1. How will COVID-19 impact the Chemical Industry short and long term? What, if any, are the short and long term impacts COVID-19 on the chemical industry?

2. Expected time for companies’ operations to rebound to its level before COVID-19

3. How do you expect COVID-19 will impact your 2020 and 2021 business?

4. Expected time for country’s Industrial Production to rebound to its level before COVID-19

5. Short-term actions and long-term strategy to fight COVID-19

6. Importance level of the questions/problems faced due to the current Coronavirus crisis

7. Conclusion

8. Appendix: Survey #3 – Profile of respondents – Position – Industries – Market

1. How will COVID-19 impact the chemical industry short and long term?

Daydream – Dynovel is a business consulting firm focusing on B2B Market Strategy & New Business Development for companies in the chemical industry. Since 2000, we have successfully helped 100+ chemical companies define strategies, overcome business challenges, and seize opportunities all over the world.

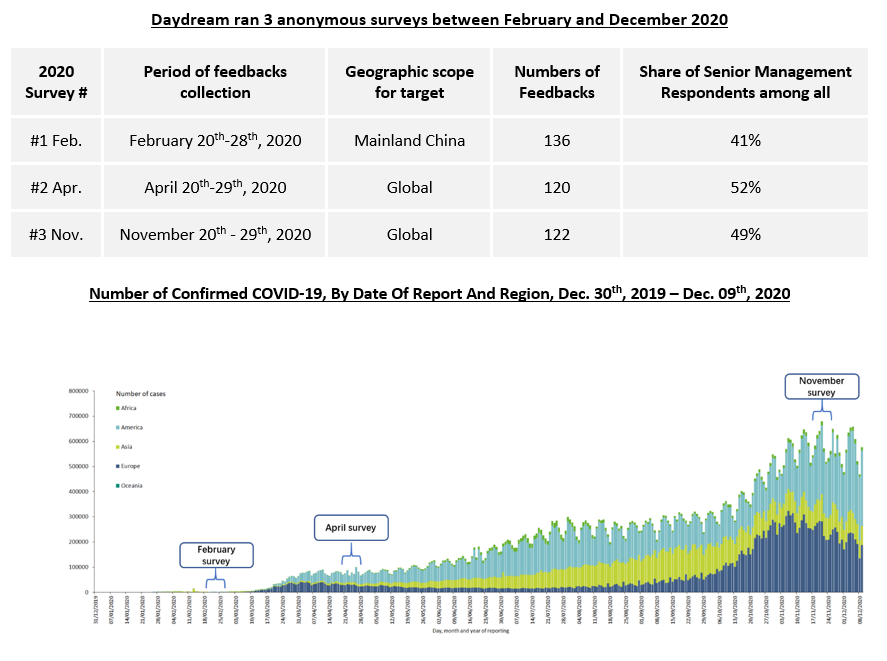

COVID-19 Survey # 1 / 2 / 3: In the special year of 2020, Daydream conducted 3 surveys (Feb. Apr. and Nov. 2020) to understand the extents of the changing impacts of COVID-19 on the chemicals and materials industries.

Survey # 3 – Nov. 2020: 122 responses gathered from practitioners in the global chemical industry during Nov 20th – 29th; primarily from senior executives, sales and marketing executives and other operational positions in chemical companies.

.

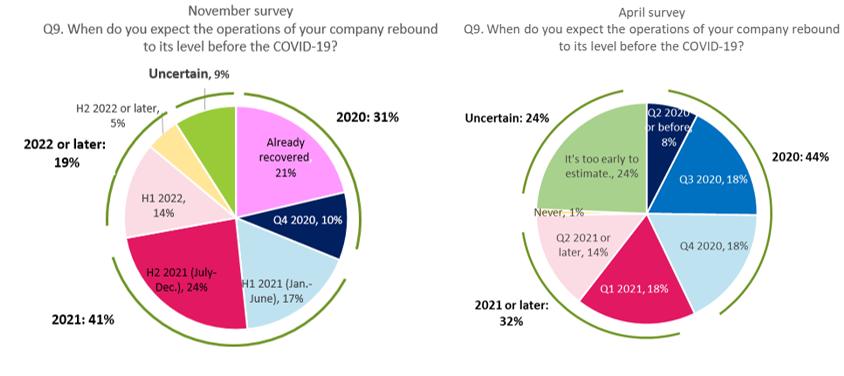

2. Expected time for companies’ operations to rebound to its level before COVID-19

Compared with Survey #2 (Apr.), the result of Survey #3 (Nov.) showed three main differences:

- Decreased uncertainty at company level

- From April to November, the share of uncertain responses decreased from 24% to 9%

- More respondents were clearer about COVID-19’s impacts on their companies and showed more confidence in the control of future at company level

- ~ 1/3 considered operations recovered to 2019 level

- 31% of respondents thought their companies’ operations rebounded to its 2019 level in the end of 2020

- More time expected before the rebound to pre-COVID-19

- Ratio of respondents expecting a rebound in 2021 or later increased from 32% in April to 60% in November

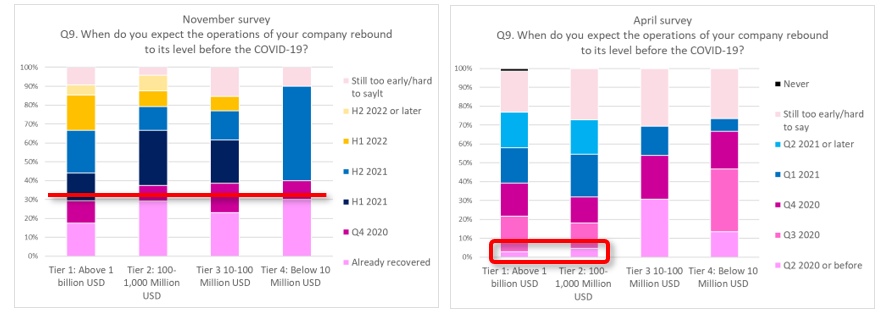

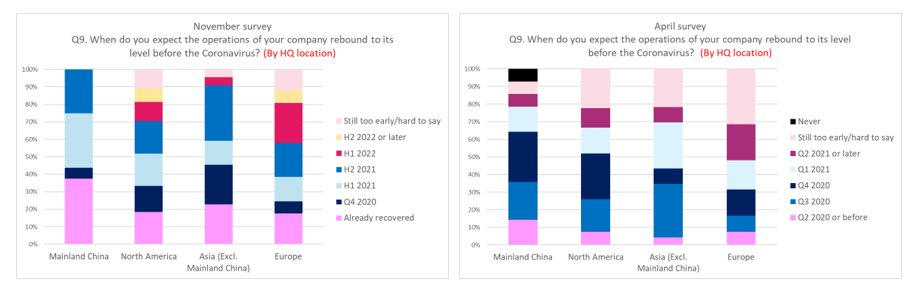

Recovery of Companies’ Operations – By Company Size

The classification of COVID-19 as a pandemic in April (Survey #2) had great negative impacts on the operations of Tier 1 & 2 companies (Annual Turnover 100+ Mn USD); while in the end of 2020, ~1/3 of the respondents believed the companies recovered to its 2019 operation level no matter the size of the companies.

