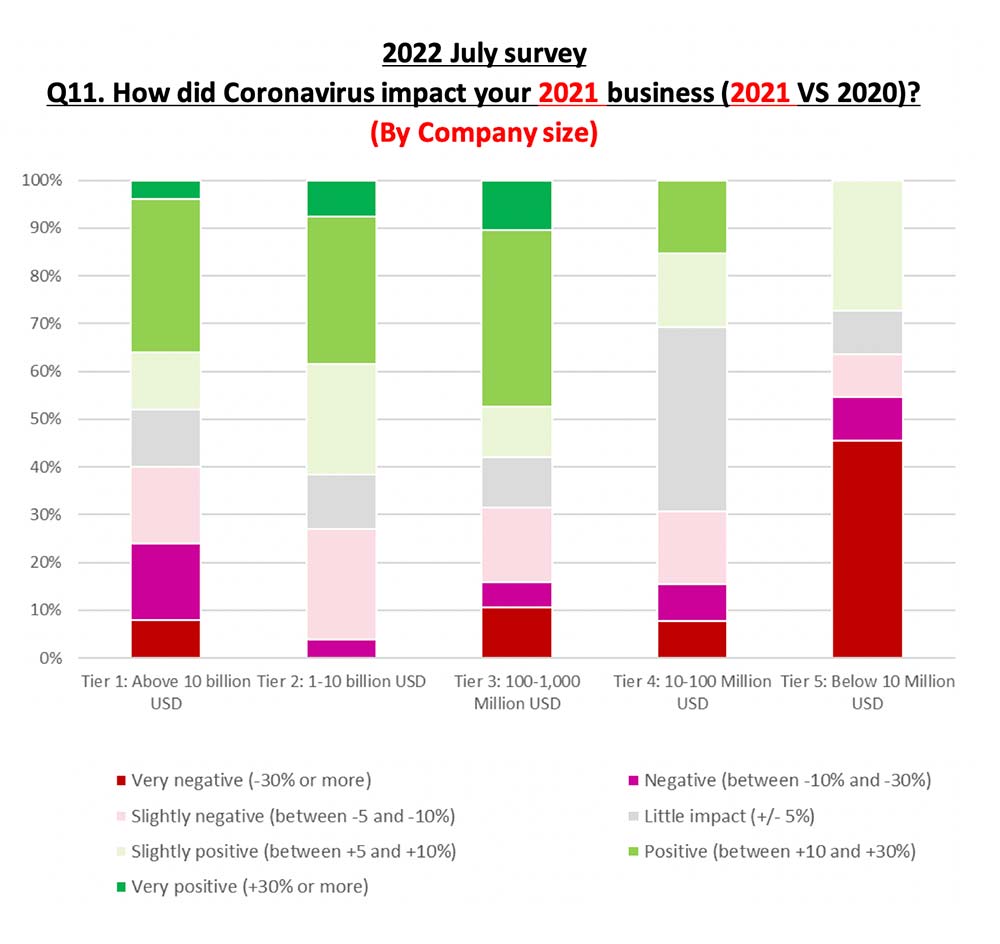

Business Impact – By Company Size

Bigger-sized enterprises revealed more positive thoughts about their company’s business in 2021

- 50-60% respondents from Tier 1,2,3 companies thought company’s business with positive growth in 2021

- Tier 5 companies suffered strongest negative impact on their 2021 business

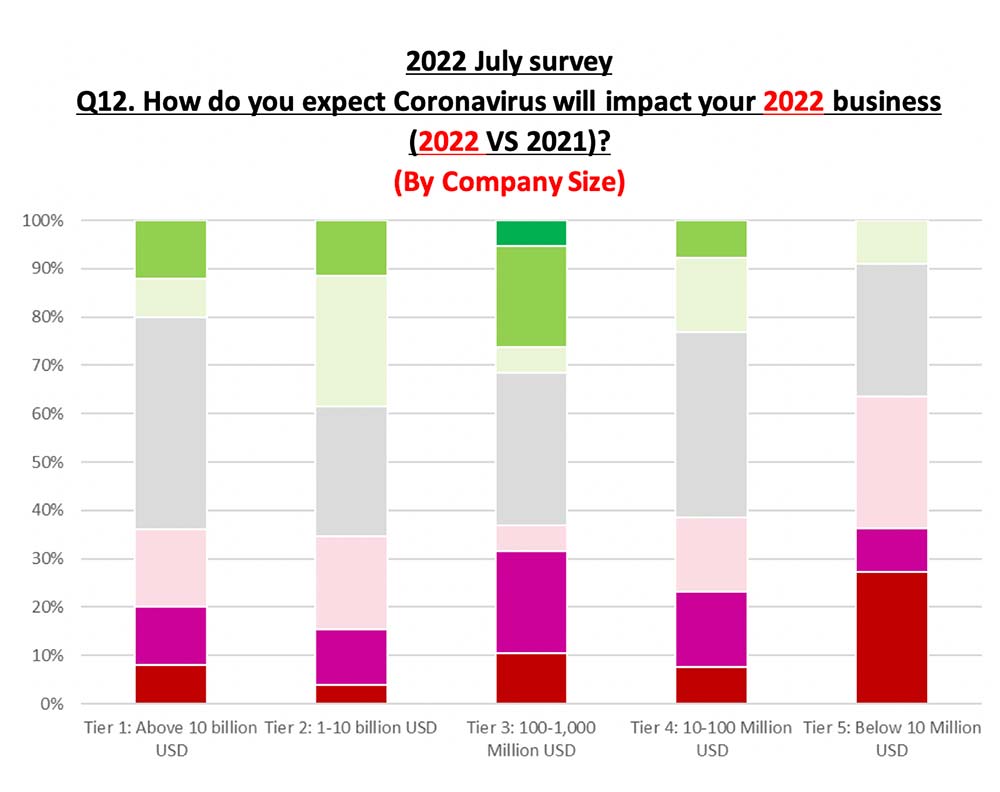

When estimating the impact of COVID-19 on company’s business in 2022

- The ratio of respondents expecting negative impact was similar to the ratio in 2021 no matter the size of company.