Recovery of Companies’ Operations – By Company Origin

Asian companies were more optimistic about the operation level in November:

- 38% of respondents in Mainland Chinese Companies thought their operation already recovered

- ~45% of the respondents in Asian companies expected a rebound to pre-COVID-19 level in 2020

- >90% of the respondents in Asian companies expected business to recover before 2022

North American and European companies’ situations remained uncertain:

- 20-25% of the North American and European companies expected the operation recovered only in 2022 or later

- Over 10% of respondents in these companies were still not clear about the recovery time

.

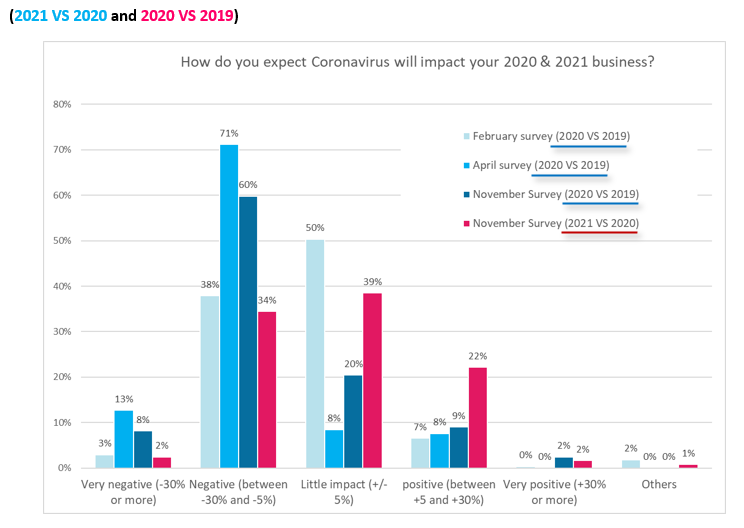

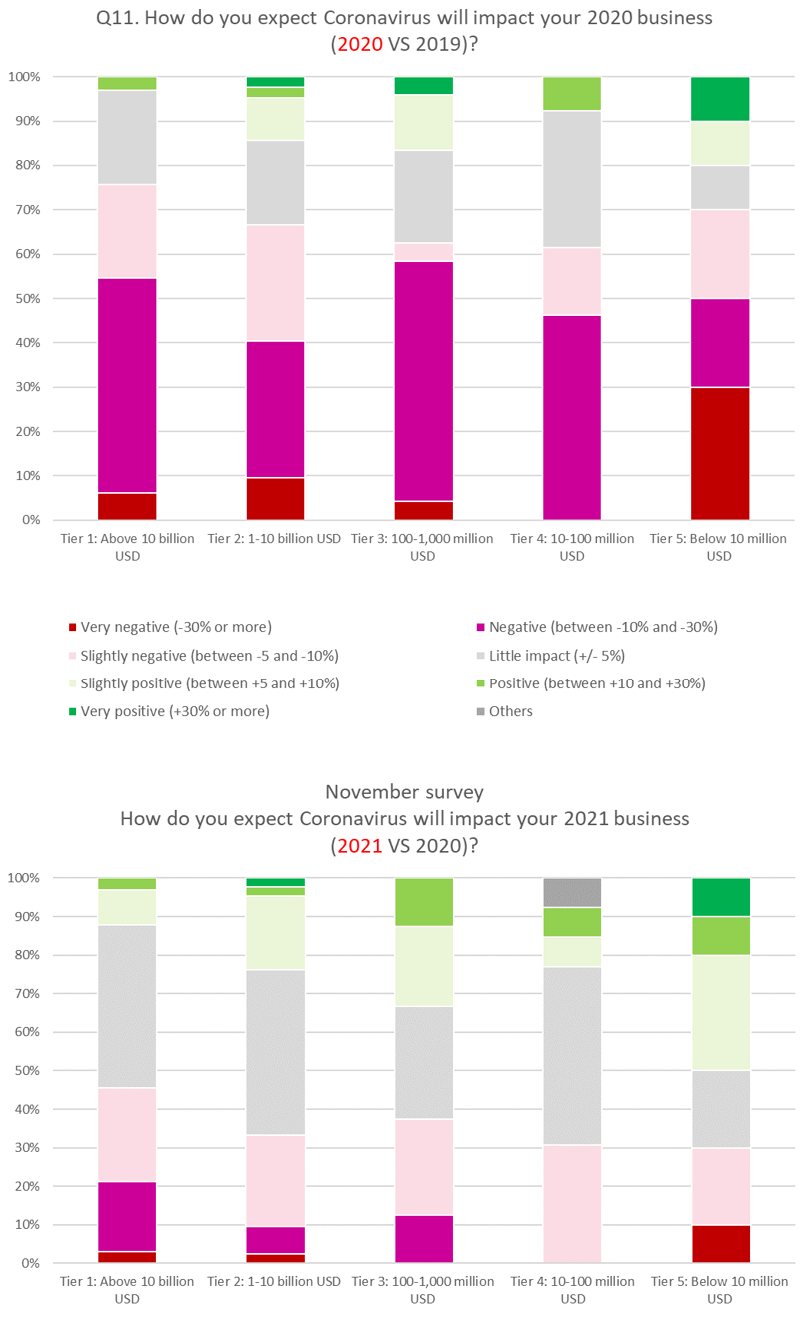

3. How do you expect COVID-19 will impact your 2020 and 2021 business? (*)

(*) negative / positive impacts refer to “the impacts on the business of companies: being decreased / increased under the COVID-19 Context”

The ratio of respondents expecting negative impacts (**) on their 2020 business compared with 2019 changed from 41% in Feb, and 84% in Apr. to 68% in Nov.

(**) including slightly negative to very negative

36% of the respondents hold negative opinions when estimating business activity in 2021 VS the almost finished 2020, during Survey #3 (Nov.). Meanwhile, 39% of respondents thought business in would remain similar to 2020.