- A higher ratio (25-45%) of respondents thought that 2022 will be a stable year for their company’s business (little impact)

- A lower ratio of respondents expect positive growth

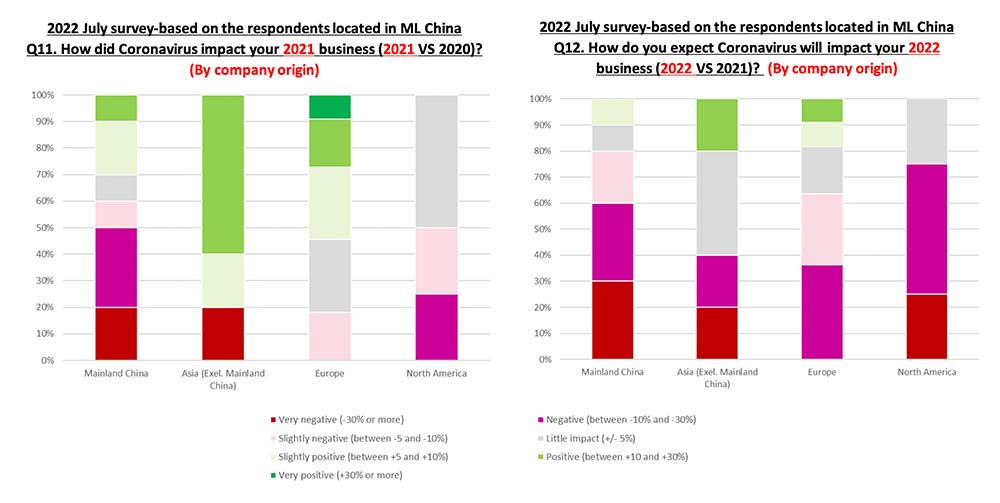

Business Impact – Company Origin

Respondents from companies with HQ in Asia (excluding Mainland China), Europe and North America held more optimistic attitude on business growth in 2021 than people from Chinese companies

- >60% of the respondents working at Mainland Chinese companies thought their business was negatively impacted by COVID-19 in 2021

- 5-10% of respondents from European and North American-based companies saw a very positive growth (+30% or more) in terms of their annual revenue in 2021 compared with 2020

Regarding to the expectation for 2022 business

- Respondents from companies with HQ in Mainland China expressed a negative point of view on their business performance year on year, from above 60% for 2021 to over 80% for 2022.

- Over 40% of respondents working in North American-based companies estimated negative impact on their company’s business in 2022

- For European and other Asian companies, ~40% of respondents foresaw “Little Impact” on their 2022 business

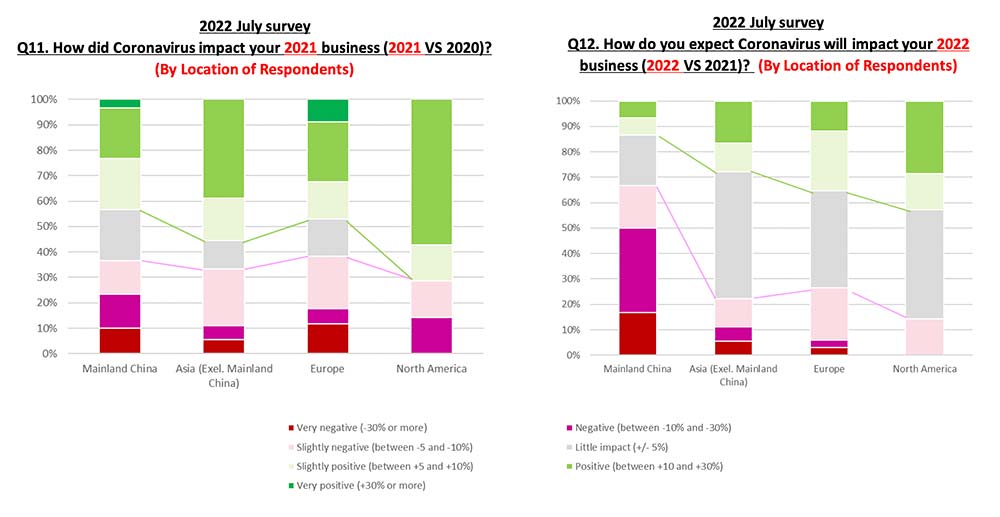

Business Impact – By Location of Respondents

In terms of the impact on 2021 business, a majority (>60%) of repondents thought that their company’s businss was positively or marginally impacted no matter where they are located. Especially, over 70% of the respondents located in North America considered postivie growth of the business in 2021

However, when it comes to the business performance of company in 2022, it is evident that the gap of geographical differences differ sharply.

- Nearly 70% of the respondents located in Mainland China estimated negative impact on company’s business in 2022

- For respondents located in other regions, less ratio of respondents expected either postive or negative impact, “Little impact” became the option with highest ratio

Business Impact – About the Chinese Market

Highest ratio of respondents working in Chinese companies suffered revenue decrease (negative impact) in the Chinese market in 2021, followed by the respondents from North American, other Asian and the European companies.