The ratio of respondents holding positive attitudes regarding their business 2020 VS 2019 rose from 16% in Apr. to 29% in Nov.; and 64% of the respondents believed 2021 will be stable or even a better year than 2020 according to the Survey #3 (Nov.)

Business Impact – By Company Size

Highest ratio of respondents working for Tier 1 companies (*) suffered the negative impacts on their 2020 business.

(*) Annual Turnover (TO) over 10 bn USD

COVID-19 has strongest impacts on Tier 5 (**) companies in both positive and negative ways, possibly due to their limited business area making it difficult to seek complementary opportunities.

(**) Annual Turnover (TO) below 10 Mn USD

In those small-sized companies which survived, in November, half of the respondents working there expected positive growth in 2021 compared with the business in 2020, while there are still 10% of them risked to face another tough year.

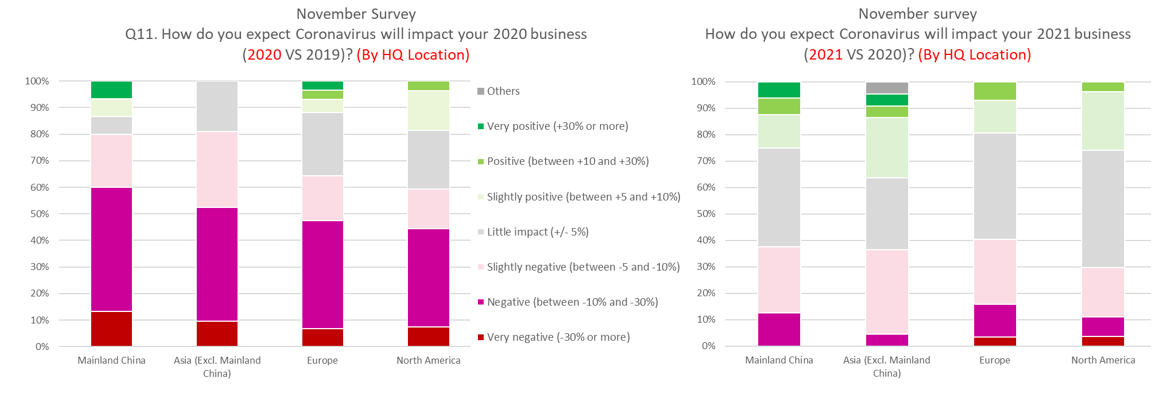

Business Impact – Company Origin

Around 80% of respondents in Asian-invested companies foresaw their business in 2020 beingnegatively impacted by COVID-19. More than 10% of the respondents working in the Chinese companies expected very negative impacts, such as a -30% decrease of annual revenue in 2020 compared with 2019.

20% of the respondents working in companies with HQ in North America expected business growth despite of the COVID-19.

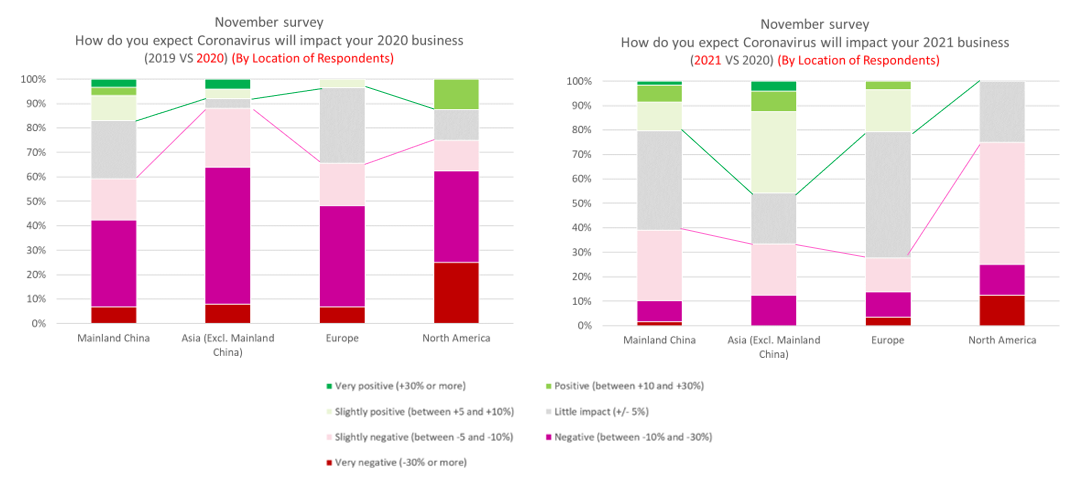

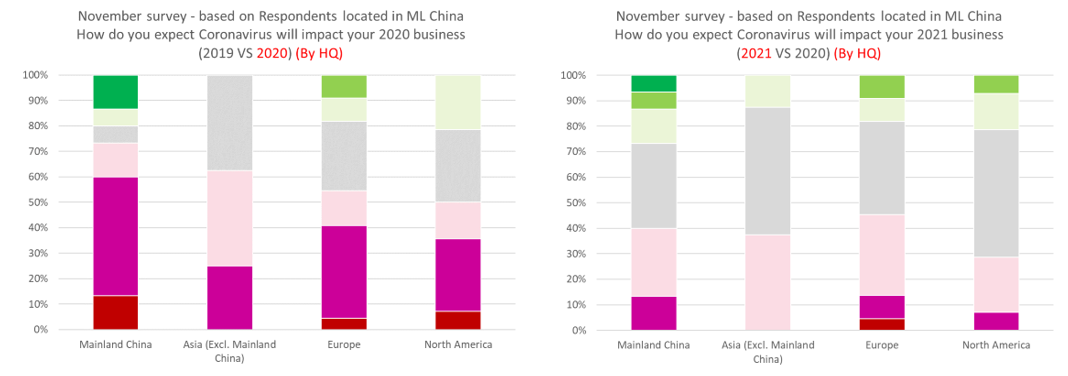

Business Impact – By Location of Respondents

Geographically speaking, the Chinese market was the least impacted in 2020. The business in 2020 for Non-Chinese Asian market was the most impacted, but had the highest ratio of respondents who expected business growth in 2021.

The highest ratio (~75%) of respondents located in North Americas foresee their business in continuing to decrease in 2021.

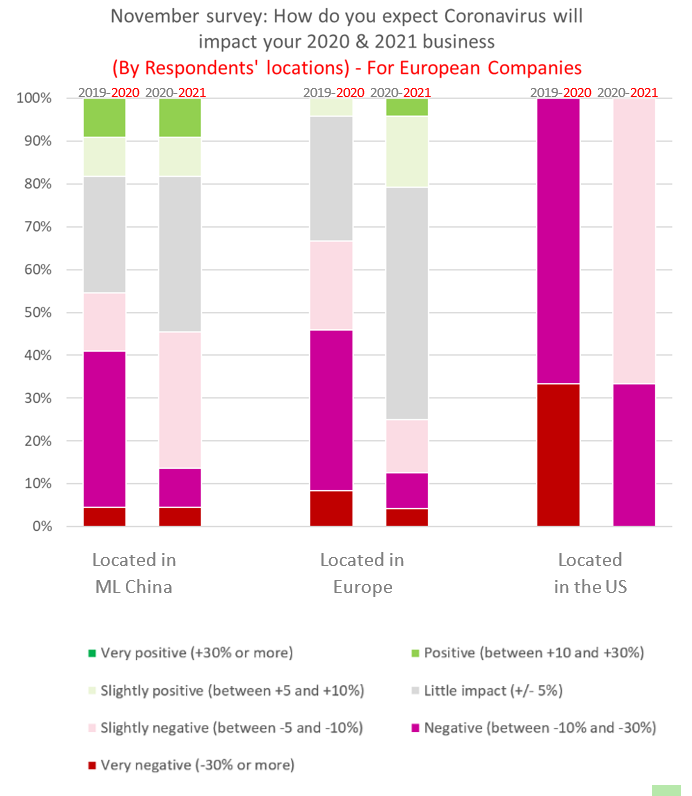

Business Impact –

Feedback from those working in EU-based companies

In 2020, their business in Mainland China was expected to be better than those in Europe or the US, as well as remaining stable, in 2021.

Majority of the repondents expect the business in the European market to stop decreasing in 2021,.

Though 100% of the employees of European companies in the US still held negative attitute of their business in 2021, the decrease rates were expected to be lower than 2019-2020 (From “very negative” to “negative” and “slightly negative”)

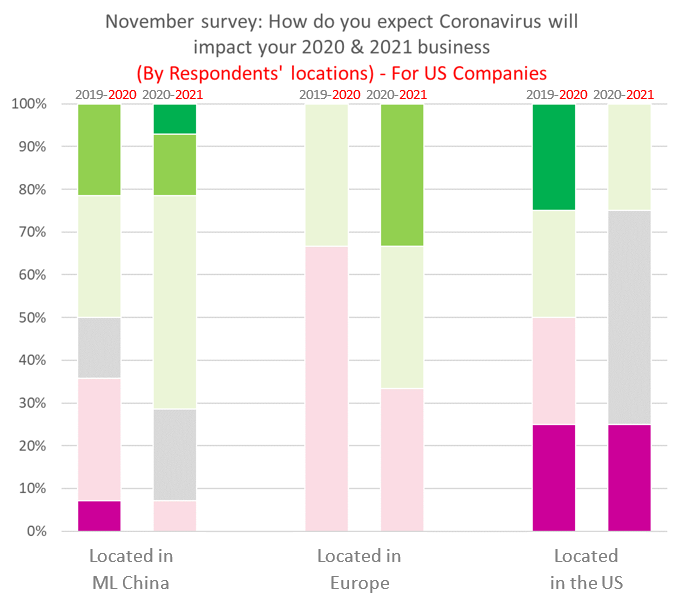

Business Impact – Feedback from those working in US-based companies

Compared with 2019-2020 period, in the coming year:

- Increasing share of respondents working in China expect business growth or even “very positive” growth (+30%)

- The ratio of respondents seeing positive growth in the European market has increased by ~15%

- Most of the respondents believed their business in the US market is going to keep still or negative as 2019-2020.

Business Impact – About the Chinese Market

Highest ratio of respondents working in Chinese companies suffered revenue decrease (negative impact) in Chinese market, followed by other Asian companies, European and US companies.