Overall, more respondents expressed a negative point of view on company’s business performance in 2022 compared with 2021, no matter where the company’s HQ is located.

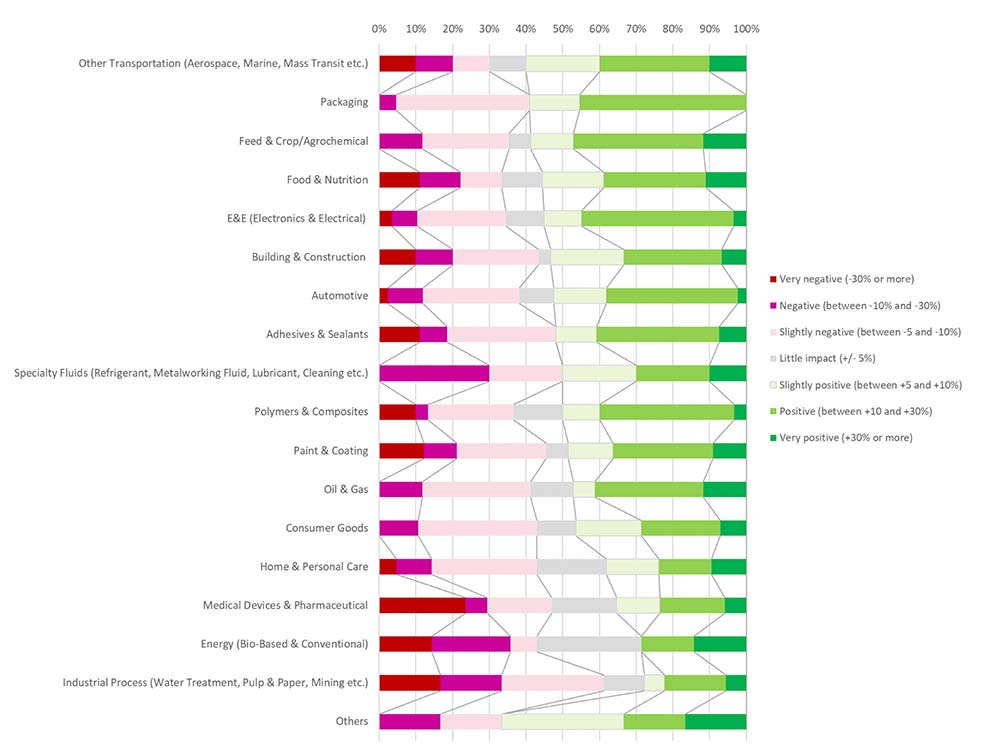

Business Impcat (2021 vs 2020) – By end-use market

- Ranked by the ratio of respondents expecting decreased business from 2020 to 2021, the most impacted market is “Industrial process (Water Treatment, Pulp & Paper, Mining etc.)” followed by “Specialty Fluids” and “Adhesive & Sealants”.

- Ranked by the ratio of respondents expecting increased business from 2020 to 2021, the most impacted market is “Other transportation” followed by “Packaging” and “Feed & Crop/Agrochemical”

2022 July survey

Q11. How did Coronavirus impact your 2021 business (2021 VS 2020)?

(By end-use market)

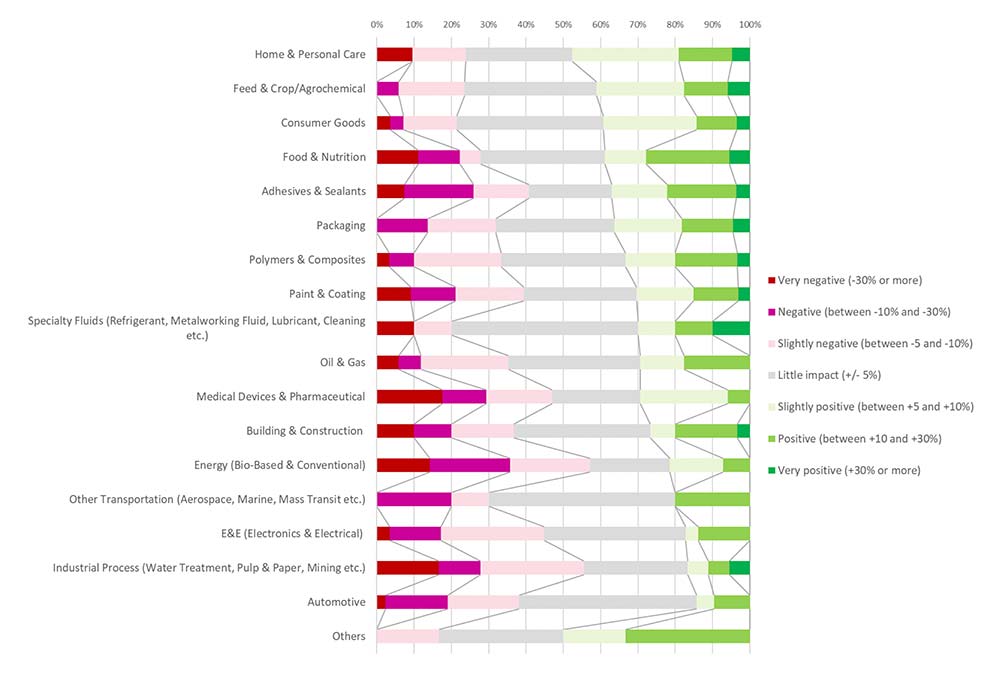

Business Impact (2022 vs 2021) – By end-use market

- The end use market segments which were expected to recover the most in 2022 are

- Home & Personal Care

- Feed & Crop/Agrochemical

- Consumer Goods

- Food & Nutrition

- Adhesive & Sealants

2022 July survey

Q11. How do you expect Coronavirus will impact your 2022 business (2022 VS 2021)?