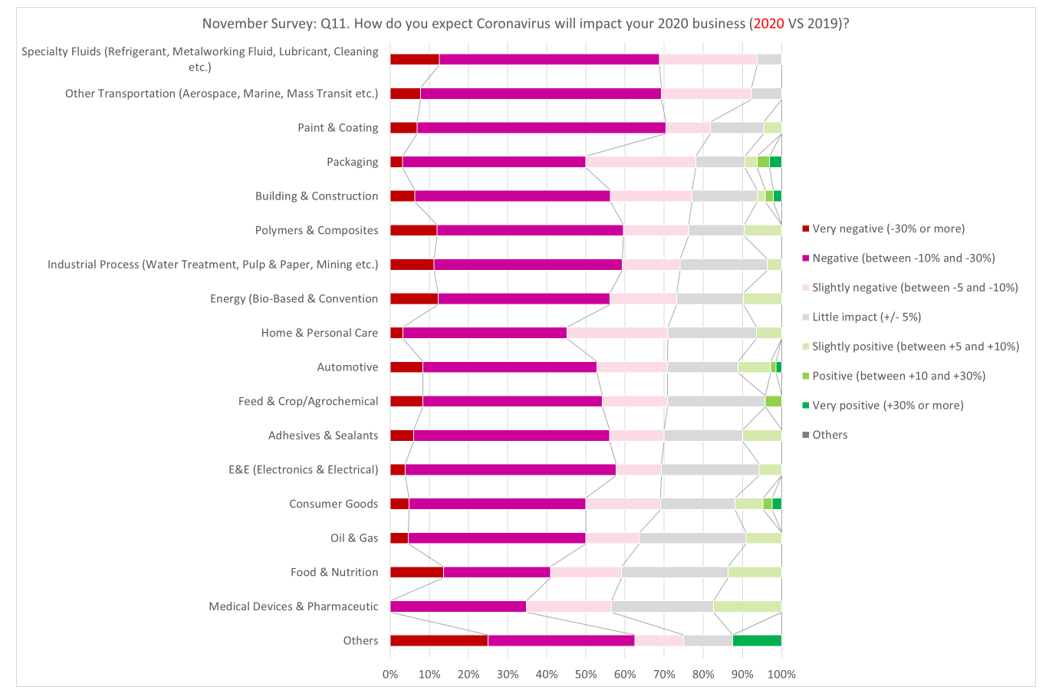

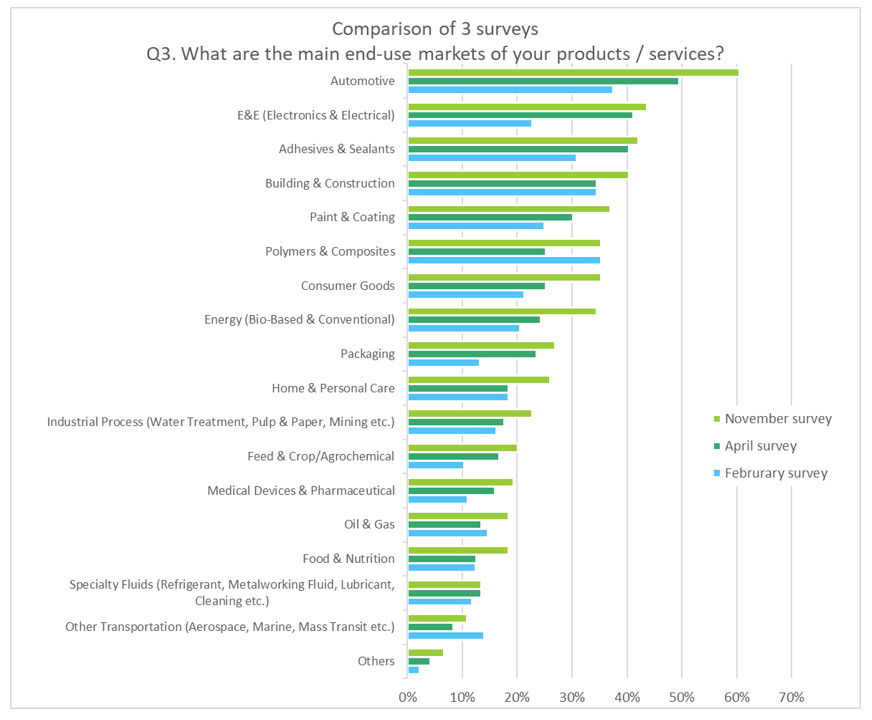

Business Impact – By end-use market

- Ranked by the ratio of respondents expecting decreased business from 2019 to 2020, the most impacted market is “Special Fluids” followed by “Other Transportation” and “Paint & Coating”

- Ranked by the ratio of respondents expecting growth of their business 2019-2020, the highest is “Medical Devices & Pharmaceuticals” followed by “Food & Nutrition” and “Consumer goods”

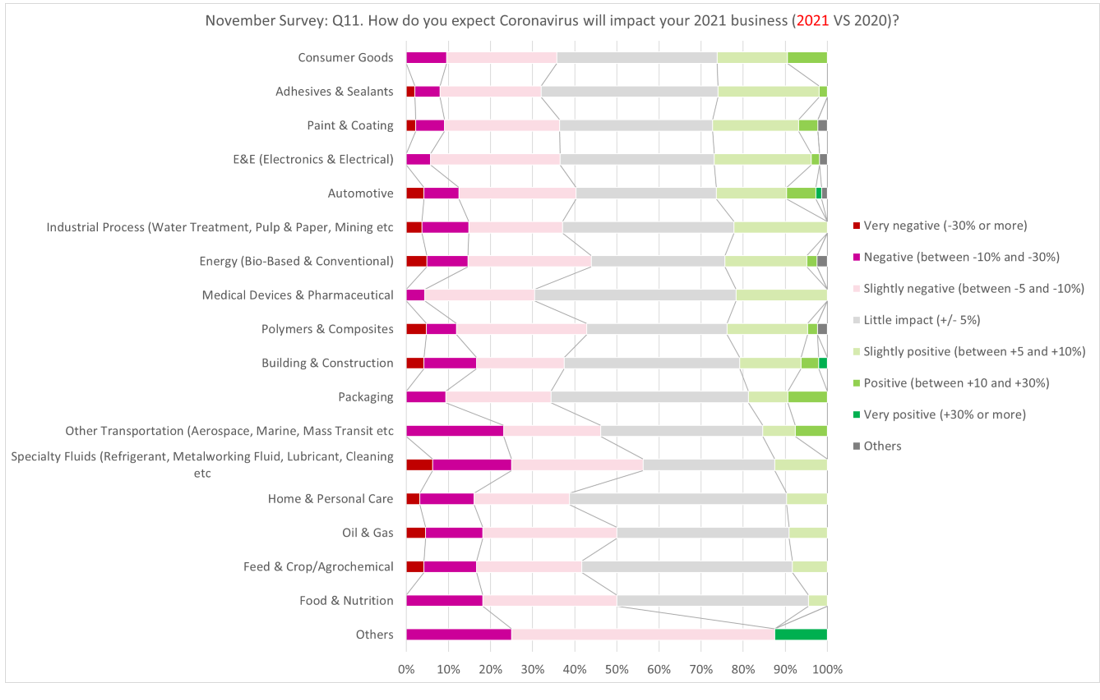

Impact of Business 2020-2021

- The end use market segments which were expected to recover the most in 2021 are:

- Consumer goods

- Adhesives & Sealants

- Paint & Coating

- E&E (Electronics & Electrical)

- Automotive

.

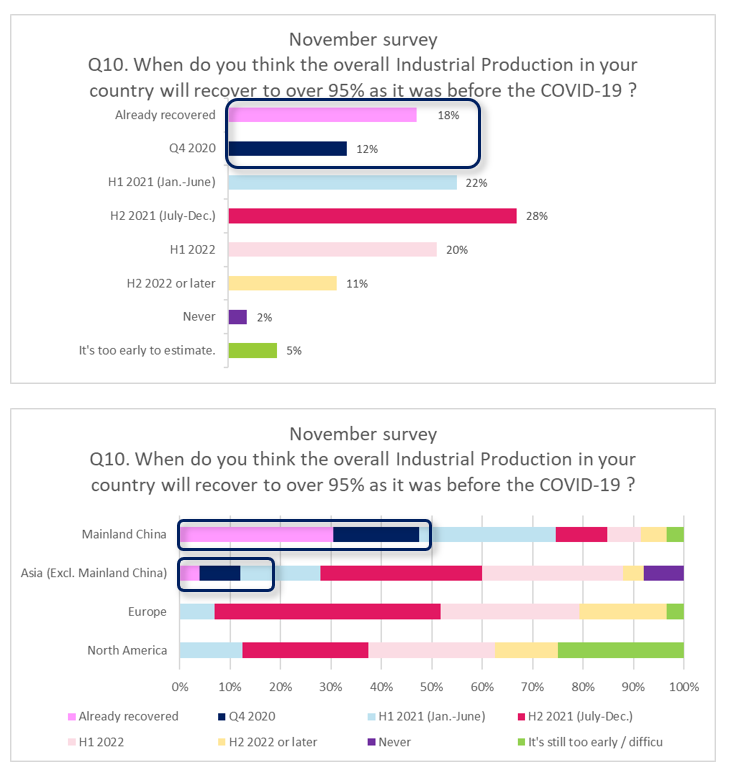

4. Expected time for countries’ Industrial Production to rebound to its level before COVID-19

Over half of the respondents expected the overall industrial production in their countries will recover to 95% of pre-COVID-19 level in 2021.

- ~ 50% of respondents in Mainland China, and over 10% of those in other Asian countries, belived the industrial production in their companies have already recovered

There is only 1 respondent located in Latin America in November survey, so it is not included in statistics to avoid bias

.

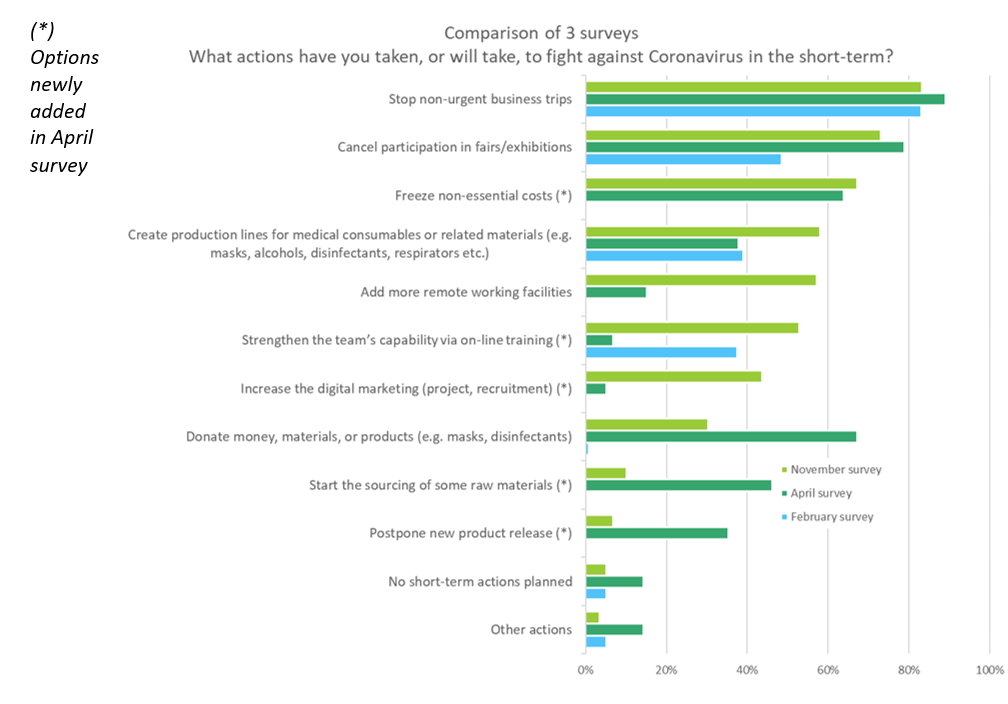

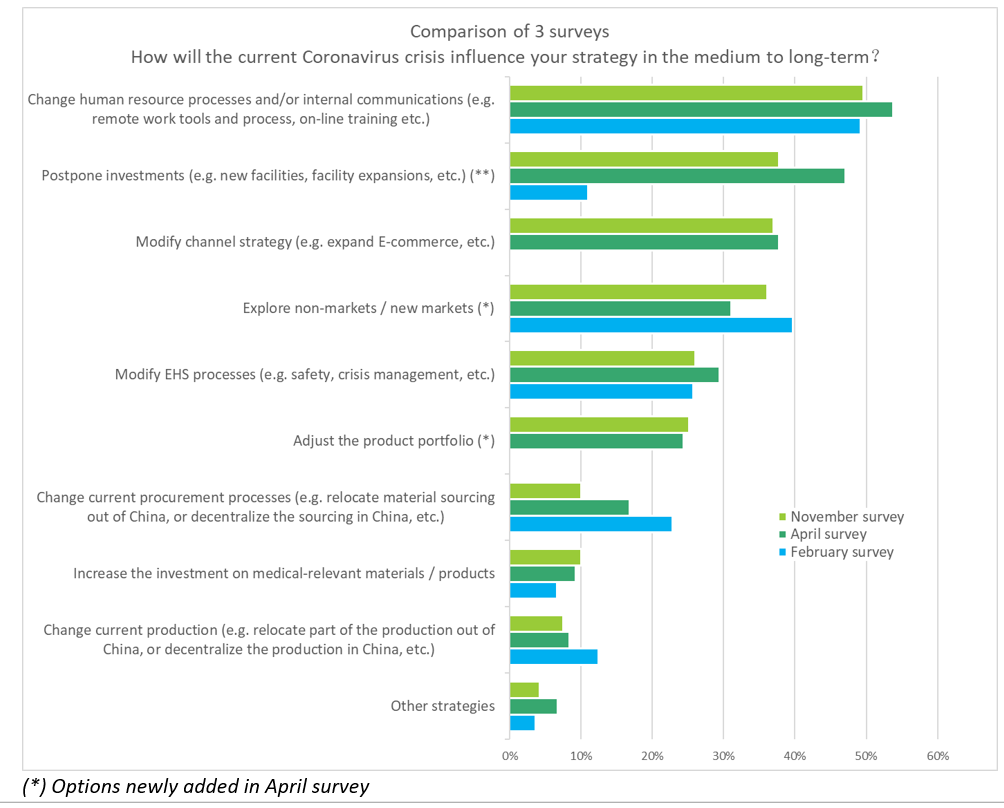

5. Short-term actions and long-term strategy to fight COVID-19

Ensuring the labor safety stay at the core of the decisions

- In short term:

- Most companies keep limiting business trips and rely as much as possible on remote work

- Though some exhibition retook place, many still cancelled the participation or visits

- In medium-to-long terms:

- Change HR process & internal communication

- Postpone the investment and modify channel strategy

2nd important measure: “Control the risk & Secure the cash flow”:

- Over 60% respondents keep freezing non-essential costs

The differences between the Survey #2 (Apr.) and Survey #3 (Nov.) are

- More actions for business recovery rather than risk controlling

- Ratio of respondents’ company adding production lines for medical related products increased by 20% from April to November

- Significantly less new product releases were postponed (decreased by ~20%)

- More rely on digital solutions for marketing and people development (increased by 40-45%)

- Some short-term actions are weighted less in November, such as

- Donation of money or medical goods (promotion and branding)

- Sourcing raw materials (probably no more problem in this aspect after 6-7 months)

(*) Options newly added in April survey

(**) In the survey ran in February, this option was “Postpone investment in Mainland China” considering that COVID-19 mainly emerged in Mainland China at that time. In the April survey, since the geographic scope for the whole survey is global, this option is offered based on a global view

.