(By end-use market)

4. When did the countries’ Industrial Production rebound to over 95% as before COVID-19?

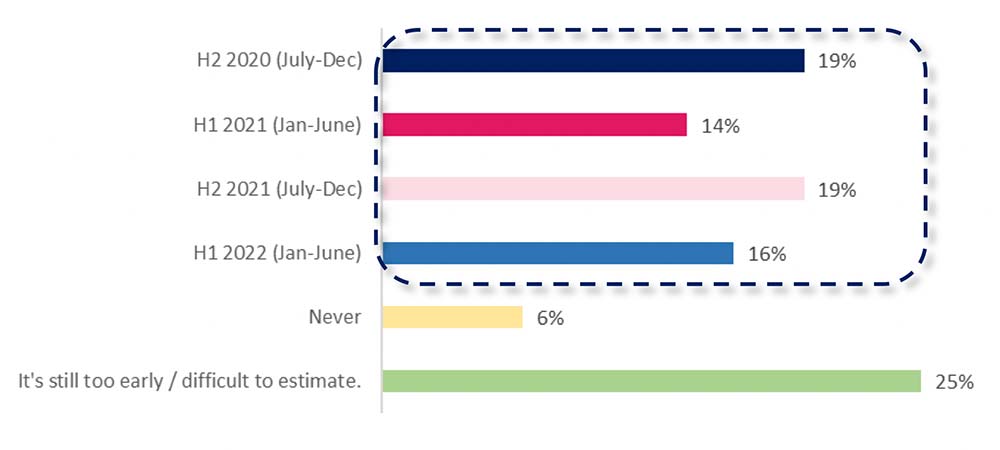

Nearly 70% of the respondents considered the Industrial Production of their country has rebound to over 95% as before COVID-19.

A quarter of the respondents found it hard to estimate the time for the recovery of countries’ Industrial Production

2022 July survey

Q10. When did the overall Industrial Production in your country recover to over

95% as it was before the COVID-19 ?

~70% of the respondents believed that the Industrial Production of their country has already recovered to over 95% as before COVID-19 no matter where they are located

2022 July survey

Q10. When did the overall Industrial Production in your country recover to over

95% as it was before the COVID-19? (By Location of Respondents)