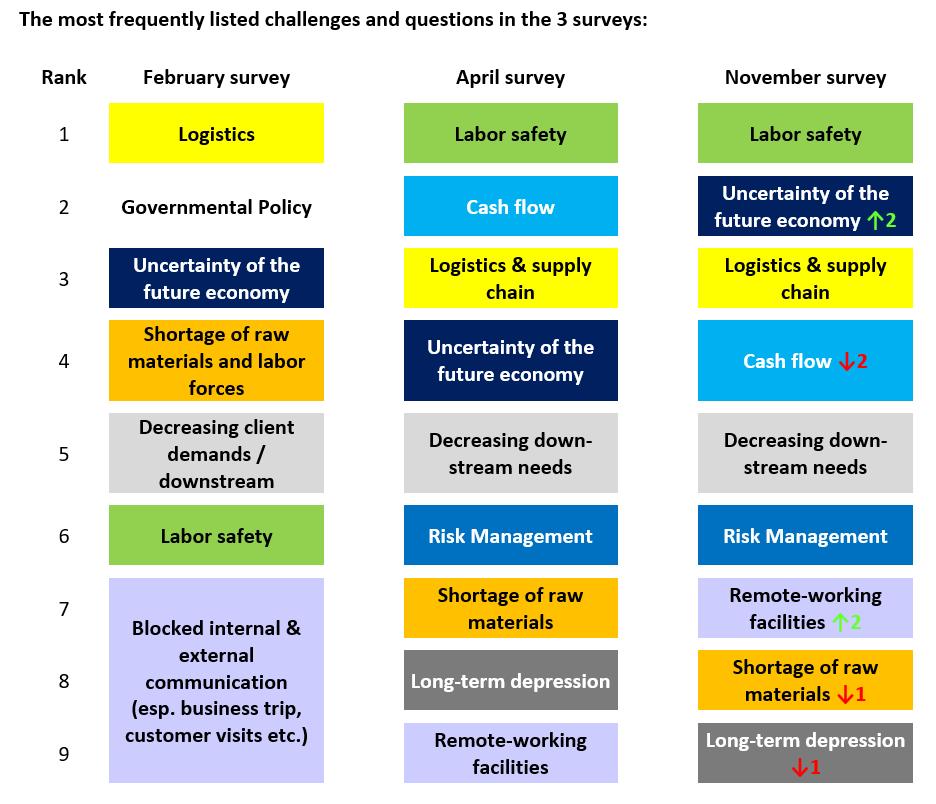

6. Importance level of the questions/problems faced due to the current Coronavirus crisis

.

7. Conclusion

More than a year after the first reported case of COVID-19, living and working styles of many of us have been changed in profound ways.

While being asked “what are the impacts and changes that are brought by COVID to the style of life, way of business?” most of the respondents mentioned:

- WFH: Work-From-Home

- Online / Remote / Digital / Virtual working styles

- Less trips / travels

- New Normal

Compared with two previous surveys, the result of our November survey showed how COVID-19 impacted the chemical industry in a year scale:

- In November, 68% respondents thought their business in 2020 decrease by over 5%

- dropped by 13% compared with April

- In November, 11% respondents thought their business in 2020 manage to increase by over 5%

- Increased by 5% compared with April

Mainland China and “consumer goods” are the earliest markets to recover from the impacts of COVID-19 on a regional and end-use basis, respectively.

Over 20% of the respondents in Mainland China, and over 45% of those in other Asian countries, believe the 2021 business will be better than 2020. Over 75% of respondents located in North America still believe the revenues in 2021 will decrease compared with 2020, although at a smaller rate.

An increasing share of respondents mentioned the measures to overcome the impacts of COVID-19 switched from reducing loss & helping fight against COVID-19 to changing working methods, improving working efficiency, and creating new markets and channels to generate more clients.

For long-term strategies, keeping labor safe, broadening sources of income, and reducing expenditure remain to be the main topics for companies worldwide.

About Daydream:

Daydream-Dynovel is a Business Consulting firm for B2B Market Strategy & New Business Development of Chemical industries, that has successfully assisted in overcoming internal & external challenges and quick adaptations in this new economic context in Europe, Asia and North America.

.

Please check more details by clicking: www.daydream.eu or contact us contact@daydream.eu

.

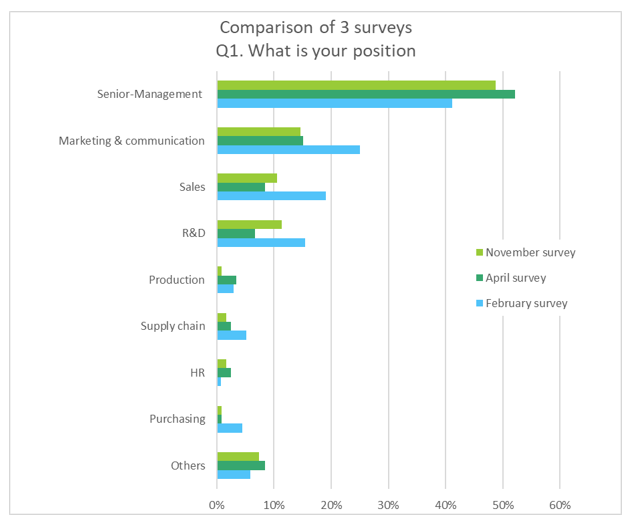

8. Appendix: Survey #3 – Profile of respondents – Position – Industries – Market

a. Position

In Survey #3 (Nov.), over half of the respondents are Senior-Management (*), followed by Marketing & communication, Sales, and R&D.

(*) Senior-Management: Group Head, President, VP, General Manager, Department or Sector Director etc.)