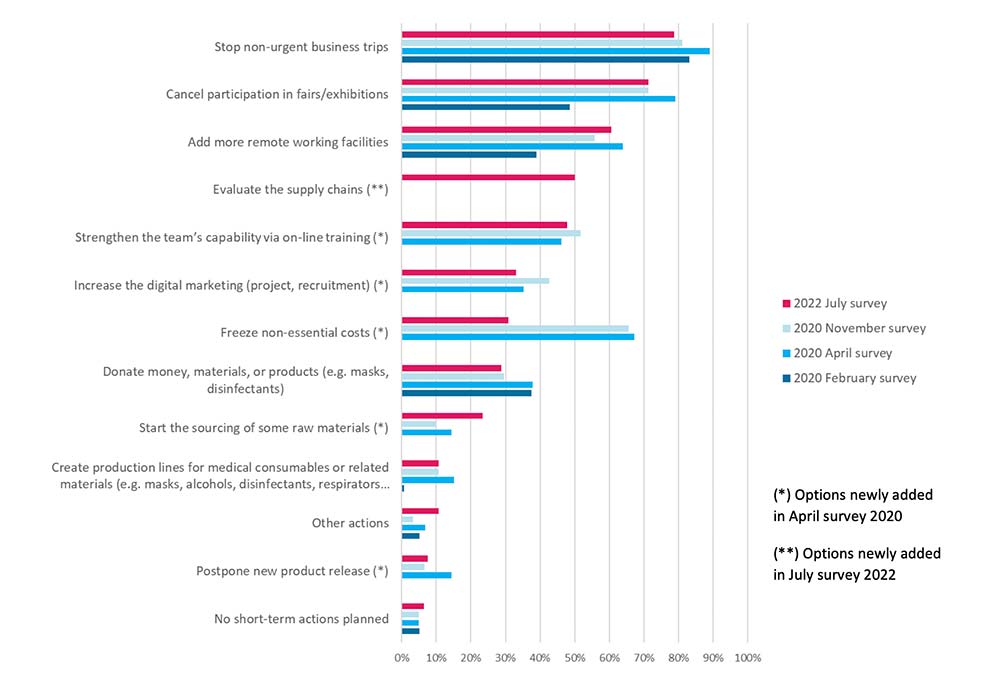

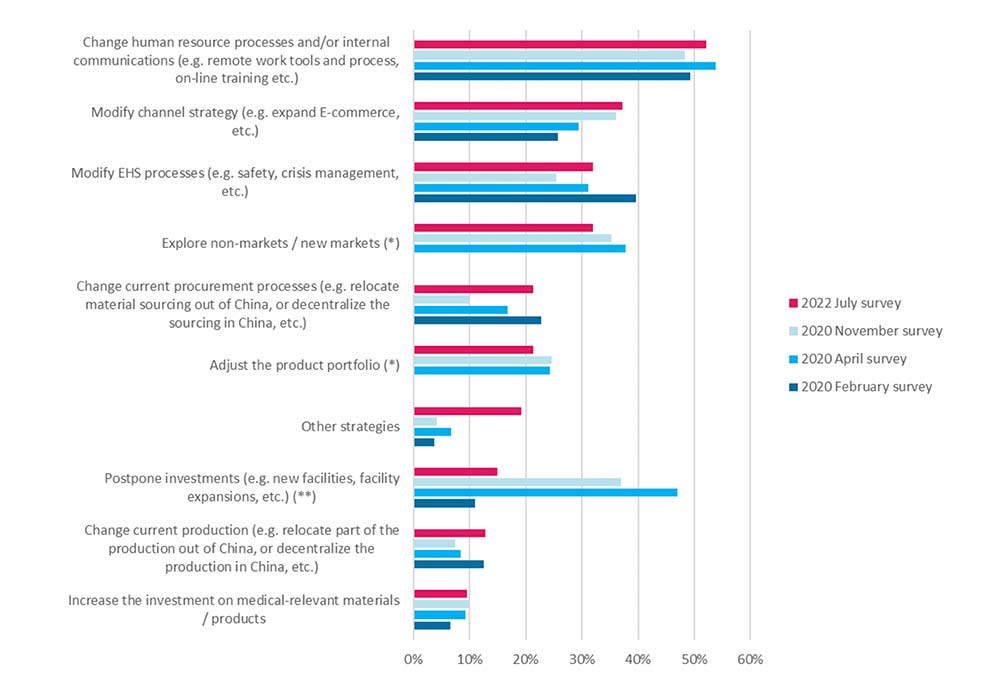

5. Previous adopted decisions and long-term strategy to fight COVID-19

1st important measure: Ensuring the labor safety still stay at the core of the decisions

- Actions taken in previous time:

- Most companies continue to limit business trips and rely as much as possible on remote work

- Though some exhibitions resumed in person, many still canceled the participation or visits

- Strategies in the medium-to-long term:

- Change HR process & internal communication

- Modify channel strategy as well as EHS processes

2nd important measure: “Control the risks & ensure stable supply chain”

- 50% of the respondents evaluate the supply chains

The differences between Survey #4 (July 2022) and Survey #3 (Nov. 2020)

- Some financial related short-term action and long-term strategy are weighted less in July 2022, possibly because after having withstood the initial shock of COVID-19, companies are looking for new increase in opportunities for business in the New Normal

- Freeze non-essential costs (decreased by ~35%)

- Postpone investments (e.g., new facilities, facility expansions, etc.) (decreased by ~20%)

Comparison of 4 surveys

What actions have you taken to fight against Coronavirus in the previous time?

Comparison of 4 surveys

How did the New Normal influence your strategy in the medium to long-term

(*) Options newly added in April survey, 2020

(**) In the survey ran in February 2020, this option was “Postpone investment in Mainland China” considering that COVID-19 mainly emerged in Mainland China at that time. In the April survey, since the geographic scope for the whole survey is global, this option is offered based on a global view

6. Importance level of the questions/problems faced due to the current Coronavirus crisis

The most listed challenges and questions in the 3 surveys:

In Survey #4 (July 2022), logistics & supply chain and shortage of raw materials were the challenges of most concern that respondents faced, especially the issue “Shortage of raw materials”, which ranked 2nd in July 2022 survey, up 6 places compared to the November 2020 survey results

7. Conclusion

Companies were still likely to be perplexed about the future of their business although a series of actions (vaccination, economic stimulus etc.) have been implemented to relief the negative impact.

Style of life and business were brought into a “New Normal” status under COVID-19 context, for which both individuals and enterprises are adapting themselves to live and operate in this New Normal

While being asked “what are the impacts and changes that are brought by COVID to the style of life, way of business”, most of the respondents mentioined:

- Remote work / work from home / home office

- Less travel / less business trip

- Online / Virtual / Digital / Flexible working styles

In the Survey #4 conducted in July 2022

Recovery of companies’ Operation

- Bigger-sized companies (turnover > 100 Mn USD) recovered better than smaller-sized companies (turnover < 100 Mn USD)

- North American and European companies showed better recovery of companies’ operation: ~80-90% of the respondents said that company’s operation has recovered in 2020 and 2021

Business impact

- 2021 VS 2020

- Small-sized companies (turnover < 10 Mn USD) suffered strongest negative impact on their 2021 business

- >60% of the respondents from Mainland Chinese companies thought a declined revenue of company in 2021 compared with 2020

- 2022 VS 2021

- Respondents located in Mainland China or working in Chinese companies revealed more negative attitude on company’s business performance in 2022 than the people located or working in other companies

Recovery of the Industrial Production of Country

- ~70% of the respondents believed that the Industrial Production of the country has already recovered to over 95% as before COVID-19

Ensuring the labor safety still stay at the core of the decisions, and under this premise, companies put more focus on the challenges about logistics/supply chain/shortage of raw materials, they took actions to evaluate the supply chains to control the risks and ensure the supply chain stability

About Daydream:

Daydream-Dynovel is a Business Consulting firm for B2B Market Strategy & New Business Development of Chemical industries, that has successfully assisted in overcoming internal & external challenges and quick adaptations in this new economic context in Europe, Asia and North America.