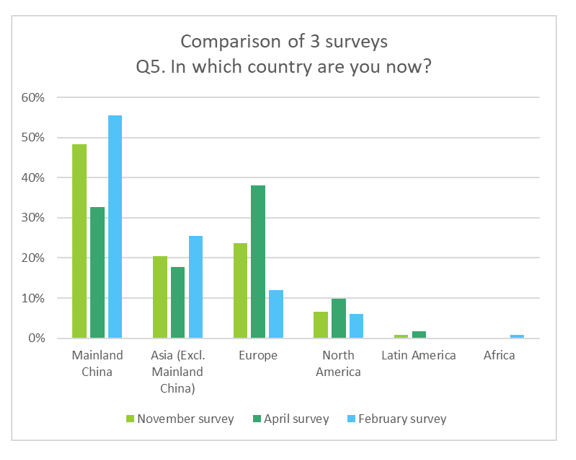

b. Location

In Survey #3 (Nov.), nearly 50% of respondents are in Mainland China, followed by Europe and the rest of Asian countries.

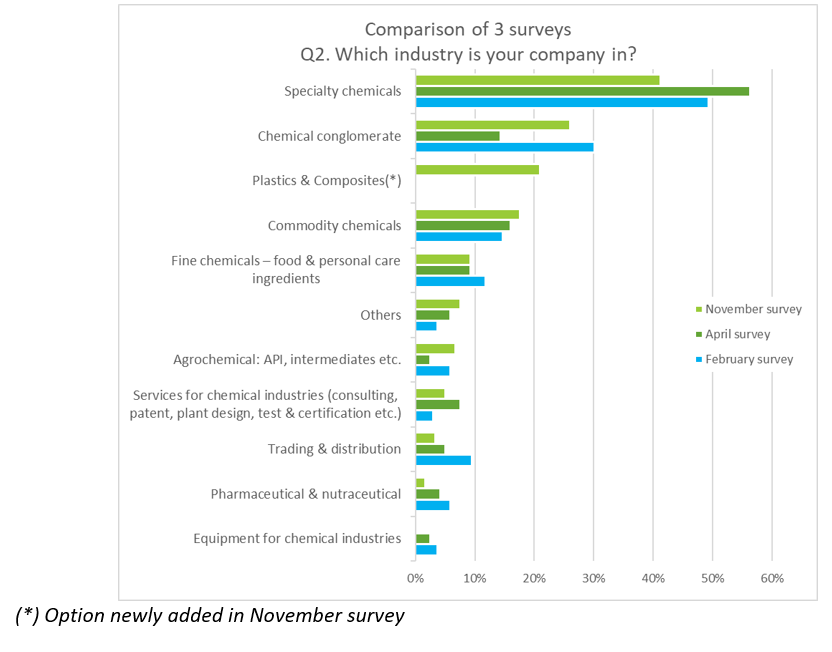

c. Industry

Respondents mostly come from Specialty Chemical companies in all 3 surveys.

d. Industry

Respondents mostly come from Specialty Chemical companies in all 3 surveys.

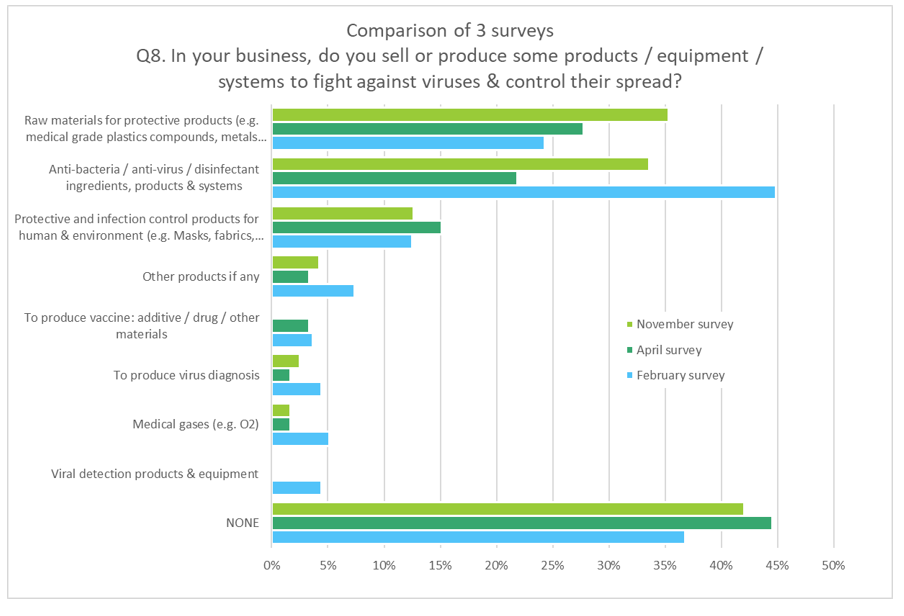

Survey #3 (Nov.) : 58% of the investigated companies sell products, equipment and systems to fight against viruses & control their spread, majority of them supply raw materials for protective products followed by suppliers of disinfectant materials.

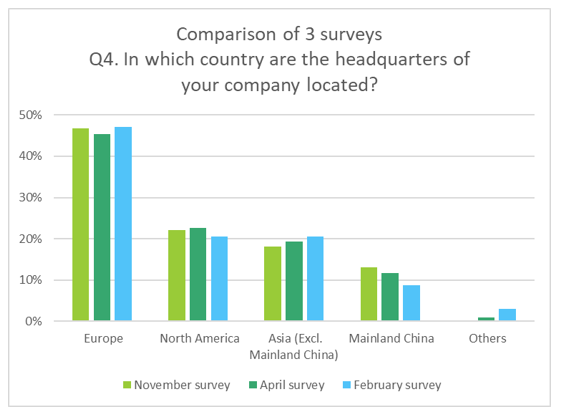

e. Location of HQ and production

Most of the participating companies have their HQ in Europe, followed by North America, Non-Chinese Asian countries, Mainland China, and other regions.

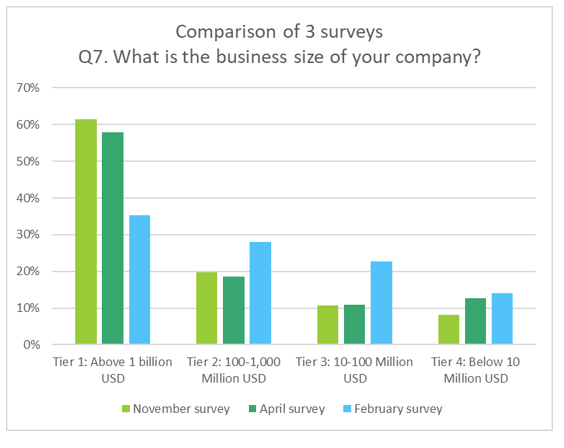

f. Business size

The proportion of respondents from Tier 1 companies (business size above 1 billion USD) is 61% in November survey. The distribution of business sizes is close to April survey.