Please check more details by clicking: www.daydream.eu or contact us contact@daydream.eu

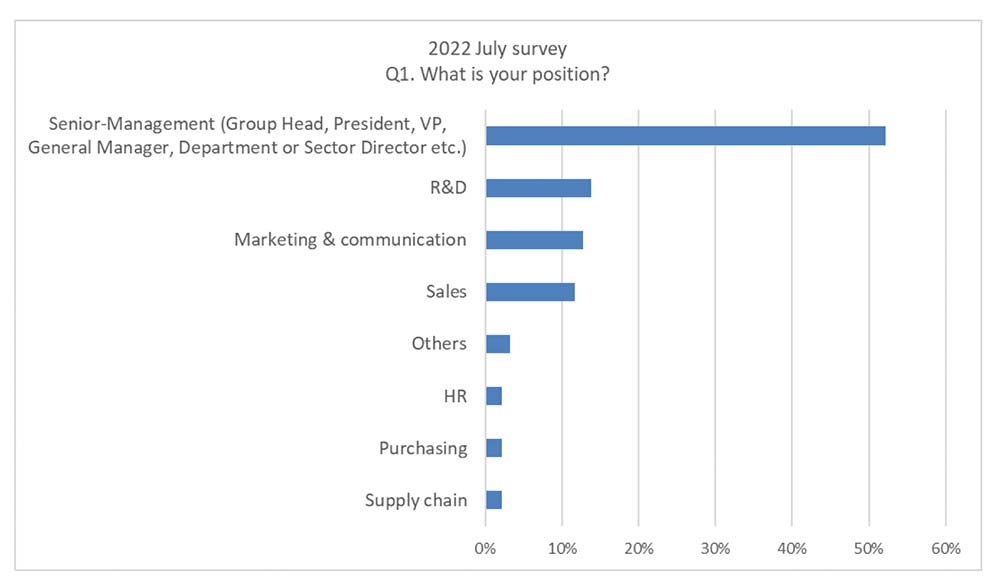

8. Appendix: Survey #4 – Profile of respondents – Position – Industries – Market

a. Position

Half of the respondents are Senior-Management (*), followed by R&D, Marketing & Communication, and Sales.

(*) Senior-Management: Group Head, President, VP, General Manager, Department or Sector Director etc.)

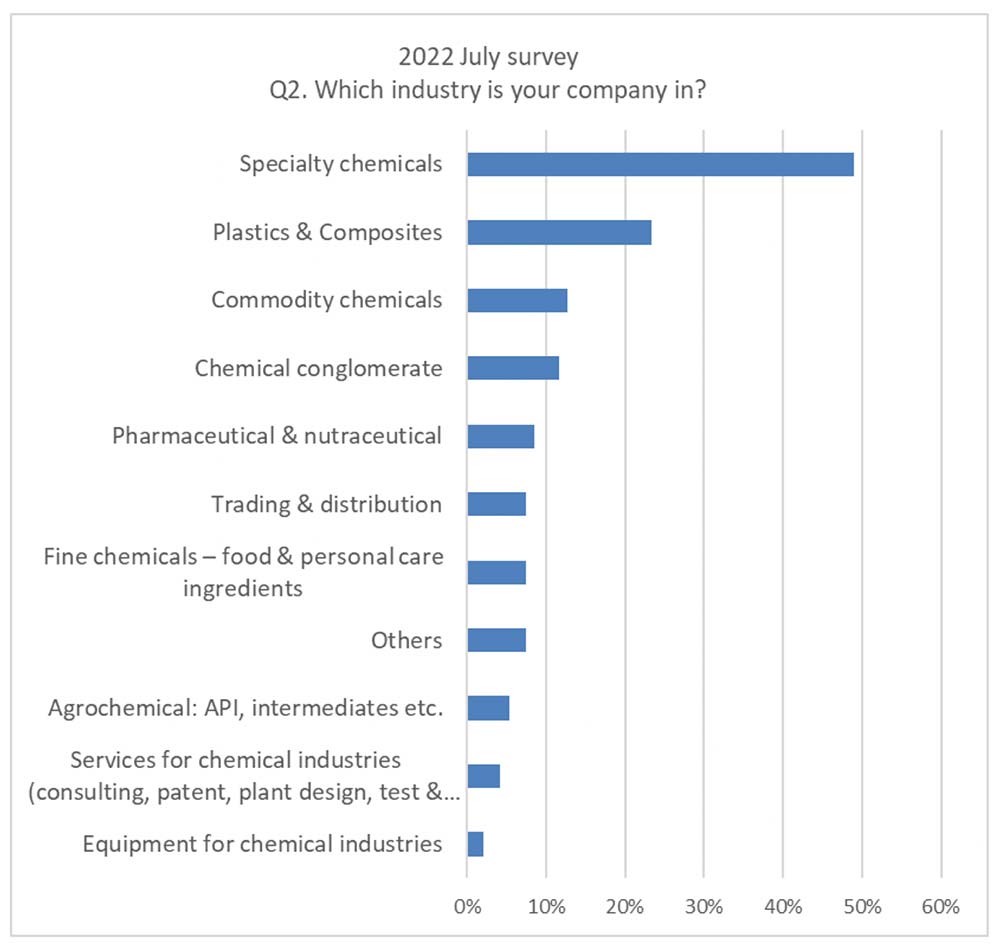

b. Industry

Respondents mostly come from Specialty Chemical companies.

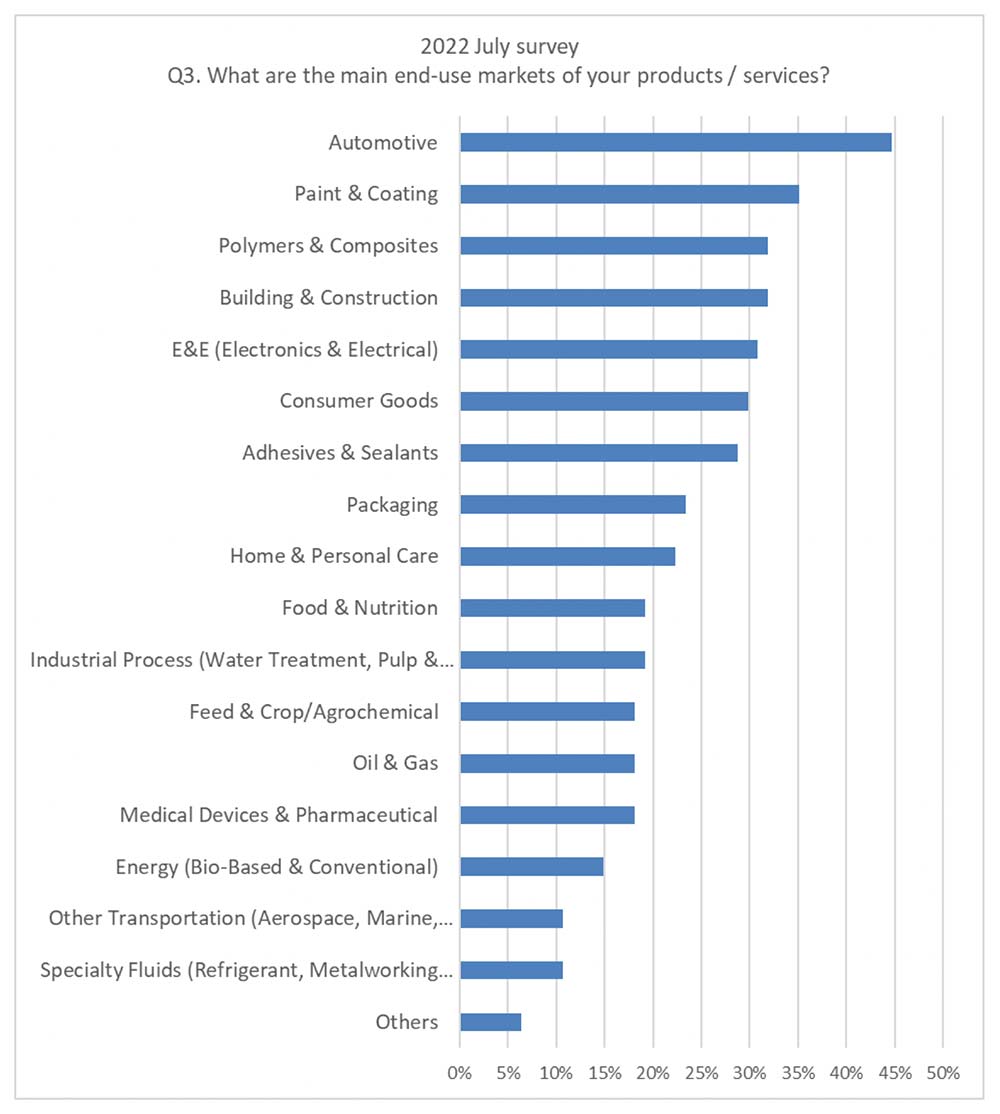

c. End-use market of the respondents’ companies

The most important end-use markets of the respondents’ companies are:

- Automotive

- Paint & Coating

- Polymers & Composites

- Building & Construction

- E&E (Electronics & Electrical)

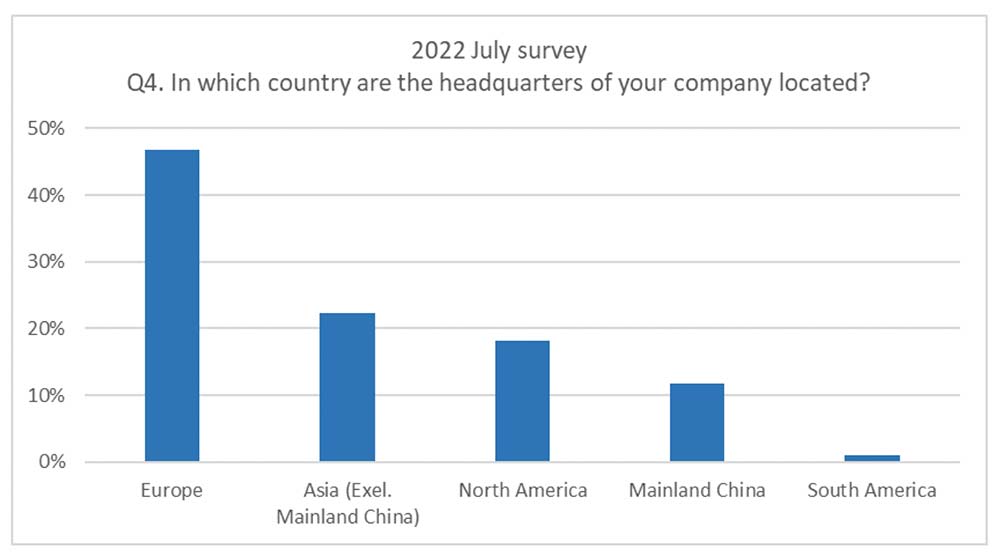

d. Location of HQ

Most of the participating companies have their HQ in Europe, followed by Non-Chinese Asian countries, North America countries, and Mainland China.

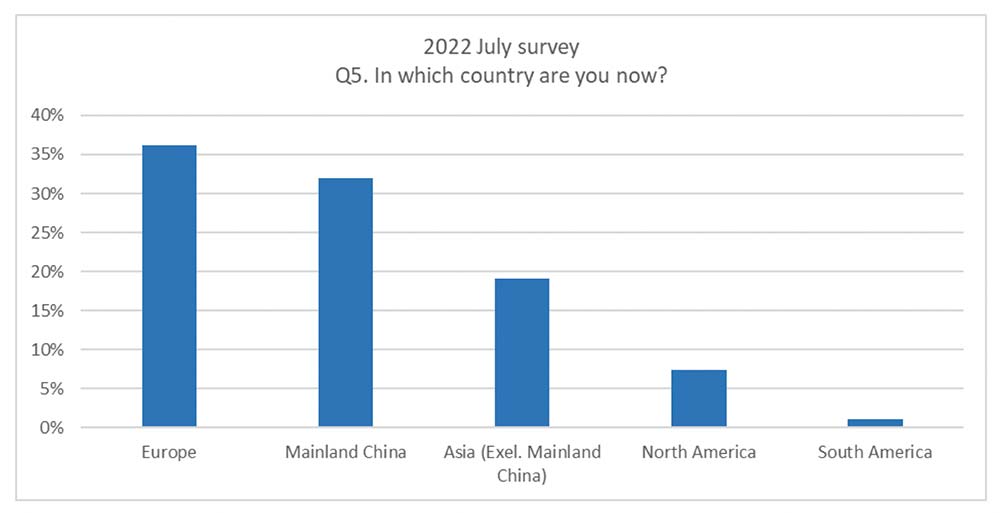

e. Location

Over a third of respondents are in Europe, followed by Mainland China, the rest of Asian and the North America countries.

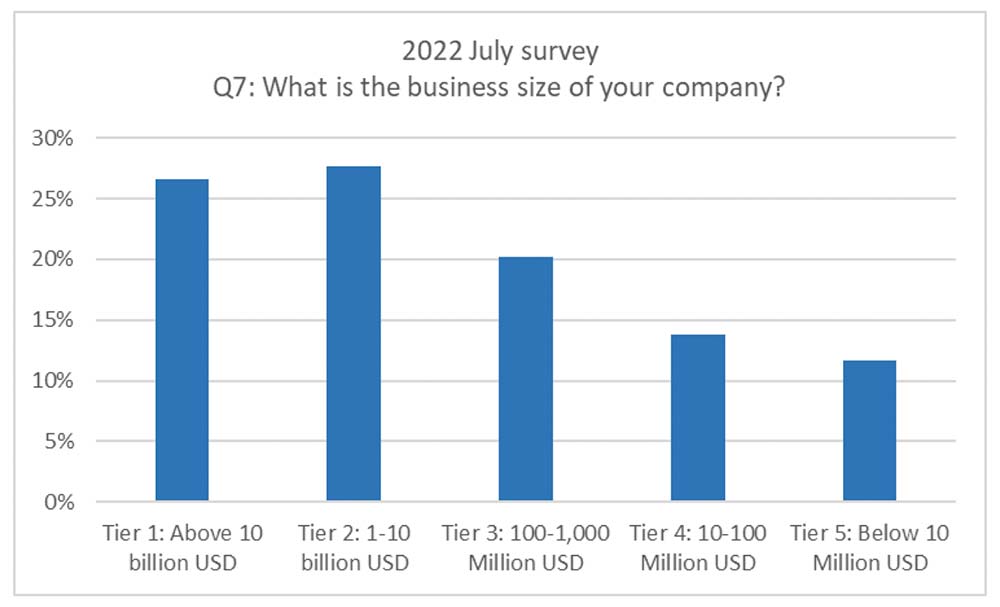

f. Business size

50% respondents come from the companies with turnover above 1 billion USD

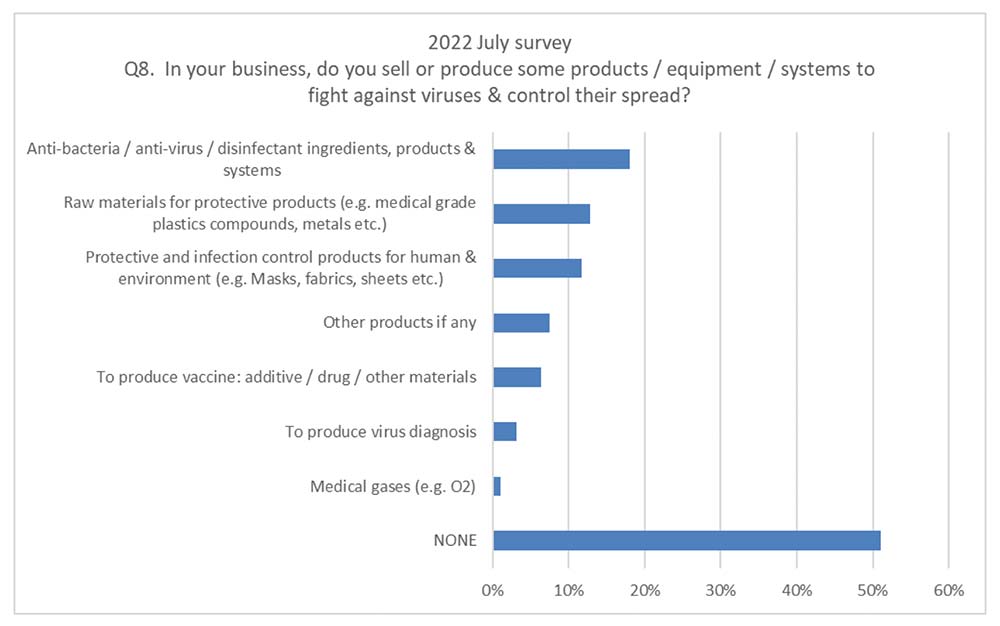

g. Products provided to fight against viruses & control their spread

~60% of the investigated companies sell products, equipment and systems to fight against viruses & control their spread, majority of them supply disinfectant ingredients, followed by suppliers of raw materials for protective products